Huge rally in copper price |

- Huge rally in copper price

- Mozambique to open new round of coal bids

- "Emergency services may be withheld": Burnaby warns Kinder Morgan

- BHP Billiton ready to offload Guinea iron ore stake

- Paragon Diamonds interest in Lemphane increased to 100%

- True Gold completes water infrastructure in Burkina Faso

| Posted: 12 May 2014 03:34 PM PDT In late afternoon New York trade on Monday July copper changed hands nearly 2% or 6c a pound higher on optimism about demand from China and receding fears about supply growth. July copper futures in New York in late afternoon dealings were last trading at a two-month peak of $3.1420 a pound after earlier in the day hitting a high of $3.1555. The copper price has now recovered 6% since falling to near four-year lows in March although the metal is still down from $3.37 at the outset of 2014. There was no fresh news out of China, responsible for more than 40% of global demand, on Monday that could have sparked the rally bar a fresh commitment from Beijing to push through capital market reforms announced earlier this year. Optimism about the market-friendly measures was also somewhat dampened by Chinese President Xi Jinping saying that slower growth is the "new normal" for the country. Traders were digesting fata released last week showed the country's inbound shipments of copper surged 52% to 450,000 tonnes in April. April's jump brought the first quarter total to a record-breaking 1.75 million tonnes, although the numbers are misleading since as much as 60% of copper inventories in China are tied as collateral for trade credit and do not necessarily reflect stronger end-user demand. China's surging imports coincide with a fall in copper stocks in LME warehouses to levels last seen in 2008. There were also unconfirmed reports last month indicating that the Chinese State Reserves Bureau has bought up to 350,00 tonnes of copper in March and April to move into state warehouses. The copper price has been hurt this year a combination of the slowdown in China and fears over surging supply. Output is to top 22.2 million tonnes this year from just over 21 million tonnes in 2013 led by Codelco's new 160,000 tonnes-plus Ministro Hales mine, Glencore's Las Bambas project in Peru it sold to China's Minmetals recently, the first full year of production at Rio Tinto's Oyu Tolgoi mine in Mongolia and expansion at BHP Billiton's already giant Escondida mine. But after an abnormally quiet 2013 with few supply disruption to existing operations, 2014 could yet turn out to be different. Freeport McMoRan and fellow Indonesian copper miner Newmont Mining are deferring exports from Indonesia due to onerous new duties slapped on copper concentrate exports at the start of the year, while delays in bringing projects on stream to replace aging mines at state-owned Codelco, which dwarves other producers of the metal, could also limit supply growth. Codelco, which produced 1.622 million tonnes last year, plans to invest $5 billion annually over the next five to six years to replace exhausted reserves and increase production with hopes of hitting than 2 million tonnes a year by the end of the decade. |

| Mozambique to open new round of coal bids Posted: 12 May 2014 02:14 PM PDT Mozambique Mineral Resources Minister Esperanca Bias said Monday the southern African nation will open bidding on new exploration licences for coal soon. "Between this week and next we will issue new bidding as we are going to revoke some licenses where the holders didn't fulfill contractual requirements," Bias told Bloomberg. Bias said the licences will be issued in accordance with a new mining law requiring between 5% and 25% local ownership of resource projects. The new law is awaiting parliamentary approval, expected by the end of June. Anglo-Australian giant Rio Tinto (LON:RIO) and Brazil's Vale SA (NYSE:VALE) have invested heavily in Mozambique's high-quality coking coal fields in recent years, but both miners have run into difficulties. Shipments along the Sena Railway line which is the sole link to the Beira port for a handful of coal mines operated by Rio Tinto and Vale located in central Tete province have on a few occasions been halted by bad weather and disruptions caused by disaffected members of Renamo (Mozambican National Resistance), the Western-backed rebel movement that battled the government during the Southern African nation's 16-year civil war. Rio Tinto acquired its Mozambique project in 2011, after buying Australia's Riversdale Mining for $3.7 billion, but last year took an asset impairment charge of $3 billion on the coking coal venture citing challenges in building the necessary infrastructure to bring the project on stream. While Anglo American (NYSE:AAL) last year walked away from the Revuboe project in the country, Vale has made Portuguese-speaking Mozambique its biggest destination for investments after Brazil. Vale plans to spend just over $2 billion through 2015 to construct a second open pit at Moatize in Tete to up annual production to 11 million tonnes. The company also aims to finish its more than $4.4 billion transport corridor to the Nacala port by the end of this year. According to data supplied by The SteelIndex spot Australian hard coking coal (FOB Australian east coast exports) traded at $101.60 a tonne, after falling to record lows in April of $97.80. The Chinese spot import price for hard coking coal was pegged at $112.80. Only around 25%–30% of the seaborne metallurgical coal trade is sold on a spot basis, but its importance is growing rapidly driven in part by China's increasing dominance as an importer. Quarterly benchmark coking coal traded as high as $330 a tonne in mid-2011 after bad weather took much of Australia's supply off the market and stayed above $200 for two years between September 2010 and September 2012, before slumping to $120 during Q1 2014. Image courtesy of Rio Tinto Coal Mozambique |

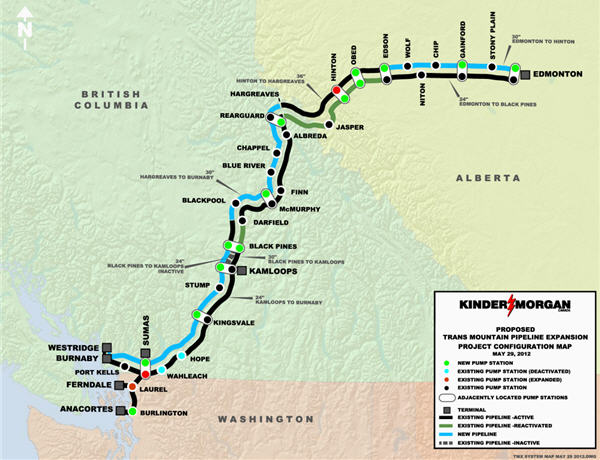

| "Emergency services may be withheld": Burnaby warns Kinder Morgan Posted: 12 May 2014 01:41 PM PDT The city of Burnaby continues to oppose Texas-based Kinder Morgan's (NYSE:KMI) Trans Mountain pipeline expansion, threatening to withhold the city's emergency services in the event of an oil spill. Burnaby's lawyer Greg McDade stated Trans Mountain has not consulted with the city's fire, police, and emergency services, adding they may not be made available in the event of an oil spill in an information request to the pipeline last week. "The project requires access to Burnaby services and assumes the support of its fire, police, and safety personnel…a project of this magnitude should not be imposed on a major municipality without the social licence from its citizens," said McDade in the request. Kinder Morgan made an application last December to the National Energy Board (NEB) to expand its Trans Mountain pipeline which flows from Edmonton, Alberta to Burnaby, British Columbia to nearly triple the capacity. If the proposal is approved, the expansion should be operational by late 2017. The line provides the interior and southern coasts of British Columbia with 90% of its gas and is the only west coast pipeline for Canadian oil products. The expansion project would allow Canada to sell more crude to American and Asian markets. The company also triggered heated reactions last May after stating oil spills could bring economic benefits. Kinder Morgan is required to respond to the City of Burnaby's information request by June 13. |

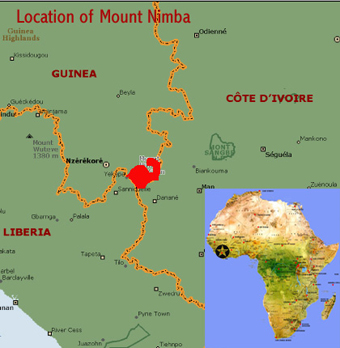

| BHP Billiton ready to offload Guinea iron ore stake Posted: 12 May 2014 12:12 PM PDT  Much like the larger Simandou deposit, Mount Nimba have yet to start commercial production due to political instability in Guinea in past years and questions over the preferred route to ship the iron ore to market. Shares in ArcelorMittal (NYSE:MT), the world's No.1 steelmaker, were up 2.25% to $15.91 on late trade Monday on reports the company was close to becoming the buyer for BHP Billiton's (ASX:BHP) stake in a major Guinean iron-ore deposit. According to The Wall Street Journal, the steel giant is in "deep, deep discussions" with BHP, in a deal potentially worth as much as $500 million. The world's No. 1 miner has been trying to sell its 41.3% stake in Mount Nimba since July 2012, as part of a strategy to survive the mining downturn, which saw commodity prices falling, costs rising, project halted, workers fired and non-core assets sold.  The Mount Nimba project is 41.3% owned by BHP and 41.3% owned by Newmont Mining, France's Areva owns a 12.4% stake. In February, Brazilian firm B&A Mineração lost interest after lengthy negotiations, because it found the project too costly, risky and difficult from an operational and political perspective. Questions over Guinea's political stability and whether the government will allow firms to export through neighbouring Liberia, which is vital to making mines profitable at current prices, have complicated investment decisions on its big iron ore projects, including Mount Nimba and the giant Simandou deposit. The sell is considered a boost to BHP's plans to exit West Africa and focus its investments elsewhere in the world. The group's CEO Andrew MacKenzie has made streamlining the company one of his main priorities, which includes cutting back spending on big, capital intensive projects. Guinea has great mining assets, 50% of the world's reserves of bauxite and significant iron ore —the feedstock ore for aluminum— and significant gold and uranium, deposits. Currently, the world's top iron ore producers, Brazil's Vale (NYSE:VALE) and Rio Tinto (LON, ASX:RIO) are in the midst of a series of billion-worth lawsuits, which came on the heels of Guinea's President Alpha Conde revoking all mining rights for both companies over a corruption probe case. (Image form WikiMedia Commons) |

| Paragon Diamonds interest in Lemphane increased to 100% Posted: 12 May 2014 12:01 PM PDT Paragon Diamonds (LON:PRG) said Monday it conditionally increased its interest in the Lemphane Kimberlite project in Lesotho, owned by Meso Diamonds, from 85% to 100%. The company, which already has projects in Lesotho, Botswana and Zambia, said it is moving toward the stage one mining development phase at the Lemphane Kimberlite project. Stage one of a two-stage production program at Lemphane targets the mining of 500,000 tonnes per annum to recover an anticipated circa 10,000 carats per year. The acquisition is conditional on admission of the new ordinary shares to AIM, expected to become effective on or around May 19, 2014. Paragon will now hold 80% of the equity in the project, together with the Government of Lesotho holding 20%. The company first undertook scoping study to design an operational model for the development of Lemphane in January. There have been significant diamond discoveries in Lesotho in the past, a landlocked country completely surrounded by South Africa, including a rare 12.47-carat blue diamond recovered by Gem Diamonds' (LON:GEMD) last year. Paragon Diamonds was down 2.10% to $3.50 by midday on Monday. |

| True Gold completes water infrastructure in Burkina Faso Posted: 12 May 2014 11:51 AM PDT True Gold Mining (CVE: TGM) announced Monday the construction of the fresh water reservoir on the proposed Karma gold project site is now complete. The reservoir will provide sufficient water for the Vancouver-based junior company's construction and operational needs, as well as for local communities in Burkina Faso. The Karma project site is located on the north of Burkina Faso and is expected to produce 97,000 ounces of gold per year over an 8.5-year mine life. The construction was completed ahead of schedule and under budget, said the company, and will eliminate future water-related project risks. The company launched an aggressive drill program at its Karma project site last week following a successful exploration last year. There are handful of Canadian mining companies in Burkina Faso including Semafo (TSE:SMF) and Roxgold (CVE:ROG) which reported a set of spectacular drill results from its Yaramoko project in the country last week. Burkina Faso is the continent's fourth largest gold producer after Mali and has commissioned eight new mines over the past six years. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Huge rally in copper price"