Gold price | CHART: <b>Gold price</b> - Yield-chasers were sold a bill of goods <b>...</b> |

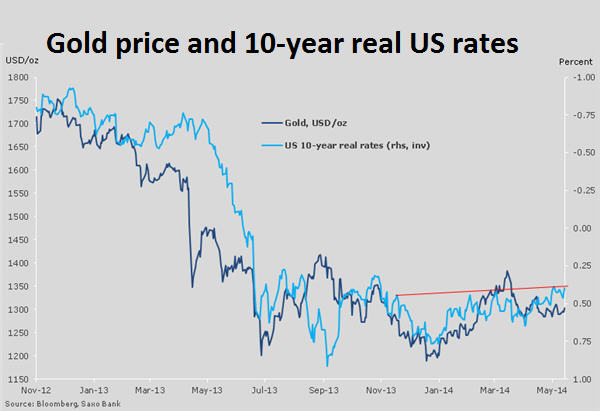

| CHART: <b>Gold price</b> - Yield-chasers were sold a bill of goods <b>...</b> Posted: 14 May 2014 04:30 PM PDT The price of gold jumped to a week high on Wednesday as talk of massive monetary stimulus in Europe and declining US bond yields up the attractiveness of the metal as an investment. On the Comex division of the New York Mercantile Exchange, gold futures for June delivery in late afternoon trade exchanged hands for $1,305.50 an ounce, up more than $10 from Tuesday's close. Gold is up 9% this year boosted by safe haven buying on tensions in Ukraine, solid underlying physical demand from Asia and rising costs at producers. The number one negative factor working against gold this year has been expectations of higher market interest rates and rising bond yields in the US as the world's largest economy continues to recover and the Federal Reserve throttles back monetary stimulus. Rising real interest rates raises the opportunity costs of holding gold because the metal provides no yield, and as the chart shows there is a strong negative correlation between real rates and the gold price. Large and small investors alike have been rotating out of gold, evidenced by a resumption of outflows from gold-backed ETFs into riskier assets, and sending stocks to record highs. Despite consensus forecast by economists of higher rates in six months' time, the expected upward march of bond yields seems to have thoroughly reversed. On Wednesday the adjusted for inflation yield in the US sunk to a meager 0.37% versus 0.75% at the start of the year. Benchmark treasuries were testing support at 2.57% from above 3% last year. German 10-year government bond yields to dropped to 1.4% on Wednesday, the lowest level in almost a year and the European central bank is readying a package of unprecedented monetary expansion that could include negative bank deposit rates. Monetary expansion in the US and around the globe, particularly since the financial crisis, has been a major driver of higher gold prices. Gold was trading around $830 an ounce before Chairman Ben Bernanke announced the first round of quantitative easing in November 2008. While asset purchases under the Fed's QE program is expected to be wound down by end-2014 a rise in interest rates is at least a year away. Just last week the Fed chair Janet Yellen reiterated that the US economy still needs "high degree of monetary accommodation". And as long as the money printing presses continue to hum, gold's allure as a hard asset and storer of wealth compared to paper money can only increase. Image by LEOL30 |

| You are subscribed to email updates from Gold price - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Gold price | CHART: Gold price - Yield-chasers were sold a bill of goods ..."