<b>CHART</b> ALERT: Quiet <b>gold</b> market primed for break-out <b>price</b> move <b>...</b> |

- <b>CHART</b> ALERT: Quiet <b>gold</b> market primed for break-out <b>price</b> move <b>...</b>

- <b>Gold Price</b> - A 40 Year Perspective :: The Market Oracle :: Financial <b>...</b>

- Silver to <b>Gold</b> Ratio: 27 Years of <b>Price</b> Data :: The Market Oracle <b>...</b>

- <b>Gold Price</b> In The Post-Nixon Era | Gold Silver Worlds

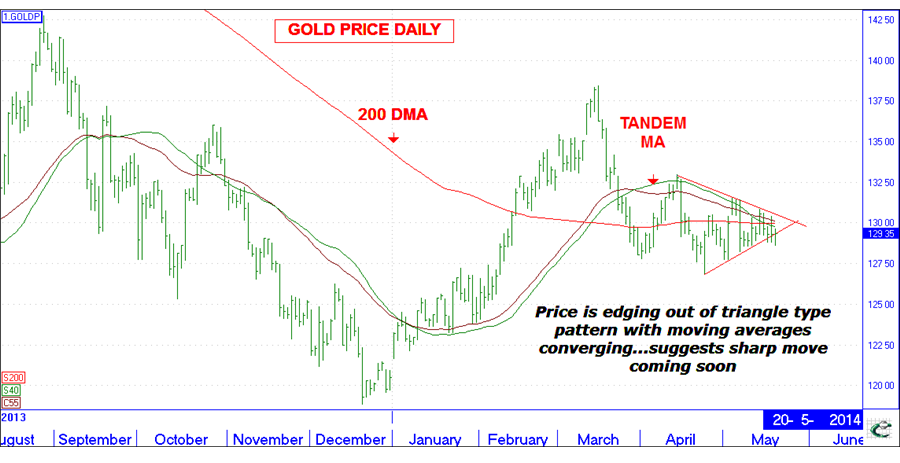

| <b>CHART</b> ALERT: Quiet <b>gold</b> market primed for break-out <b>price</b> move <b>...</b> Posted: 21 May 2014 12:30 PM PDT The gold market has been uncharacteristically calm this year with the metal hovering either side of $1,300 for the better part of two months. In a recent research note Edel Tully and Joni Teves, analysts at investment bank UBS, argued that the quiet on the gold market may be a good thing: "Gold is not on the radar for many, and with broad expectations that prices will be range-bound this year, many investors are opting to stay out of this market," UBS wrote. "That is probably gold's biggest positive right now." The thinking being that too much attention from speculators and any big economic news would automatically be seen as a negative given current gold market sentiment. Gold's charts may be telling a different story however. Tony Henfrey from technical research and investment blog InvesTRAC passed on this price graph to MINING.com showing gold is primed for a big move. "This is an alert. The gold price has formed a triangle type pattern and is dropping out of it, plus the moving averages have converged with price. This type of action invariably precedes a sharp move." |

| <b>Gold Price</b> - A 40 Year Perspective :: The Market Oracle :: Financial <b>...</b> Posted: 20 May 2014 08:59 AM PDT Commodities / Gold and Silver 2014 May 20, 2014 - 12:59 PM GMT By: DeviantInvestor

Or

My answer is: Gold peaked in 2011, bottomed in June and December of 2013, and should rally for several, and probably many, years into the future. Why?Examine the following graph of weekly gold prices since 1977 and the 144 week simple moving average shown in red. The uptrend since 2001 is clear and pronounced. The correction since 2011 is unmistakable. Worthy of note from the spreadsheet (not shown) are:

What could push the price of gold LOWER?

What will push the price of gold higher?

I could go on, but the situation is clear. Gold did NOT blow-off into a bubble high in 2011, all the drivers for continued higher gold prices are still valid, demand is huge, supply will be restricted when the western central banks run out of gold or choose to terminate "leasing" into the market, and government expenses, "money printing" and bond monetization are out of control and accelerating. Gold prices will climb a wall of worry in the years ahead. You may be interested in my comments on Silver and 2011 - here. GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail © 2014 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors. © 2005-2014 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication. |

| Silver to <b>Gold</b> Ratio: 27 Years of <b>Price</b> Data :: The Market Oracle <b>...</b> Posted: 27 May 2014 05:44 AM PDT Commodities / Gold and Silver 2014 May 27, 2014 - 06:44 PM GMT By: DeviantInvestor

Examine the following chart. We can see that:

My conclusions from this graph are that the silver-to-gold ratio is currently priced at the low end of the range, long-term silver prices are gradually increasing relative to gold, and a price explosion could occur at any time, or perhaps not for several years. Is there more we can learn from the ratio? Take the weekly prices for silver and the weekly silver-to-gold ratio and smooth them with a 7 week centered simple moving average. This merely removes some of the "noise" in the graphs. Plot that weekly data since 2002, roughly the beginning of the silver and gold bull markets. Examine that graph.

Statistics

Based on the ratio data and the statistics, we can conclude that:

FundamentalsGold demand is strong – ask China, Russia and India. Western central banks have "leased" some, or perhaps most, of their gold. The German gold stored at the NY Fed was not returned – possibly because it is no longer in the vaults. See Julian Phillips' analysis on that topic. If most of the central banks' gold is gone ("leased" into the market), demand will soon overwhelm the supply of real, physical gold. The High-Frequency Traders can suppress the paper market, but not forever. It is a reasonable bet that gold, about 40% below its 2011 high and facing large demand and dwindling supply, will rally in price over the next few years. Silver prices will follow gold prices but rally farther and faster from their currently low and oversold condition. Was the above analysis a conclusive proof that gold and silver prices must rally? Obviously not! But it strongly suggests:

Investor demand for silver and gold bars and coins is strong and increasing. I think silver and gold prices will be higher by the end of 2014 and much higher by the next US presidential election. The pieces of paper we mistakenly call money will become less valuable in the years ahead. Take this opportunity to convert some paper currency to physical silver while the High Frequency Traders and central bankers are gifting us with artificially low silver and gold prices. You might also find value in: Silver Was Not in a Bubble in 2011! Silver in the Dead Zone of Disinterest GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail © 2014 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors. © 2005-2014 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication. |

| <b>Gold Price</b> In The Post-Nixon Era | Gold Silver Worlds Posted: 20 May 2014 11:37 AM PDT Gold bull market: during the late 1960s and 70s Gold bear market: during the 80s and 90s Gold bull market: since 2001 Now we need to know:

or

My answer: Gold peaked in 2011, bottomed in June and December of 2013, and should rally for at least several years, and probably until the end of the decade. Why? Examine the following graph of weekly gold prices since 1977 and the 144 week simple moving average shown in red. The uptrend since 2001 is clear and pronounced. The correction since 2011 is unmistakable. The spreadsheet (not shown) indicates:

Gold did NOT blow-off into a bubble high in 2011, all the drivers for higher gold prices are still valid, international demand is strong, supply will be reduced when the western central banks run out of gold or terminate "leasing" into the market, and US, EU and Japanese government expenses, "money printing" and bond monetization are out of control and accelerating. Gold prices will climb a wall of worry in the years ahead. GE Christenson | The Deviant Investor |

| You are subscribed to email updates from gold price graph - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "CHART ALERT: Quiet gold market primed for break-out price move ..."