Analysts are misreading the Dow/<b>Gold chart</b> and what it means for <b>...</b> |

| Analysts are misreading the Dow/<b>Gold chart</b> and what it means for <b>...</b> Posted: 23 Apr 2014 08:56 PM PDT Posted on 24 April 2014 with no comments from readers Take a look at the Chart of the Day below that shows the ratio between the Dow Jones Index and the price of gold. Analysts have drawn a rather distorted looking trend line channel showing a break-out to the upside. That would seem to indicate higher stock market prices and a lower gold price. However, if instead you continue the downward trend line to the top of the recent high then you still get the classic bell-shaped curve beloved by hedge funds and other chartists. This would clearly indicate a long-term reversal to the mean will continue in the Dow/Gold, perhaps with quite a dramatic correction to the downside. So the Dow Jones would fall and gold prices rise. Bell-curve or not? Does this graph look like a bell-shape or it is broken? We see a distortion caused by an unsustainable spike in share prices last year and the impact of Indian taxes on the gold market. If that is true then the clever thing to be doing would be to accumulate gold at current prices and sell stocks. That's the reverse of the consensus view now but when was the consensus ever a good guide? Posted on 24 April 2014 Categories: Gold & Silver |

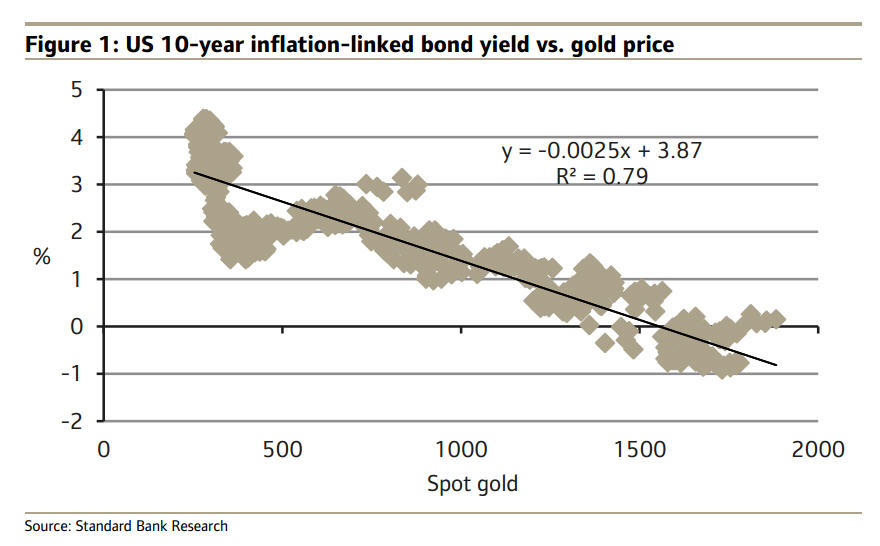

| This is the scariest <b>gold price chart</b> you'll see today | MINING.com Posted: 25 Mar 2014 11:23 AM PDT The Standard Bank commodities team's always cogent analyses revealed a stunner this week. The specialists at the commodities trading arm of the bank – which is being bought by China's ICBC and may get a table at the daily London gold fix – are not the first to point out the correlation between real US bond yields and the price of gold. But the chart plotted in the London and Johannesburg-based firm's latest research note to show the connection puts the trouble ahead for the gold price in stark relief. Analyst Leon Westgate, says the house view is that "real interest rates in the US will continue to rise in coming months as the Fed monetary policy normalises, which will put downward pressure on gold. The relationship between real long-term interest rates in the US (as proxied by 10-year US inflation-linked bonds) and the gold price is strongly negative." 10-year real yields (Treasury Inflation Protected Securities or TIPS) are currently at 0.59% which seems consistent with today's gold price of around $1,310 an ounce. Absolute future gold price levels probably shouldn't be divined from this chart, but it does point to one thing: If you buy into this theory, the gold price is going down. |

| You are subscribed to email updates from gold price graph - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Analysts are misreading the Dow/Gold chart and what it means for ..."