Vancouver's Goldcorp won't challenge friendly deal for Osisko |

- Vancouver's Goldcorp won't challenge friendly deal for Osisko

- Golden Dawn drops Tam O' Shanter property

- Trying to smuggle gold into India man swallows $23,000 worth in bars

- Turnaround stories revolve around proven management

- China opens Beijing to direct gold imports

- Why energy is catching the market’s eye

| Vancouver's Goldcorp won't challenge friendly deal for Osisko Posted: 21 Apr 2014 02:46 PM PDT Goldcorp (TSX: G) is calling it a day follow months-long efforts to acquire Osisko Mining Corporation (TSX:OSK) through a hostile takeover. The Vancouver-based mining giant announced April 21 it wouldn't amend its last bid, made about two weeks ago, of $3.6 billion to acquire all of Osisko's outstanding shares. The decision comes after Yamana Gold and Agnico Eagle Mines offered Osisko $3.9 billion last week in a friendly deal. "We stated from the beginning of this process that we would remain disciplined with respect to our offer to acquire Osisko, and our decision not to amend the offer is consistent with that commitment," Goldcorp president and CEO Chuck Jeannes said in a statement. "We move forward with an outstanding portfolio of mines and projects, and our focus will remain on maximizing the value of our investments and generating strong returns for our shareholders." Goldcorp originally tried to take over Osisko in January through a hostile bid worth $2.6 billion. Under the proposed deal with Yamana and Agnico, both those companies would acquire 50% of Osisko, whose main asset is the Malartic gold mine in Quebec. |

| Golden Dawn drops Tam O' Shanter property Posted: 21 Apr 2014 02:08 PM PDT VANCOUVER, BRITISH COLUMBIA–(Marketwired – April 17, 2014) - Wolf Wiese CEO of Golden Dawn Minerals Inc. (the company) (TSX VENTURE:GOM)(FRANKFURT:3G8A) reports due to the lack of funding opportunities for low grade bulk tonnage Gold deposits, the company has made decision to relinquish its option agreement for the Tam O' Shanter property on its Greenwood Precious Metal Project in Greenwood B.C. The Tam O' Shanter Property was contiguous to the Northwest to the Wild Rose Property. The Wild rose Property and the Tam O' Shanter property shared an inferred gold resource of 415,000 troy ounces at 0.52 grams per tonne (g/t) gold utilizing a lower cut-off of 0.3 g/t gold (see company news release dated January 29th, 2013). At this point our technical consultants are calculating the amount of reduction of the Wild Rose Gold inferred resource. Therefore the disclosures in the N.I.43-10 disclosing this resource can no longer be relied upon. The Historic Wild Rose Mine Southeast of the Deadwood Gold Zone where the bulk of the resource is located is not affected by the severance of the Tam O' Shanter property. The company will disclose the correct inferred Gold resource located on the Wild Rose Properties Dead Wood Zone as soon as our Technical consultants have made these calculations. The company is focused on advancing the historic May Mac Mine and Wild Rose Mine towards bulk sampling. The Wild Rose is a high grade narrow vein gold copper mine with an existing 350 meter adit on the wild Rose property and the May Mac Mine is a high grade polymetalic Mine with 7 exiting adits a 100 ton mill and permitted tailings pond. The Mac Mine is located 4KM south of the Wild Rose adit on the contiguous Boundary Falls property. These properties are 3 Km west of the city of Greenwood on Highway 3. On Behalf of the board of directors: GOLDEN DAWN MINERALS INC. This news release was reviewed by Mike Dufresne Q.P. under N.I 43-101. On behalf of the Board of Directors: GOLDEN DAWN MINERALS INC. Wolf Wiese, President THIS PRESS RELEASE WAS PREPARED BY MANAGEMENT WHO TAKES FULL RESPONSIBILITY FOR ITS CONTENTS. NEITHER CSE NOR ITS REGULATION SERVICES PROVIDER ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE. THIS DOCUMENT CONTAINS CERTAIN FORWARD LOOKING STATEMENTS WHICH INVOLVE KNOWN AND UNKNOWN RISKS, DELAYS, AND UNCERTAINTIES NOT UNDER THE COMPANY'S CONTROL WHICH MAY CAUSE ACTUAL RESULTS, PERFORMANCE OR ACHIEVEMENTS OF THE COMPANY TO BE MATERIALLY DIFFERENT FROM THE RESULTS, PERFORMANCE, OR ACHIEVEMENTS IMPLIED BY THESE FORWARD LOOKING STATEMENTS. WE SEEK SAFE HARBOR. |

| Trying to smuggle gold into India man swallows $23,000 worth in bars Posted: 21 Apr 2014 12:05 PM PDT Twelve gold bars weighing nearly a pound and worth US$23,000 were found inside the stomach of an Indian businessman who tried smuggling the precious metal into the country from Singapore. According to The Indian Express the 63-year-old man visited a hospital in New Delhi earlier this month, saying he had swallowed the cap of a water bottle and wanted it removed. Doctors soon operated after he repeatedly vomited and complained of sharp abdominal pain, and later found the bars. We were shocked when gold biscuits came out of his abdomen during the operation," the surgeon told the newspaper. "But I am at least happy that I could save his life. If it had stayed inside for couple of more days, it would have led to severe bleeding and rupture of the intestine and septicaemia. Moreover, he had severe diabetes." Gold smuggling into India has increased dramatically since the nation hiked its import duty on the yellow metal from 4% to 15% last year, with the customs department at the Delhi airport saying it seized 352kg of gold by the end of 2013, 52 times more than the previous year. Officials estimate that only a 12th part of all the gold smuggled through the airport is detected, The Times of India reports. Last week, the World Gold Council said India's demand for gold is likely to remain high this year, despite government attempts to slow the flow of the precious metal to the South Asian nation. India lost its position as the world's top consumer of gold to China last year and it will likely stay at number two in 2014 as both countries are expected to see their gold demand stay around the same levels they were last year, the WGC added. India's demand for gold this year is expected to reach between 900 and 1,000 metric tons, little changed from the 975 tons it consumed last year. |

| Turnaround stories revolve around proven management Posted: 21 Apr 2014 11:16 AM PDT Willem Middelkoop and Terence van der Hout of the Netherlands-based Commodity Discovery Fund believe that when the world's reserve currency is reset away from the U.S. dollar in the next decade, gold prices will rise and mining equities will follow. Van der Hout and Middelkoop tell The Gold Report that by focusing on producers, near-producers and turnaround stories, they plan to capitalize on the opportunities in North America, Africa and beyond. The Gold Report: Willem, your first book predicted the collapse of the global financial system a year before the 2008 fall of Lehman Bros. In your new book "The Big Reset: War on Gold and the Financial Endgame," you're predicting the demise of the dollar as the reserve currency by 2020. You said it can occur as a carefully planned event or as the result of a crisis. What would these two scenarios look like? Willem Middelkoop: Authorities always prefer to act within a well-planned scenario. The U.S. and the International Monetary Fund (IMF) understand that the U.S. dollar has to be replaced one day. It could be 2020. It could be 2018. It could be 2023. It has to be replaced by another anchor to support the worldwide monetary system. Both the U.S. and the IMF will try to stay in the driver's seat as they propose the transformation of the worldwide financial system. They could introduce special drawing rights (SDRs), an international reserve asset created by the IMF in 1969 to supplement its member countries' official reserves. Its value is based on a basket of four key international currencies, and SDRs can be exchanged for freely usable currencies. The U.S. and the IMF could propose that the SDRs be used to replace the dollar as the anchor for the worldwide financial system. However, the IMF and its partners, the central banks around the world, will need at least five more years to prepare the system for such a change. A crisis of confidence around the dollar could occur before the IMF and its partners are ready for a reset operation. If a crisis of confidence occurs, the IMF would have to mount a rescue operation to save worldwide trade, as we saw in early 2009. We had some similar, but smaller, resets following the crisis in Germany after the Weimar hyperinflation in 1923 and, more recently, in Cyprus. The SDRs could act like a monetary umbrella and consist of dollars, euros, British pounds and Chinese yuan after a monetary reset. TGR: A lot of this plan is going on backstage. Most people don't know about it. What signs should we look for to signal the shift so we can adjust our portfolios? WM: This is a very important question. Investors need to understand that such a transformation in our monetary system might be introduced over a weekend. In Cyprus, there were not many warning signs. That's why I started a new blog called thebigresetblog.com, where I follow the latest information, and I'm publishing the latest signs pointing toward such a reset. On March 17, I published a story that was based on an interview with George Soros. In that interview with The Financial Times, Soros said the system is broken and needs to be reconstituted. I also published an interview with Christine Lagarde, head of the IMF. She used the term "reset" multiple times in interviews during the World Economic Forum. Another important sign is an editorial by the Chinese state press agency recently saying that the time has come for a new international reserve currency to be created to replace the dominant U.S. dollar. Both East and West sent out specific signals pointing toward this transformation. Of course, it's important to watch the gold and dollar charts on a daily basis, because when a reset is close, you can expect major moves. TGR: What does this mean for gold? The signs are out there—why is the price hovering around $1,300/ounce ($1,300/oz)? WM: It's quite easy to understand why central banks would like to revalue gold to devalue the dollar at a certain stage of this reset. The U.S.'s official gold reserves, which are still 8,000 tons, are valued at the historical cost price of $42/oz. A revaluation toward $4,200/oz would grow the value of these gold reserves from the current $11 billion ($11B) to $1.1 trillion. Without such a revaluation, gold prices will have to rise as well given the structural deficits in the gold market. Worldwide gold production can't keep up with the growing demand for physical gold. Recent figures by the World Gold Council show a deficit of 700 tonnes physical gold. We have seen lots of manipulation of the gold price, similar to the 1960s when the London Gold Pool was keeping gold prices at $35/oz. Central bankers have done this for a number of years by selling large amounts of gold from the official reserves of Western central banks. We've seen another round of manipulation of the gold price in the last few years. This can't go on for another 5 to 10 years. TGR: If the gold price went up, would the precious metals mining stocks follow or, because of the manipulation, would there not be a connection? WM: The gold price started to rise at the end of December. When the gold price went up 10%, precious metal mining stocks went up sometimes as much as 30%. Investors will come to understand that the gold price might trade higher in the following weeks and months, and precious metal mining stocks should also go higher. Countries like China and Russia are also growing their gold reserves enormously. With estimates for yearly deficits in the physical gold market up to around 1,000 tons/year, more investors see precious metal companies as the only ones that own huge amounts of physical tons still in the ground. When they can be sold at higher prices, these companies will become hugely profitable. We've seen that in the past. In the 1970s, we had the last gold rush and lots of free cash flow was generated by gold and silver producers. In the late 1970s and the early 1980s, these amounts were enormous. Senior producers had gains of 200–300% in the last two years of the gold bull market. The junior producers and the exploration companies showed gains of more than 1,000% on average. TGR: What markets do you think are good right now? What commodities do you like? WM: We still have 60% of our equity investments in gold-related equities, 20% in silver-related and the last 20% in base metals and specialty metals. The only change in the last two years has been that we decreased our investment in exploration companies and increased our investment in royalty companies and senior producers. TGR: Why was that? WM: Because of the low valuation in the correction since the middle of 2011. The valuation for gold producers became almost laughable. Of course, a producer, which is creating cash flow and is still profitable at these prices, has only upside in the current market. It was a defensive move. The current bidding war concerning Osisko shows it was a smart move to add to our position during the down turn. Terence van der Hout: Technically, an exploration company that has no assets can just go to zero—there are a number that are doing that—whereas producers will always be worth something, even at fire sales. That's another consideration that we've been looking at on the downside. Very recently, we've been subtly shifting from producers and near-producers to advanced developers. We see a turn in the markets. Those companies are well leveraged to the gold price and have a fairly extreme undervaluation to catch up with. Normally, they will be revalued to something relating to the amount of resource they produce. One of the companies that we've been invested in for a while is OceanaGold Corp. (OGC:TSX; OGC:ASX). It has been producing gold in New Zealand at a steep cost, but it has a gold-copper deposit it brought to production in the Philippines that is performing very well. It's a classic story of a startup producer that is beginning to be valued at its full potential. TGR: Do you think it's beginning to be recognized by the market because of the diversification of the company or because of the new resource and reserve that it came out with? TvdH: It was a function of OceanaGold's performance in production rather than the resource update. The added resources were mainly from its newly acquired El Salvador project, which is miles away from production. OceanaGold is finally being rewarded in a market that's turning. TGR: What other companies fit that model? TvdH: Lake Shore Gold Corp. (LSG:TSX) is similar in the sense that it's showing a turnaround. It was run as an exploration company while it was producing. Lake Shore has a wonderful land package, but it should have been focused fully on production. It made a number of changes about a year ago and became cash-flow positive in the last two quarters. WM: And profitable even with the current gold price. TvdH: It's a good turnaround story. TGR: Does Lake Shore have any catalysts coming up that will help the market see what a turnaround it has made? WM: Given the current uptrend for gold prices, companies like Lake Shore Gold, which are already profitable at these low numbers, are becoming very profitable when the gold price regains some of its value toward $1,400/oz. We expect the gold price to move up toward $1,500/oz, and then these kinds of smaller producers that have turned the corner will react strongly in this better pricing environment. TvdH: The same goes for Detour Gold Corp. (DGC:TSX), which is similar to the Osisko Mining Corp. (OSK:TSX) project that's now in the throes of being taken over by a major. It has the same style of deposit. It's open pit, low grade and bulk mineable. It's been cheap to extract. Detour was expecting a quicker ramp-up with fewer problems getting to full production. Now it's focused on getting the right mine sequence. It has also made a few management changes. Detour isn't cash-flow positive yet, but it's on the right track. Much like Osisko, it's a no-brainer that Detour could be taken over sometime in the future. It will be revalued, particularly at the takeover stage. WM: Since our start in July 2008, we have had 25 takeover situations in our portfolio. The ongoing bidding war between Goldcorp Inc. (G:TSX; GG:NYSE) and Yamana Gold Inc. (YRI:TSX; AUY:NYSE; YAU:LSE) for the Osisko projects is the 25th. Detour is the largest Canadian gold mine, and it just started producing. Looking at the market cap, we get all the gold resources thrown in for free. The current market cap is a little shy of the total capital expenses to build the mine. There's great value still to be seen in the market. Investors should be taking advantage of the current situation. There's more deal flow in the market. Almost every week, we see the start of a new mining or private-equity fund focused on mining. There was a new fund started by some JPMorgan bankers. The Carlyle Group just started a new commodity fund. Billions and billions are fleeing into the market. This gives us confidence that the bottom has been set. TvdH: Another company that stands out for me is Midas Gold Corp. (MAX:TSX), which is developing a gold-antimony project in Idaho. There is currently no antimony production in the U.S. It has been designated as a critical mineral, but it is largely sourced from China, which has put some export restrictions on antimony during the last several years. Furthermore, Midas' project is large. It will be relatively cheap to build. Because of the antimony kicker, which is about $10/kilogram, we expect the mine will be cheap to operate. Idaho is also a derisked jurisdiction. A couple of mines already operate in Idaho, and the Midas gold project is designated as a brownfield site, which should make the permitting quicker. TGR: Midas just did a $10 million ($10M) private placement. Do you know how it plans to use those funds to add value? TvdH: We were lucky to have a small share of that private placement. It is putting at least part of that money into advancing toward the prefeasibility stage and deciding what kind of processing it will employ—bio-oxidation (BiOx) or normal solvent extraction. A prefeasibility study and the subsequent environmental impact statement would come along later this year. WM: We still have a very big focus on new discoveries. Our research department is very active and is always on the hunt for new discoveries. We love the discoveries by Probe Mines Limited (PRB:TSX.V), Fission Uranium Corp. (FCU:TSX.V) and Reservoir Minerals Inc. (RMC:TSX.V). TvdH: Probe was looking at classic, low-grade, large, open-pit bulk mining in Canada until it discovered a high-grade zone at depth and along strike. That was the signal for Agnico-Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) to take a 9.9% stake in the company. That started its performance on the stock market as well. Probe is becoming a bit of a different beast. It has shown that the high-grade area is consistent; it's now a matter of finding how long it is because it does need a certain volume. It would require an underground operation. Probe is drilling that area; if that shows upwards of 1 million ounces (1 Moz), it might make it to an underground mine as a standalone, apart from the open pit that Probe was looking to develop previously. It becomes a completely different kind of project from then on. TGR: When might those results be in? TvdH: Probe has been drilling since February. A few results have come in, but not quite the stepouts that we'd expected. I'm assuming that results will be coming in over the next couple of months. WM: It is an important discovery for Ontario because it changes the whole geological understanding of this part of Canada. It's important for investors to study this one. The discovery by Fission in the Athabasca Basin is too important to ignore, too. We've been big investors from the start of Fission. We were investors in Hathor Exploration, which was taken over two years ago. We were investors in the previous Fission company, which made the discovery along with Hathor. It's one of those world-class discoveries that can create billions in value. It still has a 100% hit rate—and if the deposit keeps growing, I wouldn't be surprised to see more than 100 million pounds of uranium in this discovery. TGR: And Fission has had a nice effect on all of the other companies in the Athabasca as well. WM: Yes, because it convinces us that the only good place to hunt for new uranium discoveries is this Athabasca Basin. TvdH: Interestingly, next-door neighbor NexGen Energy Ltd. (NXE:TSX.V) has made a discovery on a separate conductor to the one that Fission is drilling on, which implies that any of the conductors—Fission has loads of conductors on the rest of its property—could hold a similar amount of mineralization. That's what gets the excitement going. WM: A lot of blue sky still. I expect a bidding war on this Fission discovery within the next 12 to 18 months. It's too big and it's too important for the major producers worldwide to ignore. There will be lots of Asian interest for this one as well. TGR: Is there another discovery near Vancouver? TvdH: Falco Pacific Resource Group (FPC:TSX.V) is a fascinating story. The company purchased a drill database, which was not digitized, from Noranda Inc. It purchased the property for $5M and 7M in shares. Without one drill hole, it now has a deposit of 2.2 Moz, grading about 3.4 grams per ton (3.4 g/t) underground. On the face of it, you'd say the grade would be a bit dodgy, but Noranda had built the mine almost to the stage of opening it. It put in all the underground workings. It put in the mill. Then it realized it was gold, it wasn't a base metal, which was the focus of the company at the time. Then it had a merger with Falconbridge Ltd. Falconbridge was taken over by Xstrata plc (XTA:LSE) and this project was completely forgotten until Falco Pacific picked it up not too long ago. Falco's project is smack in the middle of the old Noranda gold district. It has a good management team led by Chairman Darin Wagner, who was involved in West Timmins Mining Inc., which sold to Lake Shore Gold. Howard Poulsen, a well-known geologist, is on its technical advisory board. Mike Byron, the vice president of exploration and a director, has more than 25 years in the field. If it can show a few more ounces, then this could be a nice mine at a cutoff of 3 g/t. TGR: A number of the companies in your fund are in Africa. How do you assess risk for a given region in Africa? TvdH: There are various types of risks in Africa. There is a cost risk in West Africa because power is expensive and infrastructure is lacking. South Africa has energy issues and social and labor unrest. We have 70% of our portfolio invested in less risky areas, like North America. We used to avoid South Africa entirely, but something has changed in the way that we look at platinum. Platinum Group Metals Ltd. (PTM:TSX; PLG:NYSE.MKT) is developing a classic platinum mine in South Africa—a thin reef mine, which will be labor intensive. But it has also come up with a new discovery at Waterberg. It's not a 30-centimeter thick layer of platinum-enriched rock—it's anywhere between 5–20 meters and wider. It's amenable to underground bulk mining methods, which makes mechanization possible. That keeps the project largely aloof from the labor unrest issues. Waterberg also has enormous size potential. The current size of the deposit is already world class. Platinum Group Metals made a stepout of about 5 kilometers (5km) recently, and it hit the same mineralization at a certain depth. Just a few weeks ago, it announced a 16km stepout had hit another mineralized structure. It owns about 23km of strike length. There is still huge blue sky on that project. We very much like the future for platinum group metals (PGMs) given that the Chinese automobile market is exploding and will need all the PGMs that the world can provide. The Waterberg project and Ivanhoe Mines Ltd. (IVN:TSX) Platreef project are the future of platinum mining in South Africa. WM: Platinum and palladium are very interesting for investors right now. The current supply and demand prognosis for palladium and platinum indicates shortages. These shortages will be structural. The palladium market will soon demand 9 Moz/year. The production will only be around 6 Moz—there's a huge deficit. Platinum and palladium are especially important to Asia, where they are used in the exhaust systems of cars, to combat the smoke and air pollution. TGR: Interesting. Where else are you focusing in Africa? TvdH: We've been watching Asanko Gold Inc. (AKG:TSX; AKG:NYSE.MKT) in Western Africa for a long time. It used to be called Keegan Resources. It was doing very well on the exploration front and then there was a management and name change. Along came Peter Breese. He has a huge track record. He has developed seven mines, which he sold to Norilsk for $6B. He developed, built and sold off a uranium company for $1B. If this gentleman steps into a project, he's not there just to pick up a paycheck. He's there to build mines. Breese, who is president and CEO of Asanko, brought about the merger with PMI Gold Corp. in February. He now has a huge cash position. He's fully financed to bring a decent-grade project to production in Ghana by 2016. TGR: You seem to like these turnaround stories. WM: A strong, proven, successful mine manager or entrepreneur can build companies time and again. The longer we are in this business—we're investors for more than 10 years now—the more we try to follow the good management teams. TvdH: That's a derisking aspect of the business: management. Management is one of the prime parameters for us. WM: However, we're quite fed up with the high salaries being paid to executives running companies that don't perform. The industry has to understand that investors are taking these compensation packages into consideration when they decide if they should invest or not. TGR: Do you predict an impact from the conflict in Russia as it is a supplier of PGMs? WM: Only if more sanctions are applied. Russian President Vladimir Putin understands how vulnerable the U.S. and the U.S. dollar have become. If strong sanctions were applied against Russia, it would be very easy for the Russians to stop selling oil in dollars and start selling it in yuan, rubles or even in gold. The U.S. knows it should be careful not to make Putin too mad because the dollar is too vulnerable. This is why no strong sanctions have been implemented until recently. TvdH: Last week, Russia-based Norilsk Nickel (GMKN:RTS; NILSY:NASDAQ; MNOD:LSE) made a deal with Chinese and Japanese buyers of palladium, which could tie up large quantities for the next five years. These are interesting deals because in the past Norilsk was just selling palladium at the spot price, whereas now the Chinese and the Japanese are seeing the strategic aspect of palladium and are willing to tie it up for longer periods to ensure their supply chain. TGR: Any final advice for our readers as we're going into this shifting world? WM: I would like to talk a little about silver. We talked a lot about gold, and gold is very important. It's my opinion that gold will come back in the monetary system. I don't expect a full gold standard, but gold will become more important. But silver is poor man's gold. When the gold price goes up too much, more people start to buy silver instead. However, there are no large, above-the-ground stockpiles available anymore. Silver was still used to produce coins until the 1980s. These above-the-ground silver stockpiles are almost completely gone. We're very interested in great silver companies with lots of ounces in the ground. TGR: Thank you both for your time. Willem Middelkoop is a successful entrepreneur and publicist from The Netherlands. He is a former market commentator for Dutch National TV, founder of Amsterdamgold.com, a web shop for gold and silver bullion that was sold in 2011, and founder of the Commodity Discovery Fund, where he is currently the principal. Middelkoop is a member of the Advisory Board of the London-based Official Monetary and Financial Institutions Forum (OMFIF). He is author of several books covering financial markets and the economy. His most recent book, "The Big Reset," his first book in English, was published at the end of 2013 and will be published in Chinese later this year. Terence van der Hout is a senior researcher at the Netherlands-based Commodity Discovery Fund. The fund focuses on investing in world-class natural resources discoveries in precious metals, base metals and specialty metals, as well as undervalued start-up producers. Van der Hout also distributes Strategic Metals Bulletin, a free, monthly commentary on developments in the world of critical metals. To subscribe, please send an e-mail to: terence@cdfund.com. Van der Hout has a background in finance and holds a master's degree in administration in political science from the University of Leiden. Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page. DISCLOSURE: 1) JT Long conducted this interview for Streetwise Reports LLC, publisher of The Gold Report, The Energy Report, The Life Sciences Report and The Mining Report, and provides services to Streetwise Reports as an employee. She owns, or her family owns, shares of the following companies mentioned in this interview: None. 2) The following companies mentioned in the interview are sponsors of Streetwise Reports: Probe Mines Limited and Fission Uranium Corp. Goldcorp Inc. is not associated with Streetwise Reports. Streetwise Reports does not accept stock in exchange for its services. 3) Terence van der Hout: I own, or my family owns, shares of the following companies mentioned in this interview: None. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. The Commodity Discovery Fund owns shares in Asanko Gold Inc., Detour Gold Corp., Midas Gold Corp., Fission Uranium Corp., Osisko Mining Corp., OceanaGold Corp., Lake Shore Gold Corp., Goldcorp Inc., Yamana Gold Inc., Probe Mines Limited, Reservoir Minerals Inc., NexGen Energy Ltd., Falco Pacific Resource Group and Platinum Group Mining Ltd. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview. 4) Willem Middelkoop: I own, or my family owns, shares of the following companies mentioned in this interview: None. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. The Commodity Discovery Fund owns shares in Asanko Gold Inc., Detour Gold Corp., Midas Gold Corp., Fission Uranium Corp., Osisko Mining Corp., OceanaGold Corp., Lake Shore Gold Corp., Goldcorp Inc., Yamana Gold Inc., Probe Mines Limited, Reservoir Minerals Inc., NexGen Energy Ltd., Falco Pacific Resource Group and Platinum Group Mining Ltd. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview. 5) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent. 6) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. 7) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes. Streetwise – The Gold Report is Copyright © 2014 by Streetwise Reports LLC. All rights are reserved. Streetwise Reports LLC hereby grants an unrestricted license to use or disseminate this copyrighted material (i) only in whole (and always including this disclaimer), but (ii) never in part. Streetwise Reports LLC does not guarantee the accuracy or thoroughness of the information reported. Streetwise Reports LLC receives a fee from companies that are listed on the home page in the In This Issue section. Their sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734. Participating companies provide the logos used in The Gold Report. These logos are trademarks and are the property of the individual companies. 101 Second St., Suite 110 Petaluma, CA 94952 Tel.: (707) 981-8999 Fax: (707) 981-8998 |

| China opens Beijing to direct gold imports Posted: 21 Apr 2014 10:47 AM PDT  Tanker passing through the Xingang Shiplock into the main harbour of Port of Tianjin, the largest port in Northern China and the main maritime gateway to Beijing. China, believed to be hoarding gold to diversify away from US Treasuries, has begun allowing direct imports of the precious metal via Beijing, in a move believed to seek keeping its import levels under the radar, sources told Reuters Monday. Until now, the nation's imports of gold have come mainly via Hong Kong, and since the mainland doesn't publish its bullion trade data, H.K. figures have been used to estimate China's import levels. But the opening of a third import point after Shenzhen and Shanghai, according to Reuters, could threaten Hong Kong's pole position in China's gold trade, as the mainland can get more of the precious metal directly rather than through a route that discloses how much it is buying. Between 2011 and 2013, Hong Kong exported 1,930 tons of gold to the mainland, which in turn imported 1,160 tons of gold from Hong Kong last year. But given that the mainland consumed only 1,066 tons of gold and its domestic gold production reached 428 tons, this leaves a gap of 522 tons unaccounted for. The World Gold Council believes the missing gold was most likely purchased by government agencies such as the central bank, while the remainder was used in financing operations. Meanwhile the country's gold reserves are officially put at 1,054 tonnes — a number officials haven't updated since 2009. Gold makes up little more than 1% of the country's $3.6 trillion in reserves compared to more than 70% for the United States, which holds 8,166 tonnes of gold in vaults. China overtook India to become the world's top importer of gold bars, coins and jewellery last year with 2013 imports soaring to 1,065 tonnes, up from 807 tonnes the year before. In addition to being the world's biggest consumer of bullion, the country is also the world's largest source of mined gold. Over the past decade, production has doubled from 217 tonnes to 437 tonnes. |

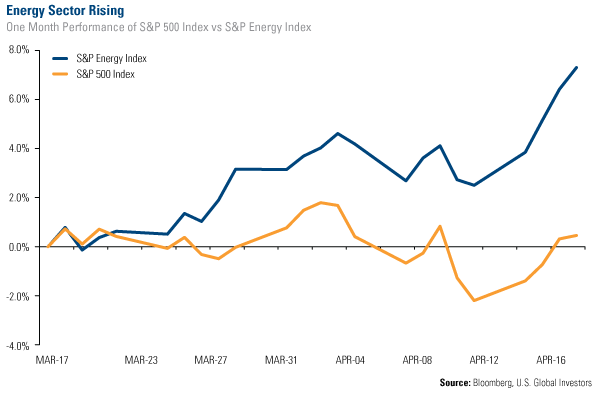

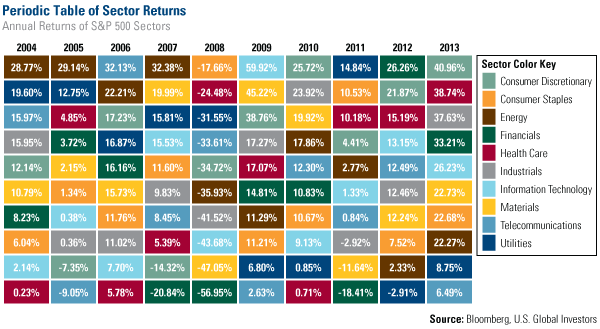

| Why energy is catching the market’s eye Posted: 21 Apr 2014 09:22 AM PDT Over the last month the energy sector has outperformed the market, and as you can see in the chart below, has done so by 6.5 percent. Year-to-date the sector is beating the S&P 500 Index by over 3 percent. In a spectacularly performing market during 2013, energy lacked some of the incredible performance seen throughout the other sectors, but recently it has turned up, catching the attention of the market yet again. What's causing this sudden shift in relative strength? As our Director of Research John Derrick describes in our recent video on the Periodic Table of Sector Returns, it is not unusual to see sectors move from top to bottom from one year to the next. For example, energy ranked as one of the top-performing sectors from 2004 through 2007, but quickly lost momentum in 2008 when it was hit the hardest after the financial crisis. In 2012 and 2013 energy turned in some solid numbers, but lagged in comparison to the other sectors. In looking at an overview of market performance, it's important to recognize what caused the moves. For example, one reason the energy sector is climbing back up, could be due to the broader market rotation that we've noticed recently, from growth stocks to value stocks. Growth stocks are generally successful companies that are expected to continue growing their earnings, usually at a rate that outpaces the market, causing investors to pay more for them. Value stocks rarely outpace the market as much as growth stocks do. Investors see potential in buying these cheaper names, ones that trade at lower price-to-earnings (P/E) ratios than the S&P average, because they still have the potential to significantly outperform over time. As I mentioned, in the past few weeks high-growth names have pulled back, while value names are steadily gaining momentum. One of the main reasons for this rotation is that some investors view the valuations of growth names as too high, especially in comparison to the value companies. What's significant is that many of these value names happen to be in the energy sector. We've taken advantage of this shift to value in our Global Resources Fund (PSPFX) through names like Pacific Rubiales and Valero Energy. Although this rotation is important to the recent moves in energy, it is not the only factor driving the sector up. Take a look at the price of oil and natural gas. Currently natural gas prices are starting to stabilize while the price of West Texas Intermediate (WTI) crude oil is up by 4 percent year-to-date, reaching $104 a barrel just last week. This price increase in WTI is linked to concerns over future supply, but nevertheless higher oil prices bode well for stocks within the energy sector. According to the Energy Information Administration (EIA), short-term projections for the price of WTI remain relatively high. Additionally, the group commented that, "Aside from seasonal issues, the EIA expects strong crude oil production growth, primarily concentrated in the Bakken, Eagle Ford, and Permian regions, continuing through 2015. Forecast production increases from an estimated 7.4 million barrels per day in 2013 to 8.4 million barrels per day in 2014 and 9.1 million barrels per day in 2015." This projection is good for North American producers and service companies. So how can you gain entry into this energy opportunity? Are you ready to energize your portfolio? I believe a well-diversified portfolio includes exposure to natural resources. In fact, I was just in Tirana, the capital city of Albania, where I have had the opportunity to expand my tacit knowledge by visiting several resource companies. I am excited to share my journey with you this week when I return home! Please consider carefully a fund's investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc. Past performance does not guarantee future results. Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. Because the Global Resources Fund concentrates its investments in a specific industry, the fund may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. Fund portfolios are actively managed, and holdings may change daily. Holdings are reported as of the most recent quarter-end. Holdings in the Global Resources as a percentage of net assets as of 03/31/14: EOG Resources 2.37%, Halliburton Co 1.87%, Pacific Rubiales Energy Corp 0.25%, Schlumberger Ltd 3.46%, Valero Energy Corp 0.29%. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Vancouver's Goldcorp won't challenge friendly deal for Osisko"