Sales at world's largest rare earth firm halves, profits evaporate |

- Sales at world's largest rare earth firm halves, profits evaporate

- 36,000 Chinese couples marry each day and gold gifts are de rigueur

- Ex-US president Jimmy Carter comes out against Keystone XL

- Legacy Introduces Tension Fabric Buildings for Mining Operations

- Yamana, Agnico Eagle offer $3.9bn for Osisko

- Fortescue misses expectations, vows to step up output to meet target

| Sales at world's largest rare earth firm halves, profits evaporate Posted: 16 Apr 2014 03:23 PM PDT China and the world's largest rare earth producer announced Wednesday a first-quarter slump in profits of 72% and a 52% drop in revenues compared to last year. Inner Mongolia Baotou Steel Rare-Earth Group recorded profits of only $11.2 million (69.4 million yuan) while revenues more than halved to $160 million (1.09 billion yuan). Baotou said sales volumes and realized prices for its rare earths – use a variety of industries including green technology, defence systems and consumer electronics – were both weak and blamed at least in part March's ruling by the World Trade Organization against China's export quotas. Xinhua reports an executive from Baotou said "producers were worried that the canceling of regulations on exports would compound the struggling sector with a further price slump." China's rare earth industry – responsible for almost 90% of global output – imposed strict rare earth export quotas in 2010, ostensibly to curb illegal mining and cut environmental damage. The industry is also being consolidated under three giant producers led by Baotou, China Minmetals Corporation and the Aluminum Corporation of China. Worries about the restrictions and China's monopoly of production sent prices for the 17 rare earth elements rocketing from 2008 onwards with some REEs going up in price twenty-fold or more, but prices have now come back to earth with a thud. Image of shrine in Baotou City by Matthew Stinson. |

| 36,000 Chinese couples marry each day and gold gifts are de rigueur Posted: 16 Apr 2014 10:42 AM PDT Last year saw frenzied buying as Chinese investors and jewellery buyers sought to capitalize on low prices with 1,035 tonnes of the shiny metal consumed, surpassing long time leader India according to a new study by the World Gold Council, an industry grouping. The total number of marriages in China has grown 60% over the last decade to reach about 13.2 million. Chinese families bought 669 tonnes of gold jewelry, about 40% of which was related to weddings according to the WGC. "Yellow means rich and abundant… non-destructible. It's a blessing that is passed on," Albert Cheng, the WGC Asia head tells Quartz: "Parents on either side of a betrothed couple give the couple jewelry – often a three-piece set of a necklace, pendant and bracelet, what jewelry stores call jiehun san jin, literally "marriage, three gold" — to represent the passing of blessing from the elder generation to the younger. This is even more the case in rural or third and fourth-tier cities where traditions are stronger." In India, marriage is perhaps even more associated with gold. The country has imposed import restrictions and high duties on gold that last year lead to a scarcity of the metal inside the country. During the wedding and festival season in India in the second half of 2013, jewelers demanded premiums of as much as $170 an ounce over the ruling London price. In Shanghai, gold also trades at a premium from time to time and last year topped out at $37 an ounce, but has since slipped back to a discount. Image of wedding celebration in Foshan, China by Kidchen915 |

| Ex-US president Jimmy Carter comes out against Keystone XL Posted: 16 Apr 2014 10:00 AM PDT Former U.S. president Jimmy Carter has joined a group of Nobel laureates in an open letter calling Barack Obama to reject the proposed Keystone XL pipeline from Canada. The message, published as a paid ad in Politico, tells Barack Obama that he stands on the brink of making a choice that will define his legacy on one of the greatest challenges humanity has ever faced — climate change. This is the first time an ex-president comes out to officially express his refusal to TransCanada's (TSX:TRP) project. "You stand on the brink of making a choice that will define your legacy on one of the greatest challenges humanity has ever faced – climate change," the Nobel Laureates write in the letter addressed also to US Secretary of State John Kerry. "History will reflect on this moment and it will be clear to our children and grandchildren if you made the right choice…. We urge you to reject the Keystone XL tar sands pipeline." The letter comes on the heels of an Environment Canada report blaming the oil and gas industry as the largest source of greenhouse gas emissions, due in large part to the expansion of the oil sands. The proposed project would transport crude from the Canadian oil sands in Alberta to refineries on the US Gulf Coast. Supporters have said it would be a boon for job creation and domestic energy production, but opponents have warned that oil extraction from the tar sands —among the most carbon-intensive methods of energy production— would likely increase should the project be approved. A University of Toronto study published last February suggested that the oil sands' impact on human health and the environment may have been underestimated due to flawed environmental assessment procedures. The Keystone XL project has been pending before the Obama administration for years, and because it crosses an international border, the State Department holds primary responsibility for approving construction. Other former US presidents have had their saying on the matter. George W. Bush said once that building the pipeline was a "no-brainer," and Bill Clinton said Americans should "embrace" the project and develop a stakeholder-driven system of high standards for doing the work. Obama has signalled that a decision on the Alberta-to-Texas pipeline is imminent before summer. |

| Legacy Introduces Tension Fabric Buildings for Mining Operations Posted: 16 Apr 2014 09:05 AM PDT South Haven, Minnesota (PRWEB) December 31, 2013 — Combining superior quality rigid frame engineering with the proven benefits of tension fabric, Legacy Building Solutions now offers mining companies the industry's first line of tension fabric buildings to incorporate structural steel beams instead of open web trusses. This engineering concept provides a high level of flexibility for storage of bulk material or equipment, vehicle maintenance shops, portable or stationary soil remediation facilities, and other fabric structures used in mining or oil and gas operations. Legacy buildings utilize a durable rigid frame in place of the hollow-tube, open web truss framing traditionally used for fabric buildings. Unlike hollow tube steel, Legacy's solid structural steel beams are not vulnerable to unseen corrosion originating inside a tube. Additionally, the structural steel has multiple coating options, including hot dip galvanizing, red oxide primer and powder coat paint. The strength of the structural steel frame provides several engineering advantages, including the ability to relocate buildings by towing or crane. The rigid frame also delivers the flexibility to customize buildings beyond the confines of standard shapes and sizes to the exact width, length and height required. Legacy's straight sidewall design allows for the inclusion of a variety of overhead doors, exit doors and dormers along the sides. Structures can be modified to provide desired eave extensions and interior columns. They also can be engineered to carry ancillary systems that need to be suspended, including overhead cranes, fire suppression systems, ventilation and lighting. Legacy buildings feature high-quality polyethylene fabric roofs that eliminate the corrosion concerns associated with metal-constructed facilities. A wide variety of PVC fabrics are also available. The durable fabric allows natural light to permeate the structure, while insulation can be added when required. Installation is faster than with conventional buildings, and the design can be adjusted for stationary or portable applications. Sidewalls can be customized and built with any desired material — including steel, paneling or siding — and then easily lined with fabric to prevent corrosion to the interior. Legacy steel components and fabric covers are backed by a 15-year warranty. Legacy offers assistance from concept to completion, including renderings, foundation design, installation and project management. To date, Legacy's in-house, professional installation crews have constructed more than 30 million square feet of fabric buildings. Legacy Building Solutions specializes in the innovative design, engineering and construction of fabric-covered buildings for several different industries and applications. For more information, contact Legacy Building Solutions, 19500 County Road 142, South Haven, MN 55382, call 320-259-7126 or 877-259-1528, or visit the company's website at www.legacybuildingsolutions.com. |

| Yamana, Agnico Eagle offer $3.9bn for Osisko Posted: 16 Apr 2014 08:15 AM PDT Canadian gold miners Agnico Eagle Mines (TSX:AEM). and Yamana Gold (TSX:YRI) have teamed up to buy Osisko Mining Corp. (TSX:OSK) in a friendly acquisition deal worth $3.9-billion. The cash-and-stock bid, said the companies in a statement, values Osisko at $8.15 a share, which is 11% more than what they'd get if accept the recent $3.6bn hostile offer from Goldcorp Inc (TSX:G) (NYSE:GG). The world's second most valuable gold miner after Barrick Gold (TSX:ABX), is seeking to take control of Osisko's low-cost Malartic gold mine in Quebec. Osisko shareholders will get $1bn in cash, $2.33bn of Agnico and Yamana shares, and shares of a new spin-off company valued at roughly $575 million, which will have a royalty on the Malartic mine. "With the announcement today of the combined bid by Yamana and Agnico Eagle, I believe we have delivered shareholders the superior value option to the hostile attempt to acquire our company," Osisko chief executive Sean Roosen said in a statement. He added that the "new Osisko" would be a company with regular and strong cash flow, strong future potential for increasing cash flow, and tremendous upside exploration potential." The news coincides with Goldcorp's announcement Wednesday of wanting to replace the board of directors at Osisko with its own slate of nominees. The Vancouver-based gold company said it would nominate 11 people including its own chief executive Chuck Jeannes to the Osisko board for election at the company's annual meeting next month. Osisko agreed to pay a $195 million break fee to Agnico and Yamana if the transaction does not go ahead. The deal needs the approval of Osisko shareholders by a two-thirds vote. |

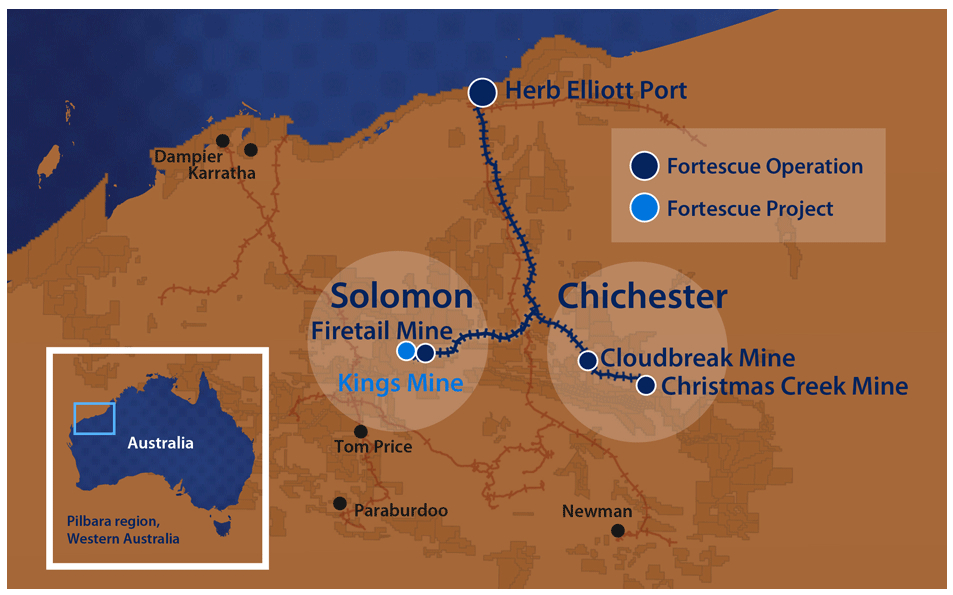

| Fortescue misses expectations, vows to step up output to meet target Posted: 16 Apr 2014 08:09 AM PDT Fortescue Metals Group (ASX:FMG), the world's fourth largest iron ore miner, said Wednesday I won't give up on its full year export target, despite revealing a set of March quarter results that missed analyst expectations. Australia's third biggest iron ore producer mined 29.6 million tonnes of iron ore in the three months to the end of March, up 17% on the same period last year, but down 8% on the previous quarter because of bad weather conditions, especially cyclones. Its larger rival BHP Billiton (ASX:BHP) has just increased its annual production forecast by five million tonnes. "Whilst there was short term volatility in the March 2014 quarter, China's demand for iron ore remains strong with the government committed to continued economic growth and urbanization," it said.

The firm also said it will run the two ore processing facilities and the train load-out facility at its Solomon Hub mines, in the Pilbara region, which have been operated by Leighton Contractors. The company took responsibility for iron ore processing at its Christmas Creek mine last year after a contractor was killed. Fortescue shares fell 8c in morning trading but rebounded to close up 6.5c at $5.395. Images courtesy of Fortescue Metals Group |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Sales at world's largest rare earth firm halves, profits evaporate"