Robert Cohen's Three Drivers for the <b>Gold Price</b> in 2014 - INO.com |

- Robert Cohen's Three Drivers for the <b>Gold Price</b> in 2014 - INO.com

- The <b>Gold Price</b> Closed at $1283.40 This is a Great Place to Buy

- <b>Gold Price</b> Looking For Short Term Support :: The Market Oracle <b>...</b>

- <b>Gold price</b> dips below $1,300 | MINING.com

- This is the scariest <b>gold price</b> chart you'll see today | MINING.com

- <b>Gold price</b> falls through key support level | MINING.com

| Robert Cohen's Three Drivers for the <b>Gold Price</b> in 2014 - INO.com Posted: 01 Apr 2014 06:18 AM PDT The Gold Report: Low interest rates, a cornerstone of recent modern Western economic policy, have proven positive for gold over the last several years. What do you see as the three primary price drivers for gold this year? Rob Cohen: The primary price driver is global liquidity. That is fed by balance-sheet expansion in many Western countries and foreign exchange reserves, typically the result of trade deficits built up in countries such as China. Number two is real interest rates. The Federal Reserve could tighten rates, but we don't know where inflation will be. Negative real rates are very good for gold. Mildly positive real rates are not harmful for gold. Positive real rates above 2% can stall the gold price.

Number three is geopolitical crisis. Strife can get priced in and out of the gold price. We also believe that gold should maintain its purchasing power to oil. Over the last 40 years one ounce of gold typically bought 15 barrels of West Texas Intermediate oil. That ratio has been knocked down to about 13:1. I would expect some reversion closer to 15:1 this year. Taking that ratio in isolation would mean that gold is underpriced by about US$200/ounce (US$200/oz). In 2013, the gold price was knocked out of whack with respect to other hard assets, driven by the 900-tonne liquidation in the gold exchange-traded funds (ETFs). The damage was probably a US$200/oz drop in the gold price. We suspect that the massive amount of gold liquidated by the ETFs were driven by hedge funds and speculators. The gold ETFs have over one million investors, who for the most part have hung onto their gold holdings. It was the fast money that appears to have left and, therefore, we do not expect to see a repeat of last year from the rest of the investor base. Between 2004 and 2012, the ETFs built up 2,600 tonnes of gold. Putting that into context, that made the ETFs the fourth largest holder of gold behind U.S., Germany and the International Monetary Fund. In one year, 900 of those 2,600 tonnes were liquidated. If a central bank the size of Germany's liquidated 900 tonnes of gold in one year, it would have made a lot more headlines. ETFs are now the sixth largest holders of gold, after the above mentioned entities and Italy and France. So far in 2014, the ETFs are back into accumulation mode, which implies that the investors are once again seeking this asset class. TGR: Wasn't some of that 900-tonne sell-off offset by gold buying in China? RC: It had to be mopped up somewhere and, in our view China is a natural buyer. If China is serious about making the renminbi a global reserve currency, part of the formula to get there is to build up gold reserves. The U.S. gold reserve is about 8,300 tonnes. As far as we know, China has approximately 1,000 tonnes, hence we believe that China will need significantly more gold as a percentage of its foreign exchange reserves.

To put this into perspective, the whole gold market in a given year is about 4,3004,400 tonnes. Approximately 2,500 tonnes come from new mine production; the rest is above ground stocks moving around. Central banks, no matter how aggressive, can accumulate only in the hundreds of tonnes annually. Hence it could be a multi-decade project for the Chinese to accumulate the gold it needs. The ETF liquidation last year would have been manna from heaven for China, allowing it to accumulate a few more hundred tonnes. Jewelers also stepped in and bought gold on the pullback in price. As the Chinese middle class expands, the per-capita consumption of physical gold has increased. The year 2013 was an anomaly. The 900-tonne sell-off harmed the market to a large degree. Gold was due to go down last year on the back of a strong U.S. dollar. The herd mentality took the price drop to an extreme. This year, U.S. employment and industrial production data are showing some cracks. That is strengthening sentiment for gold, and it's funneling down into gold equities. TGR: Ukraine, Crimea and Russia have been in the headlines. At the Prospectors and Developers Association of Canada conference, I spoke with Canada's Foreign Affairs Minister John Baird. He said the situation in the Ukraine was the most troubling geopolitical situation since 9/11. Are you managing your funds differently in light of what's happening there? RC: Not at all. We estimate that the situation in Crimea added approximately US$5080/oz to the gold price. The price hit $1,380/oz and has already come back down. Our view is that the crisis has now been largely priced out for the time being. TGR: Your Dynamic Strategic Gold Class Fund, which is 57% vested in bullion, is up about 21% since January. Last year wasn't as positive. How do you pitch your gold-based funds to investors? RC: The Strategic Gold Class Fund, founded in 2009, gives investors a mutual fund that can own up to 70% gold bullion, and hence we view this fund as being well suited for those investors looking for gold exposure, but who are less comfortable with taking on the individual equity risk. As far as the equity portion goes, we can expand and contract that depending on our view of the gold market. If the gold equities are building strong legs, we migrate the fund into gold equities by selling bullion and converting it to equities. Typically, the fund is 3070% bullion, skewed to the conservative side. Today, with 57% physical gold, we're in the middle. Although the market has been strong year-to-date, we're not ready to hand over all that bullion and put it into equities just yet. We have trimmed the gold position in baby steps. Being in Canada, we also have the option to hedge or not hedge the Canadian dollar on that physical bullion. When the Canadian dollar is rising we are likely to hedge to give investors a better return. When the Canadian dollar is weakening, we want to have more of a U.S. dollar return. If you're naked on the hedge, you get the Canadian dollar exposure. In other words, if the Canadian dollar has fallen 10% year-to-date, even without a change in the gold price, you would see a 10% gain in the gold price in Canadian dollars. TGR: Do you see a lot of value in gold equities right now? RC: On a broad level, many equities are trading near fair value at current spot prices. Some are more expensive, but it's usually a case of paying up for quality. Some of the junior companies are lagging, but investors remain cautious and conservative. Sentiment has moved a lot this year, but there's still way more liquidity in the senior companies. Smaller companies, even those that have performed well in the context of the total market capitalization, might not come back so easily. The market is building legs very slowly and investors are being choosy, especially on the exploration side. Companies with interesting discoveries are generally doing better than those at the grassroots level. TGR: One ongoing saga is Goldcorp Inc.'s (G:TSX; GG:NYSE) bid to take over Osisko Mining Corp. (OSK:TSX), which Goldcorp seems likely to win. What does that transaction tell potential investors in the gold space? RC: I'm not sure Goldcorp will win. The timing of the bid has resulted in some interesting dynamics. In January, the gold price was starting to move up and the Canadian dollar was moving down. This strengthened the Canadian dollar gold price.

A company with less leverage to the gold price was bidding for a company with more leverage. Hence, Osisko's year-to-date performance has been no better than its peer companies without a bid on them. Osisko is up 61% year-to-date. Kirkland Lake Gold Inc. (KGI:TSX) is up 59%, Lake Shore Gold Corp. (LSG:TSX) is up 65%. Osisko is trading in the middle of the pack and some investors could therefore argue that the stock may have performed better without a bid. Part of the reason for this is that the bid itself is not an all-share bid; it's CA$2.26 cash plus 0.146 Goldcorp shares. In January, had the gold price gone down, the Goldcorp shares would have gone down, but the CA$2.26 cash would have stayed the same. The cash would have represented a put option and made the bid look more attractive in a downward-trending gold market. The opposite happened: The gold price has increased substantially and the cash component has gone the opposite direction. Instead of acting as a put option, it becomes a cash drag. The bid no longer looks as interesting, given the improved gold price. The market price is reflecting this, and the shares are trading above Goldcorp's offer. At the time of the bid most shareholders balked at the idea of tendering. Those who did sell probably lacked confidence that the gold price would continue to rise. The buyers would have been arbitragers. TGR: Osisko has come out with a revised mine plan. RC: The revised mine plan pegs a lot more value on the Osisko shares than they've been given credit for in the market. It puts pressure on Goldcorp to revise the offer. I don't know if Goldcorp will succeed. It depends on where the shareholding now lies. We don't know how many shares have traded since the bid or to what degree. It's in the hands of the arbitragers. TGR: Is there a Canadian theme at work here? Osisko has a scalable Canadian project. The Canadian dollar is falling. RC: I dont see this as a Canadian theme, but one could argue that the low-hanging fruit in politically safe countries has been plucked over in the gold sector and it's harder for companies to find world-class deposits in Nevada or Canada. Acquisitions are one way for companies to stay in countries that have very strong mining laws, where it's relatively easy to permit. My view is that the next generation of high return projects will likely pop up in West Africa or other jurisdictions with more political risk. TGR: What metrics did you pay most attention to in the Q4/13 results reported by the gold producers you follow? RC: I was interested in cash flow per share and the sustainability of those cash flows. We look at the quality of the cash flows on the horizon to capture a net asset value calculation. Two companies may have the same price to cash flow, but one has a significantly longer and more robust mine life, the other has high grades that are expected to drop after a certain number of years. For development companies we look at internal rates of returns (IRR) on the projects and their economic robustness. Single-digit or low double-digit IRRs don't interest us much. We like to home in on projects with higher IRRs. We own perhaps six development companies that we like a lot. Otherwise we stick with producers, about 24 names in the entire fund. TGR: Are there silver companies among the gold? RC: A couple. We own some Fresnillo Plc (FRES:LSE). Tahoe Resources Inc. (THO:TSX; TAHO:NYSE) is a significant holding. We also have a bit of Fortuna Silver Mines Inc. (FSM:NYSE; FVI:TSX; FVI:BVL; F4S:FSE). Silver is a double-edge sword. It will outperform gold in a strong market, but in a weak market it could underperform gold. TGR: What do you think of Tahoe's Escobal mine? RC: The Escobal mine is fantastic. The knock on that stock is the fact that the mine is in Guatemala. Before Tahoe built Escobal, the company came through a lot of challenges from environmental groups. But Tahoe got it built. There are more than 360 million ounces of silver in this one project. A polymetallic silver mine is unusual. Escobal has zinc and lead. You don't often find rock in the ground that's worth more than $350/tonne. It's really hard to come up with a higher quality investment. TGR: Fortuna didn't meet the Street's expectations for earnings per share, but it's having a good year. Is there more upside left there? RC: We think that there's upside left. Fortuna is well managed and it has a high-grade discovery in Mexico that will show up in near-term production. Some people will consider Fortuna politically safer. They might prefer Mexico and Peru over Guatemala, but that varies from individual to individual. TGR: This quarter, small-cap precious metals equities have been the sector's best performers. Are these types of companies the sweet spot right now? RC: Yes, these names have done well in the risking gold price environment. As an example, Probe Mines Limited (PRB:TSX.V) has one of the better discoveries we've seen in Canada for a while. Its infill drilling results are coming in better than expected; that helped Probe go up 58% year-to-date. That story continues to unfold. I wouldn't call it a slam-dunk just yet, but it is certainly worthy to be one of the 24 names we hold in the portfolio. TGR: Can you share other development names you hold? RC: Papillon Resources Inc. (PIR:ASX) is working in Mali. Orbis Gold Ltd. (OBS:ASX) has a new high-grade discovery in Burkina Faso. That is also where Roxgold Inc. (ROG:TSX.V) is working on a high-grade underground project. All three have robust economics and are finding more gold through extensional drilling or satellite deposits, which will enhance the economics. These projects should all have fairly fast payback periods, robust rates of return on capital employed and strong cash flows. All would be potential takeover targets for a big company looking for the best quality projects. Just as importantly, even if they are not taken over, these companies won't have problems raising the capital needed to build their projects. TGR: Is it more likely that Roxgold will develop Yaramoko or that it will get taken out by someone bigger, like SEMAFO Inc. (SMF:TSX; SMF:OMX), which is next door? RC: SEMAFO would be a logical buyer, given the proximity to its Mana mine. I would give a takeover 50-50 odds. The three development companies I mentioned are also poised to develop their projects themselves. They can garner some really high rates of return and the projects aren't overly complex. The producers may wait until the mines are in production and have demonstrated that they work before paying up. However, there's more meat on the bone for them to buy in early. The producers might give up some of that in the meantime while the companies continue to derisk their projects. TGR: There's been political tension in Mali, where Papillon is working. How much of a risk is that? RC: Papillon is in the southwestern part of Mali right up against the border, more than 1,000 kilometers away from the unrest in northern Mail. We are relatively comfortable with the risk, given the distance. TGR: What can you tell us about Orbis? RC: Orbis is a new story. Its market cap is about AU$77 million. Its Natougou project is in Burkina Faso. It's high-grade, 3.5 grams per tonne (3.5 g/t), and open pittable. Orbis can run high grade for the first few years and get a very quick payback. The 3.5 g/t grade covers up the economics because of the high strip ratio. On the other hand, given that it is a flat-line deposit, there could be other opportunities. TGR: What companies that might appeal to more conservative investors are in your fund? RC: We scour the world beyond North American listings. We'll look at stocks listed in London and Australia. That's how Papillon and Orbis came into our fund. Randgold Resources Ltd. (GOLD:NASDAQ; RRS:LSE) is a key investment for us. It has a $7 billion market cap and has consistently delivered. We also own Goldcorp and Franco-Nevada Corp. (FNV:TSX; FNV:NYSE), which are both quality North American names. TGR: Franco-Nevada just announced a 10% increase in its dividend. What did you make of that news? RC: It's positive news. I'd like to see more companies, especially royalty companies, raise their dividends if they can. It might bring a broader range of investors into the stock. Generally speaking, gold companies pay low dividends. If we can maintain a solid gold price for a couple of years, companies that can afford it should pay stronger dividends. I'd like to see them all pay dividends north of 2%. At this time, many of the miners recirculate their cash flows to build other projects, some of which have lackluster returns. TGR: Randgold announced earlier this year that it is debt-free, but that it will plow a lot of money into exploration. What did you make of that? RC: Randgold has $5060M budgeted for exploration in countries like Cte d'Ivoire. It is also looking at land near Papillon's project in Mali. The company has strict criteria for its exploration portfolio and has historically generated value through exploration, so I am not opposed to them spending money on additional exploration. By next year, Randgold will be into the cash flow harvest mode. It will have money for both exploration and a dividend enhancement. I would expect Randgold to have one of the leading dividend yields in a couple of years. TGR: Could you blue-sky gold for us? RC: Gold is still sporting a few of the bruises it got last year, although they are healing. Without any change in world affairs, we believe that the gold price could rise US$100200/oz. There is fairly positive economic data coming out of the Western countries and overall strength in the broader stock market. Any significant catalyst that will erode fiat money purchasing power, such as falling industrial production, more unemployment or broader trade deficits, could take gold much higher. Gold moves when you least expect it. Investors should always have some gold in their portfolios for insurance. That's the main purpose of owning gold. Profitability is the important thing for gold miners. Profitability is not only dictated by a gold price, it's also dictated by cost levels. As long as the gold price behaves well with respect to cost inputs such as energy, oil, steel, chemicals and labor, there's a profit margin to be eked out. For more than 40 years, the gold price has been well behaved with respect to all of those input costs. Last year was an anomaly. I think we are now seeing the profit margin being restored. Capital markets are also being more generous. Companies that have quality projects will have no problem accessing capital markets, be it equity or debt. TGR: Robert, thank you for your time and your insights. A mining and mineral process engineer by training, Robert Cohen is vice president and portfolio manager for GCIC. His experience in the mining industry is extensive and includes work as an engineer and a corporate development adviser for an international gold mining firm. Cohen completed his Bachelor of Applied Sciences in mining and mineral process engineering at the University of British Columbia in 1992. In 1998, he received his Master of Business Administration and, in 2003, he received his CFA designation. Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page. DISCLOSURE: Article source: http://feedproxy.google.com/~r/theaureport/Ajgh/~3/FCivBGNBMwA/15922 |

| The <b>Gold Price</b> Closed at $1283.40 This is a Great Place to Buy Posted: 31 Mar 2014 04:48 PM PDT Gold Price Close Today : 1283.40 Change : -10.40 or -0.80% Silver Price Close Today : 19.734 Gold Silver Ratio Today : 65.035 Silver Gold Ratio Today : 0.01538 Platinum Price Close Today : 1418.50 Palladium Price Close Today : 777.50 S&P 500 : 1,872.34 Dow In GOLD$ : $265.08 Dow in GOLD oz : 12.823 Dow in SILVER oz : 833.97 Dow Industrial : 16,457.66 US Dollar Index : 80.240 Mercy! I hope y'all are listening to me, because silver and GOLD PRICES look prettier than a new puppy here. What! Have you lost what little mind you ever had, you nacheral born durn fool from Tennessee? Maybe, but maybe I ain't that big a fool after all. The GOLD PRICE lost $10.40 (0.8%) today to $1,283.40 but the SILVER PRICE only lost 3.8 cents (0.2%) to end at 1973.4. This disagreement shows up in the GOLD/SILVER PRICE, which fell from 65.436 on Friday to 65.035 today. Now I don't know nothin', not a durned thing, but I can look at a chart and report. The gold price has fallen back a little more than 50% of its December-March rise, right back to the running together of the 200 and 50 day moving averages, back to lateral support around $1,300 - $1,295. Stay with me now. From November through February gold traced out an upside-down head and shoulders reversal pattern. The neckline of that pattern strikes gold's price graph today about $1,283. So what? So after a breakout from that pattern, the market often trades BACK to that neckline for one final kiss good-bye, then turns around and races out the door. Other indicators are more oversold than government lies and propaganda. AND gold is skidding along, sliding down its lower Bollinger band. What about silver? For the first time today I looked at both silver and gold and saw a similarity in the charts. If you call silver's reversal range from November through February an upside down HandS, and you have to look very hard to see it, a line drawn across the shoulders (not the neckline) stands about 1950c. So, too, the downtrend line from April hits there, the line silver broke through and above in April, so right now it is kissing back to that line -- WHOOPS, which just happens to coincide with the 75% correction point. Put it on the razor's edge. Neither silver nor gold can fall much further than this without asking to fall a lot further. They will either stop and turn here or within a few points, or fall much further. I believe they'll turn. I believe this is a great spot to buy. I have to get out of here. I love y'all, but we have a Hereford sow that gave birth to 10 piglets over the weekend, I haven't seen them yet, and the sun is about to go down. Shucks, I forgot to tell y'all one more thing: Platinum and Palladium rose strongly today after falling hard last week. One more good sign. Mother Janet today made a speech in which she tried to un-say her mistake at the last FOMC press conference. Y'all may remember -- or y'all may have already purposely forgotten it as an item too silly and disgusting to bother cluttering your cerebellum with -- that Mother Janet made the false step of alluding to letting interest rates rise in six months. Mercy! It was like giving bad whiskeyand downers to a depressive -- stock market swooned at the prospect. So today she tried to correct that by speechifying that the Fed would have to keep interest rates low to help the job market. Stocks went manic. All this sounds a bit like Louis XIV worrying how all his illegitimate children are going to make a living. Why does that concern you NOW? Isn't it a little late for that? Besides, what does an academic and long time banking apparatchik like Yellen know what it means to strap on a tin bill and peck in the dust with the chickens? When did she ever meet a payroll? Or work two jobs just to keep food on the table? Or survive on unemployment? Ahh, yes, the little pee-puhl! Before you talk about 'em, you ought to know at least one, maybe two. Our nobility is just as arrogant as aristocrats of the French Ancien Régime, but not nearly as classy or good looking. In the end they are just nouveau riche Lumpenproletariat who've been to college, or Jeeter Lester enriched by usury. So Mother Janet's speech goosed stocks, but not enough. Harken, I will elucidate. Dow climbed 134.6 (0.28%) to 16,457.66 while the S&P500 leapt 14.72 (0.8%) to 1,872.34. That sounds like hearty progress, 'cept it did no more than propel both indices to the top of that even-sided triangle and stop. Now maybe they jump through tomorrow, but they're needing larger and larger clouds of Fed hot-gas to inflate them. 'Tain't progress. But with a drop in metals, today's Yellen-spellin' was enough to drive the Dow in metals up further. Dow in gold rose 1.7% to 12.82 oz (G$265.01 gold dollars). This corrects a little better than 50% of the fall from End December to mid-March. Garden variety correction. Dow in silver rose 0.12% to 833.21 oz (S$1,077.28 silver dollars), correcting about 75% of the December - February fall. Both indicators have stretched way up into overbought territory, which hints they will unstretch soon. The fabulous US dollar index, robber of widows and orphans, despoiler of nations, global parasite, betrayed its fans again today. It broke out upside from the little consolidation or flag it had formed, ran through its 50 DMA above with an 80.57 high, then sank like your glasses fallen out of your shirt pocket when you looked over the edge of the bass boat. Closed lower by 10 basis points (0.12%) -- puking sick weak action. Next move ought to be down. And this one was thanks to Mother Janet, too, since interest rates figure large in determining exchange rates, and Mama Janet said she intends to keep 'em low a long time. Hard not to conclude that the establishment WANTS the dollar to fall largely. Euro poked up its head 0.16% to $1.3770, but remains in its trajectory off the cliff. No big comeback there. Yen fell 0.3% to 96.88 c/Y100, trying to break out of its trading range to the downside. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| <b>Gold Price</b> Looking For Short Term Support :: The Market Oracle <b>...</b> Posted: 31 Mar 2014 01:11 PM PDT Commodities / Gold and Silver 2014 Mar 31, 2014 - 06:11 PM GMT By: Gregor_Horvat {{8830|Gold}} is bearish for two weeks now and very slow beneath 1300 level, so we suspect that market is still in wave (a) and that current sideways price action is red wave iv) as part of a bearish impulse, so we are looking down in fifth for the start of this week. 1270/1280 level could be seen before market turns up for a three wave rally in wave (b). Short-term critical resistance is at 1319. Gold 4h Elliott Wave Analysis Written by www.ew-forecast.com | Try our 7 Days Free Trial Here Ew-forecast.com is providing advanced technical analysis for the financial markets (Forex, Gold, Oil & S&P) with method called Elliott Wave Principle. We help traders who are interested in Elliott Wave theory to understand it correctly. We are doing our best to explain our view and bias as simple as possible with educational goal, because knowledge itself is power. Gregor is based in Slovenia and has been in Forex market since 2003. His approach to the markets is mainly technical. He uses a lot of different methods when analyzing the markets; from candlestick patterns, MA, technical indicators etc. His specialty however is Elliott Wave Theory which could be very helpful to traders. © 2014 Copyright Gregor Horvat - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors. © 2005-2014 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication. |

| <b>Gold price</b> dips below $1,300 | MINING.com Posted: 26 Mar 2014 12:56 PM PDT The gold price briefly dipped below the psychologically important $1,300 level on Wednesday, the lowest in more than six weeks. On the Comex division of the New York Mercantile Exchange, gold futures for June delivery last traded near its lows for the day of $1,299.90 an ounce, down $11.50 or nearly 1% from yesterday's close. The yellow metal has taken a hammering during the past eight trading sessions – gold is down from a high above $1,380 reached on Monday last week which was best level since June. On a technical basis gold is also close to dangerous waters with a key indicator – the 200-day moving average – currently sitting at $1,296.60. If the gold price should fall through this level all bets are off concerning further weakness. Gold is still up some $100 since the start of the year, but positive news from top consuming region Asia and bullish positioning from speculators in New York has not been able to turn around recent negative sentiment. Instead, large investors on the futures and options market appears to have used this week to lighten their long positions (bets that the price will go up), while investors in gold-backed ETFs booked some profits from gold's strong showing in 2014. Last week saw the first reduction in four weeks of holdings in exchange traded funds backed by physical gold. The reduction was small, only 0.2 tonnes, but the loss of positive momentum has soured sentiment. An underlying weakness has been expectations that interest rates will continue to rise in the US and boost the dollar. Gold, which unlike other financial assets provides no yield, competes with US bonds for investor money and gold and the dollar usually moves in opposite directions. Picture of gold mannequins from Dali-Theatre Museum in Barcelona by Chirag D Shah. |

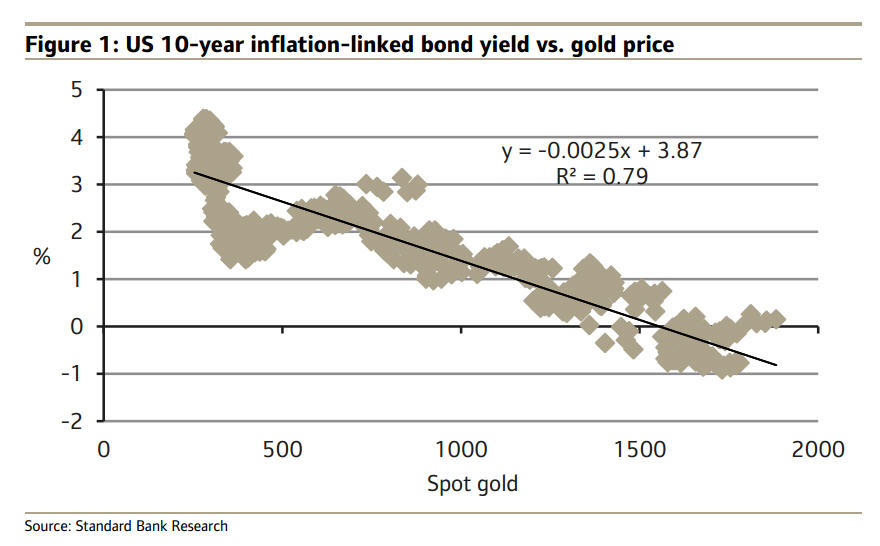

| This is the scariest <b>gold price</b> chart you'll see today | MINING.com Posted: 25 Mar 2014 11:23 AM PDT The Standard Bank commodities team's always cogent analyses revealed a stunner this week. The specialists at the commodities trading arm of the bank – which is being bought by China's ICBC and may get a table at the daily London gold fix – are not the first to point out the correlation between real US bond yields and the price of gold. But the chart plotted in the London and Johannesburg-based firm's latest research note to show the connection puts the trouble ahead for the gold price in stark relief. Analyst Leon Westgate, says the house view is that "real interest rates in the US will continue to rise in coming months as the Fed monetary policy normalises, which will put downward pressure on gold. The relationship between real long-term interest rates in the US (as proxied by 10-year US inflation-linked bonds) and the gold price is strongly negative." 10-year real yields (Treasury Inflation Protected Securities or TIPS) are currently at 0.59% which seems consistent with today's gold price of around $1,310 an ounce. Absolute future gold price levels probably shouldn't be divined from this chart, but it does point to one thing: If you buy into this theory, the gold price is going down. |

| <b>Gold price</b> falls through key support level | MINING.com Posted: 27 Mar 2014 10:31 AM PDT The gold price fell again on Thursday breaking through a key technical support level to bring losses over just the past two weeks to more than 6%. On the Comex division of the New York Mercantile Exchange, gold futures for June delivery last traded near its lows for the day of $1,294.00 an ounce, down $9.50 from yesterday's close after. Early on the gold price dipped as low as $1,291.90, but volumes remained light ahead of April gold options close-out. On a technical basis gold broke through a key support level – the 200-day moving average – sitting at $1,296.70. Now that this level has been breached the yellow metal should expect next support at $1,280. Gold is down from a high above $1,380 reached on Monday last week which was best level since June, but remains almost a $100 an ounce for the better this year. Large investors on the futures and options market appears to have used this week to scale back long positions (bets that the price will go up), which were built up to the most bullish levels in more than a year of a net 13.8 million ounces. |

| You are subscribed to email updates from gold price - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Robert Cohen's Three Drivers for the Gold Price in 2014 - INO.com"