Bolivia to revise new mining law |

- Bolivia to revise new mining law

- Former JPMorgan commodities chief under federal probe

- Green Germany returning to brown coal, villages in limbo

- Gold price up on Fed minutes, Ukraine worries and tanking stocks

- De Beers returns to Angola with new exploration deal

- Notice of Auction for Surplus Items at AngloGold Ashanti Obuasi Mine – April 15 & 22nd

| Bolivia to revise new mining law Posted: 11 Apr 2014 08:14 AM PDT  Bolivian President Evo Morales greets Carlos Mamani, who survived a mine collapse in Chile and was trapped underground for months with 32 Chileans miners. (Image from Flickr) Bolivian President Evo Morales and leaders of the National Federation of Mining Cooperatives have formed a commission to quickly redraft at least three controversial articles of a new mining law adopted late last month. The current legislation sparked last week violent protests among the country's independent miners, leaving two dead and at least 60 injured. The miners were objecting to the law because it doesn't allow them to associate with private companies, whether domestic or foreign, though it gives them tax benefits. On Monday the government said it has discovered at least 42 illegal contracts between co-op miners and multinational firms, which — added to the deadly clashes last week— led to the dismissal of the minister of mines Mario Virreira. In his place, Morales designated Cesar Navarro whose first task will be to take an audit of the illicit contracts. Evo Morales, South America's first indigenous President, has become an outspoken critic of the industrialized world. One of his first measures when taking office in 2066 was to raise mining taxes and nationalize the country's key natural gas industry. He has also expropriated the telecommunications and electricity sectors, and seized and nationalized the assets of Vancouver-based South American Silver Corp. (TSX:SAC) two years ago. Morales also made waves when defined the nation's mineral deposits as "blessings" in a 2012 law, aimed to protect the right of nature "to not be affected by mega-infrastructure and development projects that affect the balance of ecosystems and the local inhabitant communities". Though rich in mineral and energy resources, data from the Unicef shows that Bolivia is one of the poorest countries in Latin America and the weakest economy in all of South America. The newly formed commission, reports Prensa Latina (in Spanish) is scheduled to present the proposed amendments to the mining law in Parliament next week. |

| Former JPMorgan commodities chief under federal probe Posted: 11 Apr 2014 06:00 AM PDT Departing JPMorgan Chase & Co (NYSE:JPM) managing director and former head of the global commodities group Blythe Masters, is under probe by federal prosecutors in Manhattan, Bloomberg reports citing people directly involved in the matter. The investigation began after the company agreed to pay a $410 million settlement with regulators that alleged JPMorgan manipulated power markets in the Midwest and California. According to the report Masters, 45, said she was leaving the bank last month, after scoring $3.5 billion in the sale of the commodities unit to Geneva-based trading house Mercuria. She believed she would no longer have the same standing in the executive ranks after transaction and had no intention of joining the buying firm. The US Justice Department has also been investigating JP Morgan activities in China under the foreign corrupt practices act (FCPA), which bars American companies from giving money or other valuable items to foreign officials in order to win business. The US largest bank is not the only one that has been under scrutiny as of late. Authorities around the globe, already investigating the manipulation of benchmarks from interest rates to foreign exchange, have also been studying the gold market for signs of wrongdoing. Deutsche Bank, Germany's largest lender, said in January it would withdraw from the panels setting the gold and silver fixings. German financial markets regulator Bafin interviewed the bank's employees as part of a probe into the potential manipulation of gold and silver prices. Britain's Financial Conduct Authority is also scrutinizing how prices are calculated. JP Morgan reported today an 18.5% drop in first-quarter earnings on Friday. Net earnings of $5.27 billion, or $1.28 a share, came in slightly below Wall Street analysts' expectations of $1.40 a share on revenue of $24.53 billion. Revenue dropped to $23.86 billion. (Image from Blythe Masters' blog) |

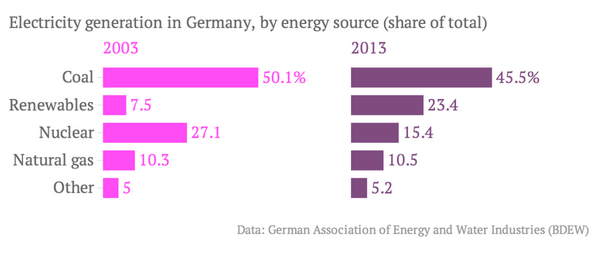

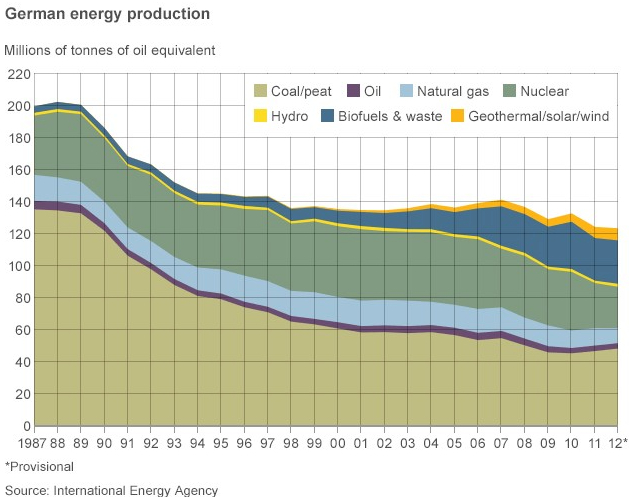

| Green Germany returning to brown coal, villages in limbo Posted: 11 Apr 2014 03:35 AM PDT  Germany is relocating entire villages. Image courtesy of Krusnohorsk. Germany, traditionally seen as one of the leaders in fighting CO2 emissions as it tries to wean itself from fossil fuels and nuclear power, seems to have grown tired of leading by example and it is about to erase entire towns of its map because they are sitting on vast coal deposits. The tiny village of Atterwasch, near the Polish border, is one of them. BBC News reports that Swedish energy company Vattenfall is planning to relocate the community in order to strip-mine the ground underneath for lignite, or "brown coal," considered the dirtiest form of the fossil fuel, which is mined in open cast pits. According to experts quoted by the BBC, the rural Lausitz region, home to pine forests, farm fields, and villages, also holds billions of tons of brown coal. There, in what was once East Germany, hundred of small towns have been destroyed to make way for massive strip mines since 1934. And while Germany has said it is committed to its "Energiewende," or energy revolution, with about 25% of its electricity currently coming from renewable sources, the sudden hunger for coal is threatening the future of several villages like Atterwasch. Coal use in the country hit is highest level since 1990 last year, industry figures show. Brown coal accounted for electricity to the tune of 162 billion kilowatt hours, equivalent to about 25% of Germany's total electricity production of 629 billion kilowatt hours in 2013. |

| Gold price up on Fed minutes, Ukraine worries and tanking stocks Posted: 10 Apr 2014 04:18 PM PDT The price of gold built on recent gains on Thursday reaching a two-week high after soothing words on US interest rates, stocks suffered major declines and worries the situation in Ukraine could deteriorate into chaos led to safe-haven buying. On the Comex division of the New York Mercantile Exchange, gold futures for June delivery in late afternoon trade exchanged hands for $1,320.50 an ounce, up more than $14 from yesterday's close. The metal touched a two-week high of $1,224 earlier in the day. Russia on Thursday warned Ukraine that it could cut of its gas supplies over more than $2 billion of unpaid bills. Pipelines crossing Ukraine supply 15% of Europe's natural gas. At the same time Nato warned that a Russian force of 40,000 troops on the Ukrainian border was "at high readiness". Gold's status as a hedge against inflation was also burnished after minutes from the US Federal Reserve released overnight showed the bank would continue scaling back its stimulus measures at a steady pace, with an early rise in interest rates unlikely. US stocks – particularly the tech sector – were slammed on Thursday with the Nasdaq Composite posting its worst session in more than two years. The blue-chip Dow Jones losts 267 points while the broader S&P 500 gave up just over 2%. More investors believe a correction in frothy US stock markets are long overdue and are rotating back into gold thanks to its perceived status as a storer of wealth. Marc Faber, editor and publisher of the Gloom, Boom & Doom Report, told CNBC a 1987-type of crash in the S&P of 30% is coming in the next 12 months. |

| De Beers returns to Angola with new exploration deal Posted: 10 Apr 2014 03:10 PM PDT De Beers, majority-owned by Anglo American (NYSE:AAL), has been granted a new new diamond exploration license in Angola, the world's fourth largest producer of diamonds by value, and sixth by volume. Geology and Mines Minister Francisco Queiroz told the Reuters Africa Summit on Thursday "the company made that big investment in prospecting, and unfortunately it didn't have great results, but it is making a new bid, and another investment will be approved." Queiroz was referring to De Beers' exploring for diamonds in the Southern African nation between 2005 and 2012 which ended without finding an economically viable project. Rough diamond prices have climbed 3% over the last few months and Bain & Company and the Antwerp World Diamond Centre (AWDC) predict prices for the gems will continue to climb at least until 2018.

The country's production volume has remained relatively stable at 8 million carats per year since 2006. After a new mining code introduced in 2011, which intended to attract foreign investment and boost exploration for diamonds and other minerals, there has been an increased interest in the country mineral potential. |

| Notice of Auction for Surplus Items at AngloGold Ashanti Obuasi Mine – April 15 & 22nd Posted: 10 Apr 2014 02:04 PM PDT The general Public is informed that an auction has been scheduled at Obuasi Mine for the disposal of Surplus Items. The auction will be conducted at the North Stores from 1500 hours to 1600 hours. Items for sale can be viewed on the date of auction from 0900 hours to 1200 hours or until one week before the auction date. Click here to view surplus items |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Bolivia to revise new mining law"