2014 gold price rally fades as ETF investors, hedge funds exit market |

- 2014 gold price rally fades as ETF investors, hedge funds exit market

- Only US oil sands player's low cost extraction patent approved

- Big praise for B2Gold's Namibia mine

- Alrosa’s production, revenue up in Q1

- Mining may cause extinction of most Colombian indigenous peoples: UN

- Teck invests further in Halifax’s Erdene to expand copper exploration in Mongolia

| 2014 gold price rally fades as ETF investors, hedge funds exit market Posted: 22 Apr 2014 03:15 PM PDT The gold price extended recent weakness on Tuesday losing sight of the psychologically important $1,300 level as investors rotate out of the metal into surging stocks. On the Comex division of the New York Mercantile Exchange, gold futures for June delivery settled at $1,281.10 an ounce, down $7.0 from yesterday's close. Earlier in the day the gold price fell to levels last seen February 10 of $1,275 an ounce. In contrast the US benchmark stock index, the S&P 500 recorded its sixth straight session gain. Post-Easter trade remained thin with only 110,000 contracts changing hands against usual volumes of closer to 200,000 contract of 100 ounces each. "Traders seem to have given up on gold as a provider of safe haven at the moment," Saxo Bank's head of commodity research Ole Hansen said in a note: "Instead the focus remain firmly on the United States, where earnings and economic data continue to indicate interest rates will rise sooner rather than later. "Hedge funds cut their net-long position back to February levels and total ETP holdings have dropped to a new 2009 low. So with the US healing, Chinese demand questionable and investment demand not showing signs of picking up, gold is back on the defensive." Latest data from US Commodity Futures Trading Commission show hedge funds and other large investors added to bets that the price of the metal would fall for the fourth week in a row. Short positions – bets that price would decline – held by managed money increased 15% to just under 28,000 lots in the week to April 15 according to CFTC data. At the same time long positions were cut by 4,766 contracts which translates into a 8.5% decline in the net-long positions held by commercial traders in the precious metal to 90,137 futures and options. Investors also continued to pull money out of the SPDR Gold Trust (NYSEARCA:GLD), the world's largest physically-backed gold ETF accounting for some 40% of total holdings in the industry. Holdings in GLD dropped to 792.1 tonnes or 25.46 million ounces on Tuesday, the lowest level since January and down almost 30 tonnes in less than three weeks. The world's physical gold trusts have experienced net redemptions of more than 800 tonnes collectively last year, with the value of precious metals assets investments falling by a record $78 billion in 2013. |

| Only US oil sands player's low cost extraction patent approved Posted: 22 Apr 2014 03:02 PM PDT US Oil Sands (CVE:USO) had a down day on Tuesday dropping 7% ahead of announcing approval of a US Patent application for its bitumen extraction process. The $110 million company is showing losses for 2014 – it is down 13% year to date, but up 23% on the Toronto venture market compared to this time last year. The Calgary-based company has a 100% interest in bitumen leases covering 32,000 acres of land in Utah's Uintah basin, the largest on state land in the US. The company raised $81 million in October last year and holds the only commercial bitumen extraction project permitted in the US. Said Cameron Todd, CEO of US Oil Sands: "We believe our bio-solvent based approach to oil sands extraction is a true game changer for the industry, as it has the dual-benefit of reducing the environmental footprint of an oil sands project and lowering capital expenditures by as much as 75% when compared to existing oil sands mining projects." The PR Spring project resource is 184.3 million barrels an US Oil Sands is targeting initial start-up for 2015. The company uses a modular construction method allowing for rapid construction in 2,000 barrel per day phases. The initial 2,000 barrels per day commercial demonstration facility is expected to cost around $30 million to construct, while subsequent phases could be added at a cost of $25 million, according to company literature. Image from US Oil Sands Inc |

| Big praise for B2Gold's Namibia mine Posted: 22 Apr 2014 12:08 PM PDT After underperforming the S&P 500 by 21% since September 2013, gold and silver equities now appear more fairly valued, believes Goldman Sachs. According to a new research note from the investment firm that stock in the sector have benefited from more responsible capital allocation, successful cost cutting initiatives and a refocus on maximizing free cash flow. Goldman Sachs now has a more positive view of gold stocks than that of the underlying commodity. Its forecast is for gold at a price of $1,050 an ounce at the end of the year; a call it recently reiterated. Goldman also upgraded B2Gold (TSE:BTG) to a buy, seeing upside for the company thanks to "imminent production growth" from the Otjikoto project in Namibia which should help fund future projects. The Vancouver-based gold miner saw it share price rise 1% on the Toronto big board to just under $3 on Tuesday, bringing year-to-date gains to 38%. Goldman's price target of $4.20 suggests lots more buying still to come. According to B2Gold's January 2013 feasibility study Otjikoto could support an open pit gold mine with a 12-year mine life, with average annual production during the first five years of 141,000 oz of gold per annum with an average operating cost of $524 per ounce. Over the entire life of the mine production is expected to average out to 112,000 oz per annum, with an operating cost of $689 per ounce. Construction should be complete by the 4th quarter and full-scale production is set for early 2015. The company with a stock market valuation of just over $2 billion also operates mines in Nicaragua and the Philippines and owns projects in Colombia and Burkina Faso. B2Gold was formed in 2007 by former execs of Bema Gold when the latter was acquired by fellow Canadian miner Kinross for $3.5 billion. Goldman also upgraded Barrick Gold (TSE:ABX) to buy, giving the world's top gold producer kudos for improving its "financial flexibility" through divesting of non-strategic assets and focusing on cash-flow generating possibilities. Toronto-based Barrick was last trading up 1.85% on the TSX despite the softer gold price. The $20.5 billion counter is flat for 2014. Goldman maintained buy recommendations on Goldcorp, Inc. (NYSE:GG), Yamana Gold (NYSE:AUY; TSE:YRI) and streaming company Silver Wheaton (NYSE:SLW), but recommended investors get out of Iamgold (NYSE:IAG; TSE:IMG)), PAN American Silver (NASDAQ: PAAS) and Eldorado Gold (NYSE:EGO; TSE:ELD).

|

| Alrosa’s production, revenue up in Q1 Posted: 22 Apr 2014 10:46 AM PDT World's largest diamond miner Alrosa said Tuesday it increased diamond production by 6% in the first quarter of the year, in comparison to the same period of 2012 due to development of new mines. Diamond production for the first few months of 2014 reached 7.9 million carats driven by improved ore grade at the Jubilee pipe, a rise in diamond production at the Aikhal underground mine and the International underground mine, and an increase in volumes of ore processed at the Arkhangelskaya pipe. In terms of sales, preliminary data shows revenues reached $1.5 billion in Q1, which is a 24% more than the same period last year. Alrosa sold 12.7 million carats during this period, while in 2013 the company's net profit fell by 5% to $900 million year-on year. The firm noted "positive dynamics" in the diamond market in the first quarter and an increase in rough diamond prices of around 4% since the beginning of the year. |

| Mining may cause extinction of most Colombian indigenous peoples: UN Posted: 22 Apr 2014 10:13 AM PDT The representative of the UN High Commissioner for Human Rights in Colombia, Todd Howland, has warned that about 40 indigenous groups are at risk of disappearing as a consequence of increased mining activity in the country. According to Howland, who was interviewed by Caracol Radio (in Spanish), the problem is that native communities affected mining projects are moving to the city, where their culture and language is lost. The UN representative called both companies and the government to conduct consultations in the communities before exploiting natural resources in their territories. "It is important for all Colombians take this problem seriously," he was quoted as saying. A recent report from the Center for Autonomy and Rights of the Indigenous Peoples of Colombia noted said there were 34 indigenous groups are at risk of extinction in Colombia, but the UN considers the number to be higher. Based on data from Colombia's National Indigenous Organization, 62.7% of the country's indigenous population were at risk of extinction as per March last year. |

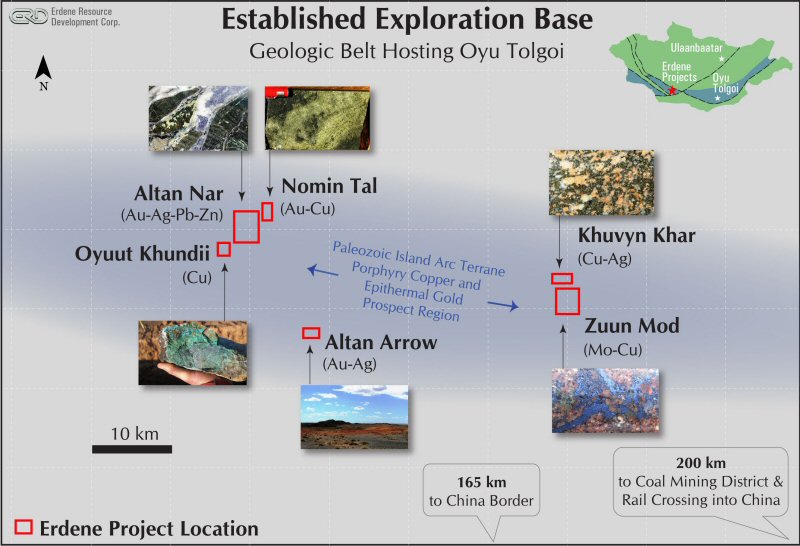

| Teck invests further in Halifax’s Erdene to expand copper exploration in Mongolia Posted: 22 Apr 2014 09:13 AM PDT Despite poor first quarter results, Vancouver-based Teck Resources Ltd. (TSX:TCK.A, TCK.B), (NYSE:TCK), one of Canada's largest miners, is increasing its investment in Halifax-based Erdene Resource Development (TSX:ERD), which will use the funds to explore for copper in Mongolia under a strategic alliance announced last year. Teck, which currently controls about 14% of Erdene's common shares, aims to boost exploration on the Halifax miner's wholly owned Altan Nar gold-polymetallic project, located in southwest Mongolia, 200 kilometres from the border with China. Erdene announced Monday it will restart drilling in the next few days and that field crews are already on site. Detailed surface work is underway, including higher density geochemical sampling, mapping, and an expanded induced polarization survey. According to the company, this work will provide a greater understanding of the extent of the multiple mineralized structures identified to date and provide a stronger base for designing a more extensive follow-up resource delineation drill program. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "2014 gold price rally fades as ETF investors, hedge funds exit market"