US coal trade jumps as domestic consumption wanes |

- US coal trade jumps as domestic consumption wanes

- Australia's gold output hits decade high

- Could Ukraine crisis push gold, US dollar up?

- Politicians decry EPA's move toward a 'premature veto' on Pebble mine

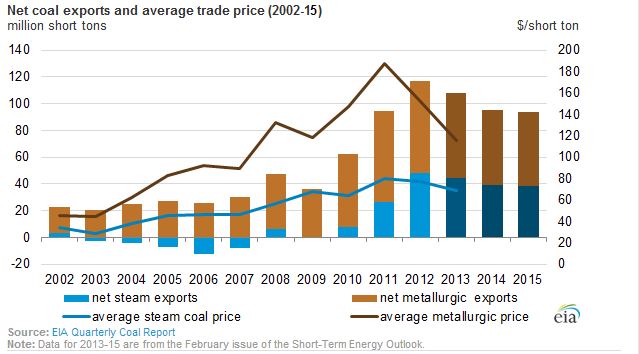

| US coal trade jumps as domestic consumption wanes Posted: 02 Mar 2014 02:00 PM PST The dollar value of US net coal exports has increased more than three-fold since 2005, data from the US Energy Information Administration (EIA) shows. "Although coal trade only accounts for about 5% of trade flows in energy fuels, the volume of U.S. coal exports has steadily increased, from 50 million short tons (MMst) in 2005 to a record 126 MMst in 2012," the EIA wrote. While coal exports declined slightly in 2013 compared with the previous year, they've been rising dramatically since the beginning of the 21st century. The US' biggest coal customer is Europe, account for 50% of exports, followed by Asia. "[C]oal exports will continue to be important for companies involved in coal production and transportation," the EIA wrote. "Key drivers of future U.S. coal exports include global coal demand and production challenges that may arise in domestic production in China and India, the world's major coal consumers, and in production by leading global coal exporters, including Australia, Indonesia, and South Africa. The domestic coal market has its own set of issues: Rising natural gas production has driven a decline in US coal demand and the Environmental Protection Agency's (EPA) new regulations could force many coal-fired power plants to shut down. In fact, a survey of US coal consumption by end-use sector shows a significant decline in coal use in every sector. US electric-power industries used 649 million short tonnes of coal last year compared with more than 1 billion short tonnes in 2007. |

| Australia's gold output hits decade high Posted: 02 Mar 2014 12:42 PM PST Australia's gold output hit a 10-year high last-year as lower gold prices forced miners to produce higher-grade deposits, according to mining consultant Surbiton Associates Pty which produces one of the largest reviews of the Australian gold industry. According to Bloomberg, production rose by 18 metric tonnes to 273 tonnes in 2013 – "the highest annual output since 2003." "Producers are responding to lower gold prices by treating less low grade material and this results in higher output and reduced costs," a director at Surbiton said, as reported by Bloomberg. "The downside in processing higher-grade ore is that some lower grade material that was economic to treat at higher prices, is no longer profitable." The gold price dropped 28% in 2013. Australia's gold output has surged since 2008 when it was the world's fourth biggest producer of the precious metal. Today the country ranks second, though its 2013 output doesn't come close to China's 430 tonnes. Image featured on homepage by neelaka |

| Could Ukraine crisis push gold, US dollar up? Posted: 02 Mar 2014 11:43 AM PST Russia's war games in Ukraine could push both gold and the US dollar up this week. "It's going to be a hectic day when markets open," the CEO of Dubai's Mashreq Capital DIFC told Bloomberg this weekend. Risk-averse investors will likely turn to the US dollar and shun the stocks and currencies of developing nations. Meanwhile, the precious metal also stands to gain due to its perceived status as a safe-haven asset. Russia's approval of military action in Ukraine has set a tone of uncertainty. "No one likes conflict between two superpowers," a managing partner of global wealth management at Mumbai-based Edelweiss Financial Services told Bloomberg. "It has an uneasy feeling in the markets." Another analyst told CNBC that the US dollar, bonds and gold could rally higher before the markets open. But the yellow metal and the greenback often have an inverse relationship and Ross Norman, CEO of Sharps Pixley in London told CNBC that the "[g]eo-political tension in Ukraine is proving a mixed blessing for gold." "It is positive as safe-haven money flows in but it is also flowing into the dollar which is having a depressive effect on bullion prices," Norman explained. In fact, CNBC's sentiment survey showed that 10 out of 18 of those polled believe gold will decline this week. |

| Politicians decry EPA's move toward a 'premature veto' on Pebble mine Posted: 02 Mar 2014 10:39 AM PST Two US politicians have publicly denounced the US Environmental Protection Agency's (EPA) decision to, for the time being, block the issuance of a key mining permit for the controversial Pebble Mine – a massive porphyry copper, gold, and molybdenum deposit. US Senator Lisa Murkowski, a Republican from Alaska, repeated the accusation that the EPA's actions constitute a "premature veto," given that the company, Northern Dynasty, has yet to submit an official proposal or permit applications. "We already have undeniably grave problems with federal agencies blocking resource production on federal lands in Alaska," Murkowski wrote. "Now to see a federal agency overstep its authority and move prematurely to block even the consideration of a permit for potential activity on state lands is something I simply cannot accept." But the Senator also pointed out that for the past three years she's been calling on the project's owners to submit their plan "so that Alaskans have greater certainty about its expected benefits and impacts." "Both parties must respect and abide by the permitting process," she wrote. Critics have often criticized the EPA for conducting assessments of the Pebble project in the absence of any formal mine plans. The Agency claims that the importance of Bristol Bay – the area that would be affected by the mine – is so great that it warrants these studies. "Over three years, EPA compiled the best, most current science on the Bristol Bay watershed to understand how large-scale mining could impact salmon and water in this unique area of unparalleled natural resources," the EPA said last month. Last summer Murkowski sent a letter to the Pebble mine owners – which at the time included Anglo American – chastising them for drawing out the permitting process for nearly 10 years. US Senator David Vitter, a Republican from Louisiana, also published his reaction on Friday. "Talk about a disincentive to invest in America, we are seeing EPA resort to a ridiculous level of allowing political prejudices determine how the Agency handles permitting," said Vitter. "When it comes to the Pebble Mine, EPA has shown that they are willing to disregard due process and lawfully established permitting procedures to ensure the failure of any project like this. EPA's desperate attempt to kill a potential mine should signal a major red flag to businesses." Northern Dynasty CEO Tom Collier said in a statement that the company "remain[s] confident" in the project and will "continue to state [its] case with the EPA." He said the EPA's actions on Friday reflect a "major overreach" onto an Alaskan natural resource. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "US coal trade jumps as domestic consumption wanes"