This is the scariest <b>gold price chart</b> you'll see today | MINING.com |

- This is the scariest <b>gold price chart</b> you'll see today | MINING.com

- Silver and <b>Gold Prices</b>: The <b>Gold Price</b> Should Rally From Here

- Real <b>Price</b> of <b>Gold</b> Since 1791 | The Big Picture

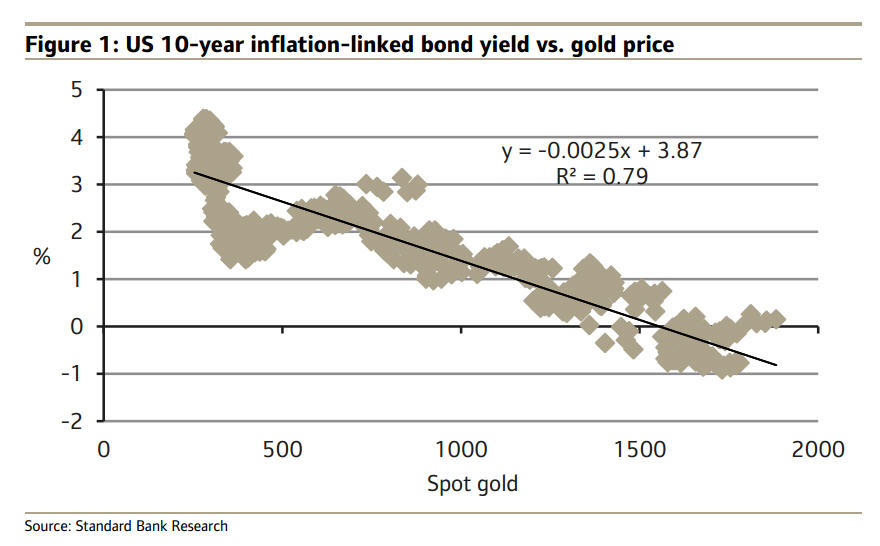

| This is the scariest <b>gold price chart</b> you'll see today | MINING.com Posted: 25 Mar 2014 11:23 AM PDT The Standard Bank commodities team's always cogent analyses revealed a stunner this week. The specialists at the commodities trading arm of the bank – which is being bought by China's ICBC and may get a table at the daily London gold fix – are not the first to point out the correlation between real US bond yields and the price of gold. But the chart plotted in the London and Johannesburg-based firm's latest research note to show the connection puts the trouble ahead for the gold price in stark relief. Analyst Leon Westgate, says the house view is that "real interest rates in the US will continue to rise in coming months as the Fed monetary policy normalises, which will put downward pressure on gold. The relationship between real long-term interest rates in the US (as proxied by 10-year US inflation-linked bonds) and the gold price is strongly negative." 10-year real yields (Treasury Inflation Protected Securities or TIPS) are currently at 0.59% which seems consistent with today's gold price of around $1,310 an ounce. Absolute future gold price levels probably shouldn't be divined from this chart, but it does point to one thing: If you buy into this theory, the gold price is going down. |

| Silver and <b>Gold Prices</b>: The <b>Gold Price</b> Should Rally From Here Posted: 27 Mar 2014 02:53 PM PDT Gold Price Close Today : 1294.70 Change : -8.70 or -0.67% Silver Price Close Today : 19.690 Gold Silver Ratio Today : 65.754 Silver Gold Ratio Today : 0.01521 Platinum Price Close Today : 1397.20 Palladium Price Close Today : 761.00 S&P 500 : 1,849.04 Dow In GOLD$ : $259.68 Dow in GOLD oz : 12.562 Dow in SILVER oz : 826.01 Dow Industrial : 16,264.23 US Dollar Index : 80.110 The GOLD PRICE sank $8.70 to $1,294.70 and the SILVER PRICE lost 6.9 cents to 1969.0c. Disaster? Not quite. Today's range with a 1958c low touched the downtrend line form the April 2013 high, same line silver broke through skyward in April. This constitutes a kiss back to breakout, and should hold -- should. The GOLD PRICE low at $1,291.20 brought it nearly to that 50% correction at $1,287, which is the neckline of the upside down Head and Shoulders gold broke through in February. Gold has now tangled its feet in the 50 DMA ($1,303.8) and 200 DMA ($1,299.41). Today's trading pretty much hit my targets for this decline. Now we might from here get a rally, then one more touch back to these levels. Of course, I will be shown once again to be no more'n a nacheral born fool from Tennessee should silver and gold prices drop sharply. Fool or not, I don't see that on the chart. Here are the highlights. Stocks continued to deteriorate, although the closes didn't show the full view of it. Closes were near yesterdays, but the lows were a lot lower, so the range was much lower than yesterdays. Whoa! S&P500 broke DOWN out of that even-sided triangle we've been watching. Dow lost 4.76 (0.03%) to 16,264.23 while the S&P500 slid 3.52 (0.19%) to 1,849.04. Should follow through lower and lower. US dollar index finally stood up and gained a whole 16 basis points (0.2%) to 80.28. This leaves the chart hopeful, but nothing to brag about. Euro looks like it ate a pound of bad meat, dropped 0.32% today to $1.3741, not far from turning very negative by falling below its 50 DMA ($1.3715). Yen lost 0.14% to 97.87 c/Y100, still treading water. - Franklin Sanders, The Moneychanger © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| Real <b>Price</b> of <b>Gold</b> Since 1791 | The Big Picture Posted: 28 Mar 2014 09:00 AM PDT click for ginormous graphic Earlier this year, we discussed the Lessons Learned from the Fall of Gold. That surprisingly generated some controversy despite the near 40% collapse from its 2011 peak. Rather than spill a lot of ink onto the page, I wanted to direct your attention to the following graphic from Catherine Mulbrandon of Visualizing Economics. It is the real price of Gold, adjusted for inflation. Continues here Category: Digital Media, Gold & Precious Metals, Inflation Leave a ReplyYou must be logged in to post a comment. |

| You are subscribed to email updates from gold price graph - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "This is the scariest gold price chart you'll see today | MINING.com"