The bursting of China’s Credit bubble |

- The bursting of China’s Credit bubble

- Great Panther back to work at its silver mine in Mexico

- Gold takes dip as investors chew on results of referendum in Crimea

- Rio Tinto sitting on vast Canadian potash deposit near BHP mine

- The ocean floor is rare earth miners new frontier—report

- China's stake in rare earths market shrinking

| The bursting of China’s Credit bubble Posted: 17 Mar 2014 03:56 PM PDT According to Garet Garrett in his book "A Bubble that Broke the World" Cheops employed 100,000 men for twenty years to build his great pyramid, "and all he had for 600,000,000 days of human labour was a frozen asset." Cheops's distortion of the Nilotic economy was nothing compared with the economy warped by the Chinese government today, which has overseen the construction of empty cities, unused airports, carless highways and bridges to nowhere. A notable difference between ancient Egypt and modern China is the ability to direct economic activity through the use of credit. The result today is a far larger scale of economically useless projects than the pharaohs could possibly entertain. Government-directed bank lending in China has financed misallocated economic resources to an extraordinary degree, artificially inflating the economy and leaving a legacy of useless property and infrastructure assets, incapable of generating income to service the debt incurred. The delusion is only sustained for as long as increasing quantities of money and credit are available to insolvent borrowers. That is now ending, because China's government is trying to restrict credit growth, which is impossible to do without setting off wide-spread debt liquidation. Instead of managing a hoped-for retreat towards order, tighter monetary conditions will almost certainly bankrupt owners of unproductive property assets, piling up bad debts at lending banks. Unlike the Lehman crisis, this time the major banks are government-owned, so China's currency is at considerable risk, and it is already displaying initial weakness. There can hardly be a stronger signal that China's credit bubble is on the edge. Furthermore, China has more than its fair share of financial entrepreneurs who have devised myriad ways to use assets to raise money many times over. In the Chinese version of shadow banking, an asset such as a few thousand tonnes of copper in conjunction with letters of credit is used to raise cash over and over again to spend on property speculation and elsewhere. All sorts of shady deals, some of them downright fraudulent, can be expected to come unstuck, and China seems set to provide an extreme example of this empirical truth. China's rich have an estimated equivalent of $3 trillion in personal assets to protect from a credit and currency maelstrom. Inevitably this will lead to huge shifts in asset allocation, and gold bullion is likely to be the outstanding beneficiary. In common with all other Asians the Chinese regard gold as true money, a safe-haven from government currency. And only five per cent of $3 trillion at current prices is 68,000 tonnes of gold, which gives an idea of how dramatic the effect of even a small flight to gold would have on the price. This is likely to catch Western capital markets on the hop, given the common misconception that gold is little more than a demonetarised commodity. With a credit crisis appearing to be developing in China, this view could face its ultimate test at a time when the West is systemically short of physical gold and silver, and its institutions even short of paper gold as well. Today's troubles over Ukraine can come and go, but for gold China is the bigger story by far. So much so, that this could turn out to be a very bad time to own claims on gold instead of physical gold itself. by Alasdair Macleod, Head of Research, GoldMoney |

| Great Panther back to work at its silver mine in Mexico Posted: 17 Mar 2014 12:43 PM PDT Vancouver-based Great Panther Silver Ltd. (TSX:GPR) said Monday it had restarted full mining and plant operations at its Guanajuato mine complex, in Central Mexico, after it was illegally occupied last week. Robert Archer, President and CEO of Great Panther said the firm recovered its main administration building and plant facility on Thursday, after which employees and contractors assessed the condition of the facilities and returned them to full operation. The silver producer added it was working with authorities as they conduct an investigation into the illegal occupation, which began in early march, following the death of an illegal miner killed in a clash with guards at the same mine. Guanajuato is next to Michoacán state, where drug cartels have began tapping into illegal mining as a fresh source of revenue (see map below). However, there was no immediate indication of any cartel involvement in the Guanajuato case. |

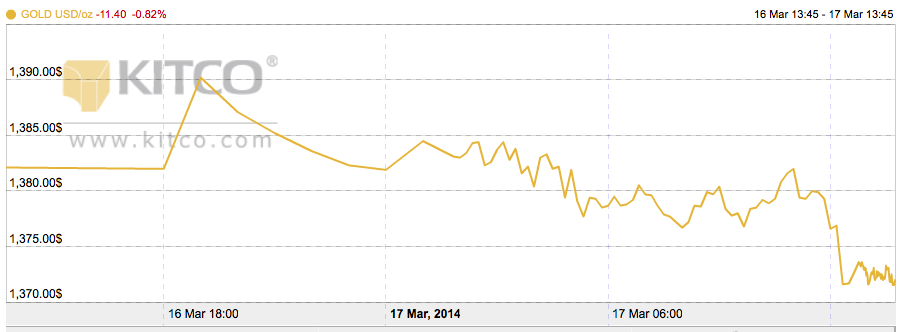

| Gold takes dip as investors chew on results of referendum in Crimea Posted: 17 Mar 2014 11:00 AM PDT Gold prices hit a brief six-month-high Monday, trading at $1,390 this morning to fall later about 0.7% to 1,376.90 at around noon ET, despite the United States and the European Union announcing further sanctions over Crimea decision to join Russia. US President Barack Obama imposed restrictions on 11 Russian and Ukrainian officials blamed for Moscow's military incursion into Crimea, including two top aides to Russian President Vladimir Putin. European Union foreign ministers, in turn, agreed to enforce travel bans and asset freezes on 21 officials from both nations. Traders are now focusing on the US Federal Reserve next interest rate announcement on Wednesday, which will be followed by a news conference with new Fed chair Janet Yellen. The world's most powerful central bank is expected to cut its monthly bond purchases by another $10 billion to $55-billion a month. Gold prices have gained close to 15% so far this year, but experts such as Michael Widmer, metals strategist at BofA Merrill Lynch Global Research, believe this rally won't last. Widmer told CNBC Monday that negative economic and geopolitical news have created a "perfect storm" for the gold price, but that there were "a few things in the market" that make him believe it is not a sustained gain from here onwards. |

| Rio Tinto sitting on vast Canadian potash deposit near BHP mine Posted: 17 Mar 2014 08:38 AM PDT Mining giant Rio Tinto (LON, ASX:RIO) shocked the potash market Monday as it unveiled it believes to be sitting on a vast potash deposit in Canada's Saskatchewan, right by where its rival BHP Billiton (ASX:BHP) is building its touted $3.8 billion Jansen mine. Based on Rio's annual strategic report, the KP405 potash discovery has already been branded as the eighth "tier-one" finding the company has made in the last decade. "Drilling results indicate encouraging potash grade and thickness," Rio said back in 2012. But its Russian partner JSC Acron, through its the Canadian subsidiary North Atlantic Potash, has been more enthusiastic, saying there is the potential for a long-life, low-cost mine at the "massive" KP405 deposit. While a United Nations report expects the world's population to surpass 9 billion people by 2050 (we are around 7.2 billion today), potash, which is a key fertilizer ingredient, is expected to boom as income in emerging economies continues to improve. BHP recently committed to spending an additional $2.6 billion on Jansen over the next few years, just to gain access to the deposit. Image: Opening of the Saskatchewan Potash Interpretive Centre in 2006. By Scott Prokop. |

| The ocean floor is rare earth miners new frontier—report Posted: 17 Mar 2014 07:26 AM PDT The demand for hard-to-find rare-earth elements needed for portable electronics and batteries for hybrid vehicles continues to push mining companies to scour the ocean floors. Since 2001 the United Nations' International Seabed Authority has issued 30 exploration permits for the Pacific, Mid-Atlantic and Indian Oceans. But BBC News correspondent Nick Davis says there has been a rush of late, with another seven ready to be issued. Last year, the United Nations published an update to its plan for developing a regulatory framework for deep sea mining, saying private firms would be allowed to apply for mineral, oil and gas extraction licenses as soon as 2016. "We are at the threshold of a new era of deep sea mining," told the UK House of Commons in January the Minister of State, Foreign and Commonwealth Office Hugo Swire. He added a recent assessment of the Pacific Ocean has estimated over 27 billion tonnes of "rock nodules" —small mineral-rich rocks from the seabed— may be lying on its floor, including 290 million tonnes of copper, 340 million tonnes of nickel and an undetermined but immense amount of rare earth elements, among several other rcihes. You can watch the BBC report here: |

| China's stake in rare earths market shrinking Posted: 17 Mar 2014 03:50 AM PDT While China continues to be the rare earth industry leader, producing about 92% of the global output, its share in global production has decreased steadily in recent years, a study by Germany's Federal Institute for Geosciences and Natural Resources (BGR) released early March shows. According to the Hannover-base institute, in 2010 the Asian nation covered 97.6% of worldwide demand, which means China's piece of the pie has shortened by 5.7% in the last three years. Profits, in turn, slumped 28% to less than $1.3 billion, as prices for the elements a used by variety of industries including green technology, defence systems and consumer electronics, continued to fall. The same study says United States produced over 4% of rare earth last year, while Russia contributed 2.3%. China has been cracking down on the industry for years to curb illegal mining, smuggling and environmental devastation, but progress has been slow. Despite imposing export quotas, shutting down small mines and forcing industry mergers, the country's rare earth landscape remains fragmented and suffers from a lack of global competitiveness due to weak research and development. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "The bursting of China’s Credit bubble"