HudBay target Augusta says it's got nine potential buyers |

- HudBay target Augusta says it's got nine potential buyers

- Ukraine to pay 80% more for Russian gas

- Desperate Canadian juniors turn to medical pot industry to raise funds

- World’s No.1 copper miner output fell to 5-year low in 2013

- US city mulls blocking Canada’s oil sands crude from reaching its port

- Randgold targets higher gold output, gives CEO 36% pay rise

| HudBay target Augusta says it's got nine potential buyers Posted: 28 Mar 2014 02:29 PM PDT Following an unsolicited takeover offer from Hudbay Minerals (TSE:HBM), Augusta Resources (TSX:AZC) has generated some strong interest from potential buyers. The company revealed on Friday that as a result of its ongoing strategic review process, "nine interested parties, including a number of significant industry players, have signed confidentiality agreements and have been conducting an extensive review of the materials in Augusta's electronic data room." Augusta will being the process of site visits to its Rosemont Copper project next week. "As we anticipated, our strategic review process has proven to be very robust and we are pleased with the quantity and quality of the interested parties," CEO Gil Clausen said in a news release. "The Board is fully committed to maximizing value for our shareholders by carefully considering all available alternatives to HudBay's low-ball bid." In February HudBay Minerals offered Augusta shareholders 0.315 of a Hudbay share per Augusta share, representing approximately $2.96 per Augusta share. Augusta will hold a meeting of shareholders on May 9 to vote on whether to continue the shareholder rights plan or have it terminated. The rights plan was adopted in 2013 in response to HudBay acquiring a large number of Augusta shares. Essentially, it requires that new shares be issued if one shareholder owns more than 15% of the company, "Our Board takes seriously our fiduciary obligation to protect our shareholders against the predatory and coercive tactics of HudBay. We respect the rights and interests of Augusta's shareholders and are putting the power directly in their hands. We are confident that they will strongly support our Board for putting this critical decision to them." According to Reuters, HudBay has said that if shareholders don't cancel the plan, it may ask for a cease-trade order which would block the issuance of new shares. Augusta shares were trading at $3.12 apiece by Friday afternoon, up from about $3 the day before. The company's sole project is Rosemont, located in Tuscon, Arizona. The site has the potential to become the US' third largest copper mine, producing approximately 243 million pounds of copper and 5.4 million pounds of molybdenum per year. It's now near the last stages of permitting and production is planned for the first quarter of 2017. |

| Ukraine to pay 80% more for Russian gas Posted: 28 Mar 2014 10:38 AM PDT As of next week, Ukraine will pay nearly 80% more for Russian gas. This means Moscow might charge Ukraine "close to $500 for 1,000 cubic meters of gas," according to the New York Times. Ukraine uses gas for about 40% of its energy needs, and more than half of that supply comes from Russia. Earlier this month Russia said it would no longer provide Ukraine with discounted gas. Under the agreement signed in 2010, Russian gas flowed cheaply into Ukraine and, in exchange, Russia was allowed to extend its lease on a military base in Sevastopol, Crimea. Now that Russia controls Crimea, it doesn't need the gas deal. "Russia, because it committed armed robbery of Ukraine, and in this way in fact destroyed our bilateral agreement, wants to raise the price of gas for Ukraine," Ukrainian Prime Minister Arseny Yatseniuk told reporters, as reported by the New York Times. Ukraine has since secured $27 billion financing deal with the International Monetary Fund (IMF) to help stabilize the economy. |

| Desperate Canadian juniors turn to medical pot industry to raise funds Posted: 28 Mar 2014 10:00 AM PDT Trying to stay afloat in a tough environment, a group of Canadian junior miners have decided to diversified their business by tapping into an emerging, but controversial market: medical marijuana. According to a Reuters' report, in the last two months there have been at least a dozen of these companies, hard hit by a downturn in the mining industry, have announced they are considering growing cannabis. Interest in this business has been growing since Health Canada announced it would allow licensed commercial growing of medical marijuana beginning April 1. In the US, meanwhile, states such as Colorado and Washington are moving to legalize the drug. Companies such as Next Gen, Sartori Resources and TSX Venture-listed Cavan Ventures, have floated the idea of an incursion in the industry, with the news regularly sending their stocks to a temporary high. "What links the two industries is that they are both highly regulated. Having worked within a regulated mining framework definitely gives a new entrant a leg up in this new industry," Cavan said this week in a news release. While the junior mining sector have endured a couple of rough years as of late, a recent study suggests these companies are more resilient than many expected, with only 31 juniors that were trading at the Toronto Stock Venture Exchange being delisted in the 12 months ending June 30, 2013. However the market value of the top 100 Canadian juniors dropped 44% to $6.49 billion in the same period, which means that miners are no longer the dominant force on the Venture exchange. |

| World’s No.1 copper miner output fell to 5-year low in 2013 Posted: 28 Mar 2014 09:45 AM PDT Chile's Codelco, the world's largest copper producer, said Friday production dropped to a five-year low and its profit fell by half in 2013 as declining ore grades and lower metal prices hit the state-owned miner. According to 24Hours.cl (in Spanish), the company's copper production fell 1.5% in 2013, compared to the previous year, due to lower ore grades, harder rock and slightly more difficult production in deeper deposits. The 1.62 million tonnes of the red metal reported excludes Codelco's stakes in the El Abra and Anglo Sur deposits, but it is the lowest production figure posted since 2008, when it mined roughly 1.47 million tonnes of copper. "This is due to production falls at the Chuquicamata, Radomiro Tomic, Salvador, Andina and Gabriela Mistral (mines), which was partially compensated by an 8% increase at the El Teniente (mine,)" Codelco was quoted as saying. The firm, however, showed some progress in containing costs. Direct cash costs last year fell 0.3% to about $1.631 a pound of copper, helped by lower power prices. Currently the world's largest copper producer hands all its profits back to the state. The government then decides how much to re-allocate to Codelco, often creating uncertainty in the run-up to the announcement and at times spurring disagreement over how much is ultimately assigned. In December last year, the government handed Codelco $1 billion, which didn't help the miner much, as the funds essentially amounted to an accounting increase, not fresh capital. Heller said he hopes Chile's President-elect Michelle Bachelet, who takes office on March 11, will give Codelco the fresh cash injection it urgently needs to counter declining ore grades at its aging mines, as well as to deal with increasing costs and low copper prices. Early this year CEO Thomas Keller said he hoped Chile's new president Michelle Bacheletwould give Codelco the fresh cash injection it urgently needs to counter declining ore grades at its aging mines, as well as to deal with increasing costs and low copper prices. Chile expects mining investment to reach $112 billion by 2021, figure that includes the $27bn planned by Codelco. By the same year, the country's total copper production is projected to reach an annual 8.1 million metric tons. The red metal accounts for 60% of Chile's exports and 15% of gross domestic product. Image courtesy of Codelco, via Flickr |

| US city mulls blocking Canada’s oil sands crude from reaching its port Posted: 28 Mar 2014 07:57 AM PDT  The city of South Portland does not want Alberta's oil sand from getting anywhere near its waterfront. The city of South Portland, Maine, could be the first place in the US to pass a law that would prevent Canada's crude from Alberta's oil sand from getting anywhere near its waterfront. CBC News reports that the city has already imposed a temporary moratorium on any new structures used by oil companies to help load oil from a pipeline on land, to oil tankers in their harbour, the third-largest oil port on the US East Coast. "We have no interest in having the world's dirtiest oil come through our community," Tom Blake, the former mayor of South Portland, told CBC. When Canada's National Energy Board approved the reversal of Enbridge's (TSX:ENB) Line 9B to bring oil sands bitumen east to Montreal early this month, the community of South Portland assumed it was only a matter of time before that oil would be heading south to their port for export. With recent advances in mining and processing technology, Alberta's oil sands are shifting the balance of global energy production, giving Canada the world's third-largest known reserves of recoverable oil, after Saudi Arabia and Venezuela. Paired with the oil and natural gas boom in the northern plains of the United States, the oil sands could provide North America with energy independence and free the US from Middle Eastern entanglements. Canadian firms, however, continue to face opposition, both locally and across the border. So far, they have been unable to access new markets in Asia and better prices as pipeline projects to the west coast languish in a regulatory morass. TransCanada's (NYSE:TRP) is advancing a west-east pipeline called Energy East, but after several years its Keystone XL project still has not received the green light to cross the border into the US. Enbridge's other big project, the Northern Gateway pipelines, seems an ever-diminishing prospect. Kinder Morgan's (NYSE:KMI) proposal to expand its existing pipeline to the Pacific coast, is also facing fierce opposition. |

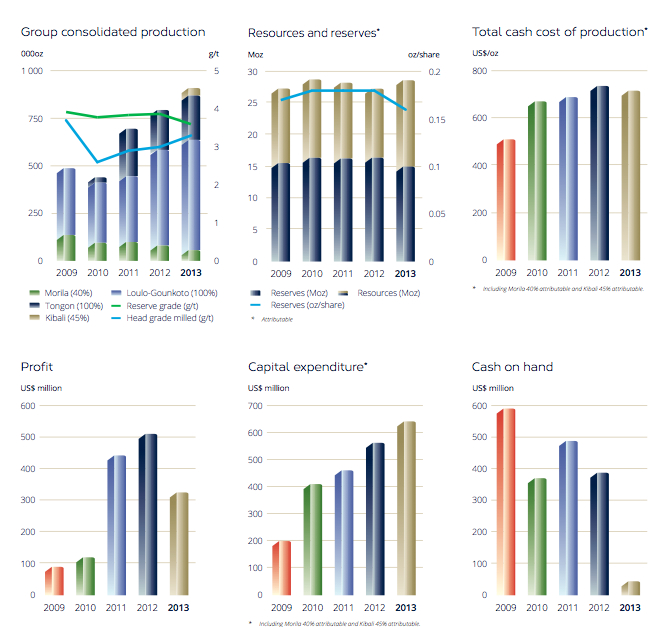

| Randgold targets higher gold output, gives CEO 36% pay rise Posted: 28 Mar 2014 03:00 AM PDT Africa-focused gold miner Randgold Resources (LON:RSS) said Friday is targeting over one million ounces of gold production for the year, adding it is getting close to its long-term goal of 1.2 million ounces by 2015. The company achieved a 15% increase in production to 910,364 in 2013 at a reduced cash cost of $715 per change and it is now aiming for an increase in production of between 24% and 30%, with costs expected to fall to between $650 and $700 per ounce. But those were not the only big news delivered in the company's annual report. The miner also unveiled it has given its chief executive officer Mark Bristow, a 36% pay increase to $7.4 million, after a jump in long-term share payments. Bristow, who founded Randgold in the 1990s, was paid a $2.57 million bonus on top of his $1.58 million salary last year. Payments under the long-term incentive plan more than doubled to $3.22 million. Under his management, Randgold Resources has grown to have a market value of $7 billion (4.2 billion pounds) and become the U.K.'s biggest gold producer. Thanks to Bristow's conservative policies, the company has not needed to write down its reserves and resources as the gold price dropped, unlike most of its gold peers. This is because Randgold has calculated its reserves at $1,000 per ounce and its resources at $1,500 per once for the past three years. "We have looked closely at all our mines to ensure that they will still be profitable at US$1 000/oz and we'll continue to review our operations against a range of gold price scenarios. We've also put a solid budget in place for 2014, kept our rolling five year plan intact and are now building this into a ten year plan" he said in a separate statement. Production growth is expected to come from rising grades at the company's flagship Loulo-Gounkoto complex in Mali, improved throughput at Tongon in Côte d'Ivoire, and the first full-year contribution from the recently commissioned Kibali in the Democratic Republic of Congo. The company warned that its reserves fell 8% to 15 million ounces, reflecting the fact that the company ramped up both production and grade during the period, impacting on its inventory. However, it said, management is confident that Randgold will replenish its reserves through ongoing exploration as well as resource conversion. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "HudBay target Augusta says it's got nine potential buyers"