European central banks may end deal capping gold sales |

- European central banks may end deal capping gold sales

- Another day, another copper price plunge

- This $33.3 million Faberge golden egg was minutes away from being melted as scrap

- Rinehart's Roy Hill iron ore project gets much needed $7.2bn fund injection

- Oh, Gold! Down to three-week lows after Yellen comments

- Miners among most productive, happiest workers in the world: study

| European central banks may end deal capping gold sales Posted: 20 Mar 2014 02:48 PM PDT An executive board member of the Bundesbank, Germany's central bank, told the Wall Street Journal Deutschland that continent's central banks may end a 15-year-old restriction on sales of their gold holdings at its next meeting in September. "The negotiations are still ongoing," Carl-Ludwig Thiele said in an interview with German edition The Wall Street Journal yesterday, concerning another extension of the 1999 agreement which cap sales of Europe's 17 central banks at 400 tonnes over a five-year period. "No one can see into the future, that's why it is currently under discussion whether it should be continued," Thiele said, adding that Germany has not intention to sell any of its reserves, over and above the four to five tonnes used to mint gold coins annually. In 1999 gold was trading at around $240 an ounce, and persistent central bank sales took much of the blame for the low price. But in recent years the official sector have become net buyers, making the agreement largely superfluous. About half of the Bundesbank's gold reserves of 3,396 tonnes are held overseas. January last year the Frankfurt-based bank said it will ship back home all 374 tonnes it had stored with the Banque de France in Paris, as well as 300 tonnes held in Manhattan by the US Federal Reserve, by 2020. So far the bank has only managed to repatriate a paltry 37 tonnes of the total, with a mere 5 tonnes held by the US finding its way back into German coffers. Germany's official gold holdings on a per capita basis is the highest in the world and it makes up two-thirds of the country's total foreign reserves. |

| Another day, another copper price plunge Posted: 20 Mar 2014 12:28 PM PDT In afternoon New York trade on Thursday May copper changed hands at $2.936 a pound, erasing all of yesterday's strong gains. Earlier in the day the red metal fell as low as $2.913, down more than 2%, after Federal Reserve Chair Janet Yellen made upbeat comments about the strength of the US economy. On Wednesday copper price futures went on wild ride falling to multi-year low of $2.877 by midday only to attract strong buying towards the end of the day to close within sight of the psychologically important $3.00 a pound level. While the hawkish comments by Yellen indicate expectations of stronger growth in the US thanks to housing starts at a six-year high and continuing strength in manufacturing, growth in the US cannot offset the slowdown in China. Copper is down more than 13% this year, with most of the losses coming in March after a steady stream of dismal economic numbers out of China – responsible for 47% of total global copper demand – sent prices tumbling. Given its widespread use in transportation, manufacturing and construction the weakness in China is having a significantly negative impact on underlying copper demand. At just over 10 million tonnes a year, China consumes more than four times the amount of copper than the US does and three times that of Europe. Chinese growth is expected to come in below the official target of 7.5% this year, the slowest pace since 1990 as the country's new leaders transform the economy from an investment-led to a consumption driven one. Chinese authorities are also doing everything they can to throttle back debt-fueled growth – earlier in March, Choari Solar became the first Chinese company in history to default on a corporate bond, sending shivers through Chinese industry and sparking fears of a knock-on effect. The slowdown in China is also coming at a time of significant production expansion. Codelco's new 160,000 tonnes-plus Ministro Hales mine in Chile, Glencore's Las Bambas project in Peru it is close to selling to China's Minmetals, expansion at other Codelco properties and at BHP Billiton's Escondida will help global output top 22.2 million tonnes from just over 21 million tonnes in 2013. |

| This $33.3 million Faberge golden egg was minutes away from being melted as scrap Posted: 20 Mar 2014 11:13 AM PDT

According to the Daily Telegraph, the dealer — who has chosen to remain anonymous— sensed the tiny golden egg was worth considerably more than the $13,000 asked price, so it bought it without further questions, only to find later it was once owned by Russia's Tsar Alexander III. The egg, seized during the Russian Revolution, is one of only a few original Faberge eggs still known to exist and it is worth over $33 million (£20 million). According to the Daily Mail, Kieran McCarthy, the Faberge expert who verified the discovery, compared it to "Indiana Jones finding the Lost Ark." The 8.2-centimeter (3.2-inch) egg, g on the brink of being melted down for scrap, is supposed to be one of three the Tsar Alexander III gave his wife, Tsarina Maria Feodorovna, as an Easter gift in 1887. The piece lies on top of an elaborate gold stand supported by lion paw feet. Three sapphires suspend golden garlands around it, and a diamond acts an opening mechanism to reveal the Vacheron Constantin watch inside. Peter Carl Faberge made about 50 imperial eggs for the Russian Tsars from 1885 to 1916. Images courtesy of Wartski. |

| Rinehart's Roy Hill iron ore project gets much needed $7.2bn fund injection Posted: 20 Mar 2014 09:49 AM PDT Aussie mining billionaire Gina Rinehart's massive Roy Hill iron ore project can finally go ahead as the company has landed a US$7.2 billion financing package from a consortium of lenders, including Australian banks. After 18 months of negotiations, Australia's richest person has been able to pull off a seemingly unachievable total of $10 billion, and now she is ready to continue building Australia's largest mining construction project. According to Roy Hill chief executive, Barry Fitzgerald, the funding deal is the biggest ever provided for a mining project in the world. Five international export credit agencies and 19 commercial banks contributed to today's $7.2 billion package, to be used in building a 55 million tonne a year port, a 344km railway and the mine project itself. Rinehart and her 30% equity partners in Roy Hill, Korea's POSCO, Japan's Marubeni and Taiwanese steel maker China Steel Corp, have already injected over $3 billion into construction of the iron ore mine. The project, originally expected to begin production last year, is way behind schedule. While the company last pushed it out to September 2015, industry analysts believe it is more likely to see the light by 2016. So far it is only about 30% complete. Rinehart's current fortune is estimated at some $17 billion, thanks to its Hancock firm, which she inherited from her father who claimed swathes of the rich Pilbara iron ore deposits in the 1950s. |

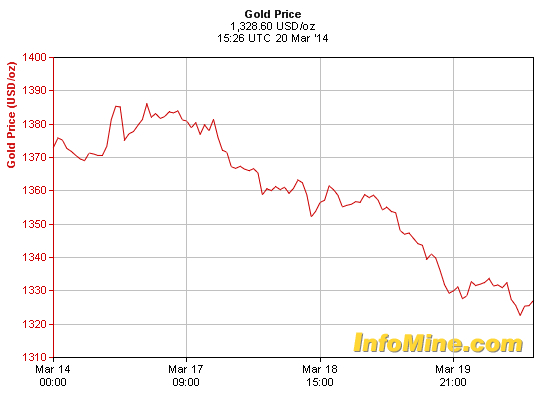

| Oh, Gold! Down to three-week lows after Yellen comments Posted: 20 Mar 2014 08:39 AM PDT Down again gold went on Thursday, hitting three-week lows after posting its steepest one-day fall since late January in the previous session, as investors continue to process the US Federal Reserve's head comments on how interest rates could rise sooner than expected. Markets seem to have interpreted Janet Yellen's remarks as impending rate hikes as early as early 2015. Spot gold extended losses this morning to $1,325.34 an ounce, its lowest since late February. It was down 0.3 percent at $1,327.10 an ounce at 1017 GMT, while US gold futures for April delivery were down $13.60 an ounce at $1,327.70. The gold price has been sinking this week after the situation in Ukraine simmered, lowering demand for gold as a safe-haven asset. The sharp drop is inconsistent with steady gains seen since the beginning of the year. |

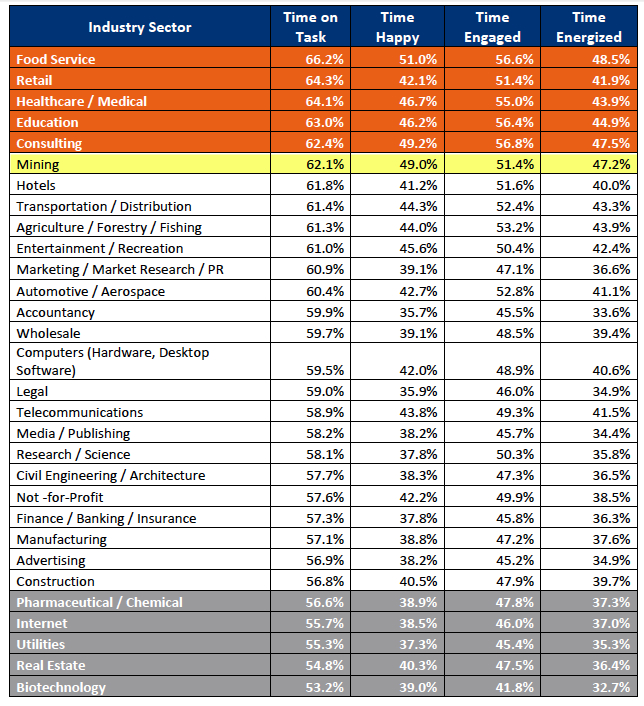

| Miners among most productive, happiest workers in the world: study Posted: 20 Mar 2014 07:44 AM PDT Miners across the globe are not only one of the most productive employees, but also rank among the happiest, reveals a study published Thursday by London-based iOpener Institute for People and Performance. The cross-industry study, which analyzed responses from over 30,000 professionals, reveals significant differences between personal productivity levels depending on the country and industry sector, with mining scoring a higher than average "time on task" —total hours workers are actively producing outputs that make a tangible contribution to their organization—of 62.1%. In terms of countries, Mexico shows to have the highest productivity (73.2% of time on task) and Portugal the lowest (43.3%).  Courtesy of iOpener Institute. Jessica Pryce-Jones, founder director of the iOpener Institute and author of "Happiness at Work – Maximizing Your Psychological Capital for Success," says the findings offer organizations a contextual starting point. "Those in mining can ascertain how they measure up when compared to their sector and country averages, and tailor their productivity initiatives accordingly," she says, adding that while the mining sector can be proud for scoring high, "there is still room for further improvement, particularly as rising costs and supply and demand imbalances make for a challenging market. " |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "European central banks may end deal capping gold sales"