Brien Lundin: East meets west in junior market rebound |

- Brien Lundin: East meets west in junior market rebound

- Five reasons the platinum price should take off

- Miners protest at Anglo’s Los Bronces mine in Chile

- Gold price drops after ETF outflows resume

- Duke Energy tries to retain customers after charged with illegally pumping coal ash into rivers

- SouthGobi hit badly by coal prices slump, seeks funding to avert default

| Brien Lundin: East meets west in junior market rebound Posted: 24 Mar 2014 04:24 PM PDT Can you hear it? Brien Lundin does. It's the sound of the junior resource market mounting a comeback. Lundin, editor of Gold Newsletter, president and CEO of Jefferson Financial and the man behind the New Orleans Investment Conference, traces the rebound to Western speculators coming to the market at the same time that Asian buyers are maintaining a strong level of demand. In this interview with The Gold Report, Lundin pinpoints the fastest horses in his stable of top picks. The Gold Report: I'm hearing something and I think it's the sound of a junior market rebound. What are you hearing? Brien Lundin: Yes, I hear it. I've been very cautious despite a few rallies and bounces since last fall, but momentum is building. We saw a lot of tax-loss selling in the metals at the end of the year, and thus the beginning of the year saw a natural rebound in the resources markets. That momentum has been backed by metal buying in Asia, which, in turn, attracted more speculative buying from the West. In short, speculators and speculative enthusiasm are returning to the junior market. TGR: In the March edition of Gold Newsletter you suggest that Asian precious metals demand is underpinning the rising gold price. That's not a new narrative, but tell us what's changing with that story. BL: Asian demand wasn't surprising. In mid-April speculators, in what appeared to be a very coordinated attack on gold, drove the price down by hundreds of dollars an ounce in a couple of trading sessions. That spawned a burst of Asian gold-buying demand. Historically Asians are very price-sensitive buyers. What's surprising is that the higher level of demand has yet to abate. It's encouraging for gold bugs and somewhat surprising. TGR: Alasdair Macleod, head of research at GoldMoney, puts China's gold imports at 2,668 tons in 2013. If he's correct, that would be one-quarter of all the gold reserves in the U.S. Do you believe his number is accurate? BL: I do. He's done the best work I've seen. The World Gold Council places it at less than half his number, but that doesn't account for a lot of the buying that we've seen through the Shanghai Gold Exchange (SGE). The SGE is essentially a physical delivery mechanism, unlike the Comex in the U.S., where gold investors and gold savers in China actually take delivery of gold. Macleod uses those figures as a starting point and conservatively nets out the various flows in and out of Hong Kong so that there's no double counting. Still, his numbers appear to be conservative because there are other entry points into China that are not accounted for. His numbers are still much more accurate than some of the other more mainstream sources of information. That number—2,668 tons of gold—is not much less than the entire level of gold production last year. In other words, almost every ounce of newly mined gold is going into China. That's important. That's dramatic evidence for a new secular trend of Asian buying. TGR: Any theories on what China is going to do with that much gold? BL: This level of demand implies that something is up—that there's some type of official encouragement or plan afoot. There was recently some speculation that China was about to reveal its level of gold reserves, but it hasn't. Whether the gold it is buying now goes into official reserves or into the hands of its citizens, it's gold in-country, which is effectively national reserves. It's part of a long-term plan to establish China as a preeminent global economic power. TGR: And maybe world economic reserve currency? BL: More likely as a global economic reserve currency of equal standing to the dollar, and perhaps to the euro. TGR: Newsletter writer Jim Dines has been called a "connoisseur of bottoms." Gold recently put in a double-bottom. How have those been positive for the gold price? BL: A double-bottom on a chart is a very powerful pattern that implies a robust rebound. That's exactly what gold has put in place since the first bottom in June 2013 and the second bottom in December. There's been a very steady and consistent rise recently, in contrast to the pattern of "two steps back, one step forward" that took hold in 2013. In 2014, it's been closer to five steps forward, one step back. TGR: The junior market rebound is not just about higher commodity prices. What other factors are involved? BL: Sellers got exhausted. Once there are no more sellers, there is a natural rebound. That upward trend is gaining momentum and in turn attracting more speculators as the technical picture improves. TGR: As things heat up, how can investors identify the promising juniors? BL: Go to conferences. Subscribe to newsletters. Find companies with proven resources. Investors can buy companies with established resources for the same price that ground-floor exploration companies were selling at a few years ago. Why take on the additional risk of exploration when you can buy ounces in the ground? TGR: Many of the companies you follow in your newsletter are developing projects with resources in Mexico. What are three or four juniors that are poised to ride the rebound? BL: Mexico is one of the most prospective exploration frontiers. Regulatory and tax events have thrown a damper on the area, but explorers and developers still have to go where the gold and silver is, and Mexico has proven to be one of the best places to find new deposits. A number of companies in our portfolio are exploring there. I particularly like Santacruz Silver Mining Ltd. (SCZ:TSX.V; 1SZ:FSE). It has three projects at different stages—one in production, one nearing production and one that is defining a resource. Its future is laid out clearly for investors to see. It has great management with a proven ability to bring a project into production on a shoestring budget—and still ahead of budget and ahead of schedule. It's a silver growth story. TGR: Santacruz is similar to other more established companies, like First Majestic Silver Corp. (FR:TSX; AG:NYSE; FMV:FSE) and Endeavour Silver Corp. (EDR:TSX; EXK:NYSE; EJD:FSE), in that it took a past-producing asset and made it work. Could Santacruz reach the level of those companies? BL: Yes, it has a plan that's realistic and it has management and financial backing to bring it to fruition. The only question is the timing. If you're looking for a silver company that will grow significantly in resource and production over the next three or four years while you ride a rising wave of silver prices, then Santacruz is one of the best bets out there. Another company I like is Almaden Minerals Ltd. (AMM:TSX; AAU:NYSE). It's a company run by Duane and Morgan Poliquin, who I've known for more years than I care to mention. Almaden is an interesting company that's been able to keep its share structure tight and deliver value for investors. It's been a consistent winner in our portfolio during the past dozen years or so. It was one of the companies that adhered very closely to the prospect-generator model before it became popular to do so. It farmed out every one of its projects. Almaden decided a few years back to finally drill a few of its projects. Sure enough, the second project it decided to drill itself, the Tuligtic project in Mexico, yielded a tremendous discovery on the Ixtaca gold-silver zone. Almaden has consistently expanded that discovery. TGR: Almaden has 4.5 million ounces (4.5 Moz) Measured, Indicated and Inferred, which is a solid resource. Who is in the market for an asset like that? BL: The majors are not in the market to any great degree right now, but eventually will be. If you buy value, everything else will take care of itself. Smart money was behind this stock at $3/share. At about $1.50/share, it's proven value. TGR: Take us on a tour of other hot names in Mexico. BL: Cayden Resources Inc. (CYD:TSX.V; CDKNF:OTCQX) was created essentially by the same team as Keegan Resources, which is now Asanko Gold Inc. (AKG:TSX; AKG:NYSE.MKT) in Ghana. Like Asanko, Cayden's stock has rarely been cheap, but there's always been value there. There's a lot of smart money in Cayden because it does not have to finance for another couple of years. Cayden has two premier exploration properties, one of which, the Morelos Sur property, is adjacent to Goldcorp Inc.'s (G:TSX; GG:NYSE) Los Filos mine, and is a valuable property position. Cayden received about $16 million ($16M) in a transaction from Goldcorp for part of its property, which allows it to explore its other prime area, the El Barqueño gold project, for the next couple of years without issuing another share or doing another financing. That's the project that has the greatest potential to deliver big news in the near term, and I fully expect it to do so. It has some of the best surface-exploration results I've seen on any Mexican exploration project and Cayden has only done the first phase of drilling. TGR: Cayden CEO Ivan Bebek believes that some of the Los Filos mineralization runs over onto Cayden's property. BL: Cayden has already gotten some results at depth on the Las Calles target. Cayden is confident that at some point Goldcorp will want to buy that portion of its property because the mineralogy extends onto Cayden's ground. That property seems destined to be sold to Goldcorp and could provide substantial new funding for Cayden. TGR: What are some of the other names getting regular ink in Gold Newsletter? BL: I like companies with resources on sale at a fraction of what they've sold for before. Columbus Gold Corp. (CGT:TSX.V), which has the Paul Isnard deposit in French Guiana, has no more development risk until prefeasibility. That allows it to focus on an exciting portfolio of exploration projects it has in Nevada. Columbus Gold is one of those companies that has a number of ways to advance, and is a bargain at its current levels. TGR: Can an asset in French Guiana be developed? BL: Absolutely, especially when a major company like Nordgold N.V. (NORD:LSE) is funding the project. Most of the gold production in French Guiana is unofficial, below the radar and smuggled out. There aren't a lot of reliable statistics for gold production in French Guiana because so much is not reported. A project of this size that's so well-backed is not a problem. Closer to home I like Midas Gold Corp. (MAX:TSX). Midas' Golden Meadows deposit in Idaho is getting great results and has attracted a lot of investors. It's another smart-money play. TGR: Midas recently announced a $12.8M private placement. What do you think the company will use that cash for? BL: Developing a resource. I don't think that Midas is going to be the company to bring this project into production. It will get bought out at some point. Another company that I've been very high on recently is Brazil Resources Inc. (BRI:TSX.V; BRIZF:OTCQX). It's run by Amir Adnani, who is well known as the entrepreneur who brought Uranium Energy Corp. (UEC:NYSE.MKT) from an idea into one of the first new uranium producers in North America. Brazil Resources is buying resources for pennies on the dollar in Brazil. It's taking companies that have failed during the market malaise and buying their resources. It has accumulated about 4 Moz in a flash. TGR: Does Brazil Resources have the cash? BL: It has plenty of cash and smart financial backers: The Casey Group and Sprott Asset Management. Brazil recently did a financing of $6.4M in late December. It's building a war chest for new acquisitions. It's a company to watch for news flow and acquisitions. TGR: What are a couple of themes you expect to dominate in the junior space in 2014? BL: Buying established resources while they're still on sale is a theme that will endure for much of this year, but the opportunity is beginning to wane. High-quality companies have already doubled or more in value from where they were in late December. They're still at good prices and values, but the opportunity is diminishing. An ever-present theme is drill-hole plays, or companies that are making discoveries. When that happens, it gives a jolt to the market both for that company and for companies in the surrounding area. Even in the worst correction the junior resource industry has seen for many years, there were plays like Fission Uranium Corp. (FCU:TSX.V), which is spectacular with its Patterson Lake South discovery. That's going to go down as one of the greatest mineral discoveries in modern times, regardless of the metal or mineral involved. It's still growing. It has a 100% drill success ratio record. Plays like that continue to pop up. Those kinds of reratings in market value are the most explosive when a company can make a discovery like that. TGR: What are you doing in Gold Newsletter this year to attract subscribers? BL: I'm offering some opportunities for lower-cost subscriptions. We recently went to an all-electronic format. It allows us to send out interim recommendations and alerts as new opportunities emerge. There's no more delay between when I see an opportunity and when our readers get a hold of it. I actively cover about 35 companies. I'm starting to cull the number down to focus on the faster horses. I see a number of exciting new opportunities emerging that I want to get into the portfolio, too. TGR: It's always about editing your portfolio as an investor. BL: The buying part is easy. The selling part is more difficult. TGR: Thanks, Brien. With a career spanning three decades in the investment markets, Brien Lundin serves as president and CEO of Jefferson Financial, a highly regarded publisher of market analyses and producer of investment-oriented events. Under the Jefferson Financial umbrella, Lundin publishes and edits Gold Newsletter, a cornerstone of precious metals advisories since 1971. He also hosts the New Orleans Investment Conference, the oldest and most respected investment event of its kind. Source: Brian Sylvester of The Gold Report (3/24/14) http://www.theaureport.com/pub/na/brien-lundin-east-meets-west-in-junior-market-rebound Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page. DISCLOSURE: Streetwise – The Gold Report is Copyright © 2014 by Streetwise Reports LLC. All rights are reserved. Streetwise Reports LLC hereby grants an unrestricted license to use or disseminate this copyrighted material (i) only in whole (and always including this disclaimer), but (ii) never in part. Streetwise Reports LLC does not guarantee the accuracy or thoroughness of the information reported. Streetwise Reports LLC receives a fee from companies that are listed on the home page in the In This Issue section. Their sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734. Participating companies provide the logos used in The Gold Report. These logos are trademarks and are the property of the individual companies. 101 Second St., Suite 110 Tel.: (707) 981-8999 |

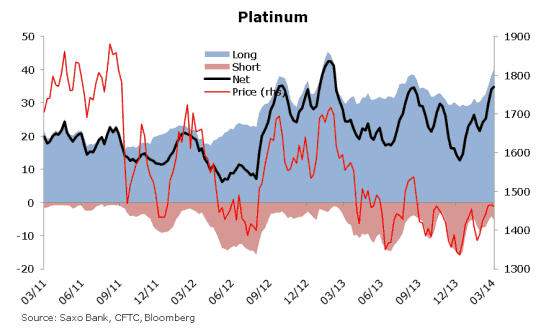

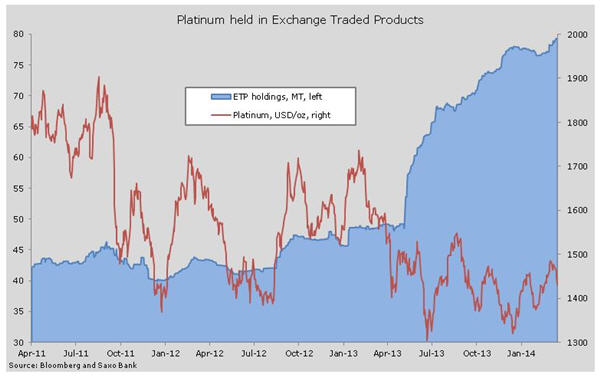

| Five reasons the platinum price should take off Posted: 24 Mar 2014 03:40 PM PDT

Platinum held in exchange product reached an all-time high in the week to 21 March of 79.3 tonnes, up more than 30 tonnes or 64% in a year. At the same time large investors on the platinum derivative markets have increased their net long position to 1.75 million ounces, more than doubling the number of contracts since the start of the year. That's about half the combined annual output of strike-affected Anglo American Platinum (LON:AAL), Imapala Platinumm (OTCMKTS:IMPUY) and Lonmin (LON:LMI) which account for some 60% of the world's production. Yet the price remains soft; with spot declining again on Monday to a month low of $1,430. The price of platinum has also declined since the start of the strike even though 10,000 ounces of production are lost each day it drags on. Year to date platinum is up 4.2%, but still 165 below where it was this time last year. Palladium is doing much better, but is not exactly shooting the lights out. Palladium production of the metal – often used a platinum replacement in autocatalysts – is even more concentrated that platinum. The metal gained on Monday touching the highest level since September 2011 and up 11% since the start of the year. Graphs are from Saxo Bank's Trading Floor. Worth a visit. Image by Tom Holbrook |

| Miners protest at Anglo’s Los Bronces mine in Chile Posted: 24 Mar 2014 11:25 AM PDT Contract workers staged Monday a massive a protest at Anglo American's (LON:AAL) Los Bronces copper mine in central Chile, as the company refused last week to negotiate their demands. The London-listed miner said in a statement that operations remain unaffected. However, it noted there have been "fires, looting, vehicle thefts and disturbances." The contractors' leader, Cesar Inostroza, told local newspaper La Tercera (in Spanish) they are demonstrating against alleged anti-union practices, including layoff threats and harassment. Anglo, the operator of Los Bronces, owns 50.1% of the mine. Mitsubishi has a 20.4% stake, and Chile's state-owned Codelco and its joint venture partner Mitsui hold the remaining 29.5%. |

| Gold price drops after ETF outflows resume Posted: 24 Mar 2014 11:14 AM PDT The gold price plummeted to a more than one-month low on Monday deepening the 3.5% slide suffered last week as traders and investors in gold-backed ETFs book profits. On the Comex division of the New York Mercantile Exchange, gold futures for June delivery last traded at $1,311.20 an ounce, down nearly $25 or 1.9% from Friday's close, and not far off the day's low of $1,308.40. The yellow metal has taken a hammering during the past six trading sessions – gold is down from a high above $1,380 reached on Monday last week which was best level since June. Gold is still up 9.4% since the start of the year, but the positive momentum seems to be grinding to a halt. Last week saw the first – albeit small – reduction in four weeks of holdings in exchange traded funds backed by physical gold. Latest data show in the week to 21 March global gold ETF holdings declined by 0.2 tonnes taking total holdings down a notch to 1766.2 tonnes. The week before saw inflows of 12.3 tonnes – the biggest move since November 2012 and the highest level since December 27. Gold bullion holdings in global ETFs hit a record 2,632 tonnes or 93 million ounces in December 2012, but last year saw net redemptions of a staggering 800 tonnes. Holdings of SPDR Gold Shares (NYSEARCA: GLD) – the world's largest gold ETF holding more than 40% of the total – on Friday shot up 4.2 tonnes, bringing year to date gains to 18.75 tonnes. While the additions have been fairly modest it compares to 2013 when GLD recorded only 17 days of inflows over the course of the 12 months and almost 540 tonnes left the fund. In contrast to ETF investors, speculators in gold futures and options turned more bullish last week. Long positions – bets that the price will go up – held by large investors like hedge funds increased to 151,939 lots in the week to February 18 according to Commodity Futures Trading Commission data released after the close of business on Friday. At the same time short positions, indicating weaker prices ahead, were cut by 7,563 to just under 13,510, which translates on a net basis hedge funds holding 138,429 lots or 13.8 million ounces, the highest in more than a year. The 2014 rally in the price of gold has not convinced most bears, and Goldman Sachs on Friday reiterating its call for gold to fall to around $1,050 an ounce by year-end due to a recovering US economy and rising interest rates. Image by Javier Cabrio. |

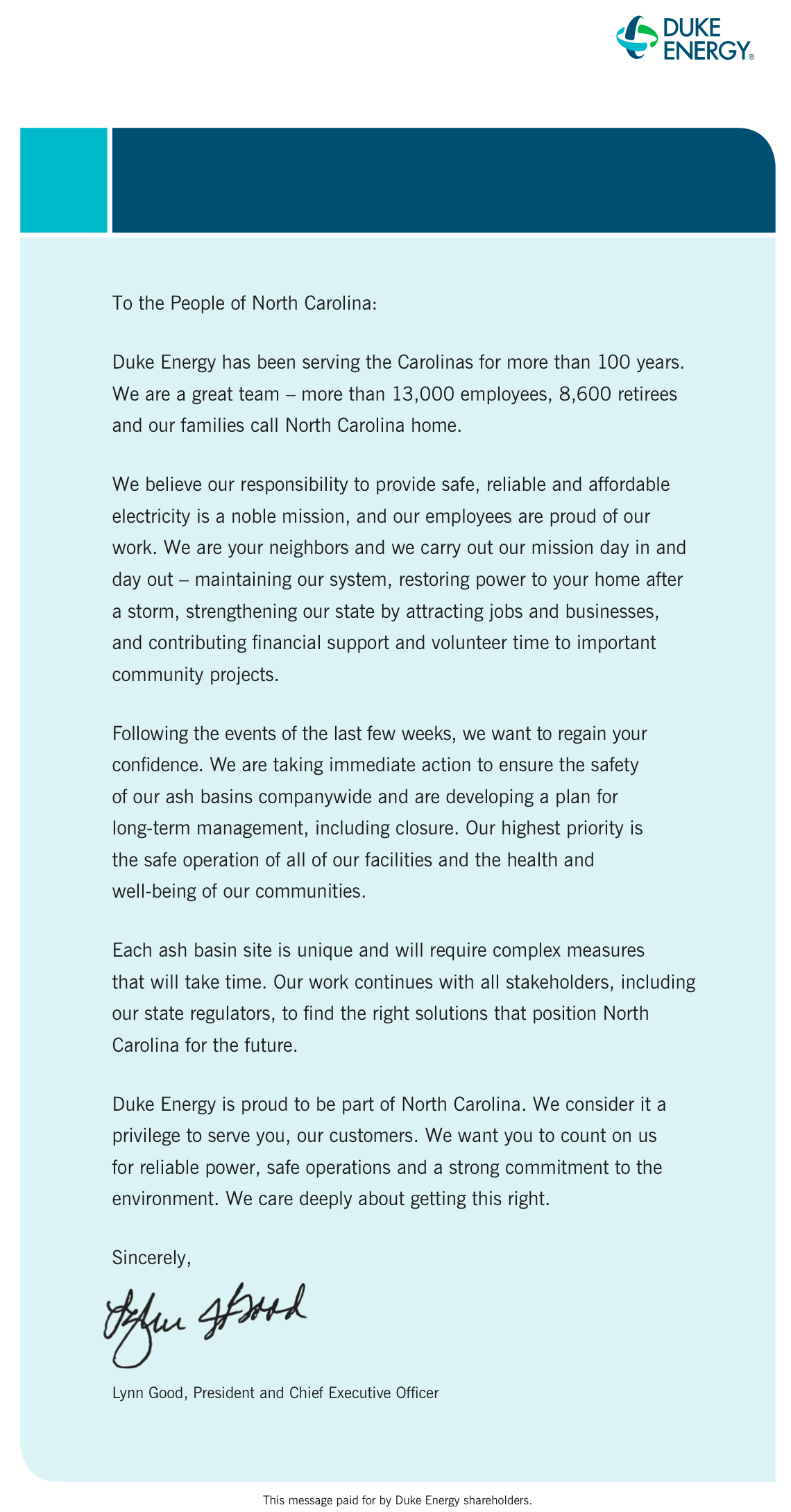

| Duke Energy tries to retain customers after charged with illegally pumping coal ash into rivers Posted: 24 Mar 2014 10:21 AM PDT  Regulators said last week the firm illegally pumped 61 million gallons of contaminated water from a coal ash pit into the Cape Fear River, marking the eighth time in less than a month Duke Energy has been cited for environmental violations. Duke Energy (NYSE:DUK), the US largest electricity company, is stepping up efforts to "regain" customer confidence following a toxic spill from a coal ash dump in North Carolina last month that forced authorities to treat the drinking water supply for Virginia, Danville and South Boston. The incident brought to light Duke's history of polluting groundwater with its leaky, unlined coal ash dumps, as subsequent investigations by the North Carolina Department of Environment and Natural Resource (DENR), showed the company had been pumping the coal ash for months from two facilities without authorization or the proper safety measures in place to filter the contaminated water. Taking a full-page ad in local newspapers Sunday (see below), the company said it is setting in motion actions to "ensure the safety of our ash basins and develop a plan for long-term management, including closure." Duke's president and chief executive officer, Lynn Good, told state officials last week the firm was studying ways to move ash ponds at Riverbend and Asheville away from the lakes and rivers they border and to bury the waste in lined landfills rather than the unlined pits currently used. The company also has agreed to accelerate its effort to close the Sutton ponds down. Duke has coal ash dumps at 14 power plants in North Carolina, all of which were cited last year for polluting groundwater. Coal ash is the by-product of burning coal for industrial power generation and contains concentrated amounts of toxic metals such as arsenic, lead, mercury and selenium, as well as aluminum, barium, boron, and chlorine and varying amounts of radioactive uranium, thorium and potassium. The toxins have been linked to cancer, heart damage, lung disease, respiratory distress, kidney disease, reproductive problems, gastrointestinal illness, birth defects, impaired bone growth in children and behavioural problems, according to waste assessments done by the EPA. Image: Screengrab from a News&Record report |

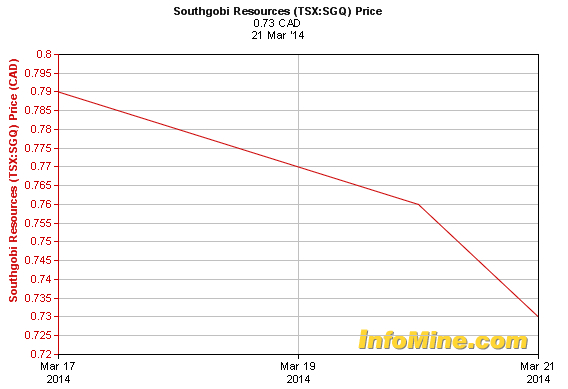

| SouthGobi hit badly by coal prices slump, seeks funding to avert default Posted: 24 Mar 2014 08:05 AM PDT Mongolia-focused coal producer SouthGobi Resources (TSX: SGQ) said Monday is seeking additional financing to avoid defaulting on a $250 million convertible debenture due to the ongoing coal prices slump. Delivering its 2013 results, the Vancouver-based miner said it expected continued pressure on its margins and liquidity, as coal prices were likely to stay weak in China this year. Shares in the company tumbled down almost 11% to 0.560 at 10:40 am in the Toronto Stock Exchange. The company, controlled by Rio Tinto (LON:RIO) logged a $197 million loss from operations in 2013 compared to a $124 million loss from operations in 2012. Excluding certain items, loss from operations was $25 million, compared to a loss of $15 million a year earlier. SouthGobi operates the Ovoot Tolgoi metallurgical-coal mine, located about 40 km from Mongolia's border with China. Prices for metallurgical coal have plummeted to a three-year low amid slowing economic growth in China, the top consumer of the steelmaking ingredient, and an increase in supply from Australia. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Brien Lundin: East meets west in junior market rebound"