Top gold ETF holdings jump most in 16 months as rally gains momentum |

- Top gold ETF holdings jump most in 16 months as rally gains momentum

- FL Smidth announces year-end loss, expects downturn to continue in 2014

- Teck down after announcing 44% profit hit

- Major Mining Equipment Disposal Project

- Turquoise Hill shares plunge on Oyu Tolgoi update

- Gold price scales $1,300 after US data disappoints

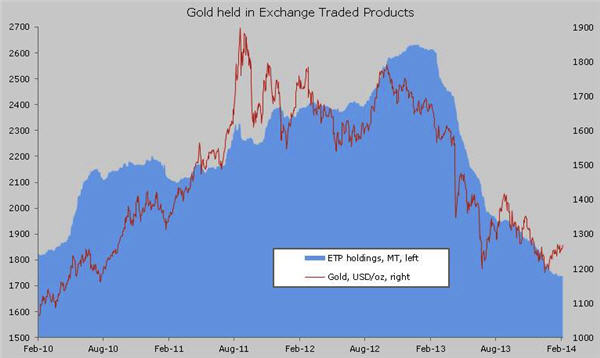

| Top gold ETF holdings jump most in 16 months as rally gains momentum Posted: 13 Feb 2014 05:05 PM PST Gold futures for April delivery – the most active contract – settled at $1,300.50 an ounce on Thursday. It was the first time the metal traded above $1,300 since early November and gains for 2014 now top 8%. The price of gold slid 28% in 2013 – the worst annual performance since 1980 – on the back of mass liquidation of gold-backed ETFs. Last year the world's physical gold trusts experienced net redemptions of more than 800 tonnes collectively and suffered depreciation of close to $80 billion. Along with the stronger gold price, the first signs of a reversal of what had become a one-way bet is now visible. Holdings of SPDR Gold Shares (NYSEARCA: GLD) – the world's largest gold ETF by a wide margin – on Thursday shot up the most since October 2012. Investors bought a net 7.5 tonnes on Thursday bringing holdings back above 800 tonnes for the first time this year. That compares to just over 9 tonnes of inflows on October 4, 2012 when gold was trading just under $1,800 an ounce. GLD recorded only 17 days of inflows all of last year and almost 540 tonnes left the fund in 2013 from a peak of more than 1,350 tonnes. Gold bullion holdings in global ETFs hit a record 2,632 tonnes or 93 million ounces in December 2012.  Source: Bloomberg | Saxo Bank |

| FL Smidth announces year-end loss, expects downturn to continue in 2014 Posted: 13 Feb 2014 03:41 PM PST Major Danish services supplier FLSmidth (CPH:FLS) ended the year in the red with a loss of DKK-784 million compared to a profit of DKK1,303 million in 2012. The company was 7.16% lower to DKK277.30 The company was gored by all the major miners announcing cost cutting. FL Smidth said the order intake decreased 25% to DKK20,911 million. In 2012 it booked DKK 27,727 million. The company lowered its dividend to DKK2 a share, from DKK9 a share for 2012. The mineral processing division is expected to decline, DKK55 to 6.5 billion in 2014 compared to DKK9.3 billion in 2013. Overall, the company was gloomy:

One bright spot was the company's service division. The company said its after market held up well due to mines running continuously leading to wear and tear on equipment. The company forecast revenue of DKK7.5-8.5 billion in 2014, about the same as 7.6 billion in 2013. |

| Teck down after announcing 44% profit hit Posted: 13 Feb 2014 02:10 PM PST Blaming lower prices for its "key products", Teck Resources (NYSE: TCK) reported a 44.5% profit drop of $1.0 billion, or $1.74 per share, compared with $1.8 billion or $3.03 per share in 2012. The diversified miner, which released its unaudited fourth quarter results for 2013, was down 6.62% to $23.68 per share on the NYSE. While the company touted higher production and more cost savings, it couldn't overcome steep price declines for commodities in 2013: "We achieved record annual steelmaking coal sales, had record throughput at three of our mines, implemented approximately $360 million in savings from our cost reduction program and, with our partners," said said Don Lindsay, President and CEO, in a news release. "However, prices for all of our key products were down compared to last year, resulting in lower profits and cash flows than in 2012." Looking forward, the company saw further squeezes due to more supply and currency issues. "While we believe that the longer term fundamentals for steelmaking coal, copper and zinc are favorable, the recent weakness in some of these markets may well persist for some time." The company forecast that new sources of supply will put downward pressure on coal prices. The falling US dollar means operating costs and capital spending will rise. In 2014 Teck expects a drop in copper production as a result of lower production from Quebrada Blanca with less dump leach production and from Antamina as the mine enters a period of significantly lower grades. The company expected 320,000 to 340,000 tonnes compared with 364,000 tonnes produced in 2013. The outlook for coal depended upon buyers. "Our actual production will depend primarily on customer demand for deliveries of steelmaking coal. Depending on market conditions and the sales outlook, we may adjust our production plans. Zinc concentrate was also going to decline in 2014 from 623,000 tonnes to in the range of 555,000 to 585,000 due to production decreases at Antamina and Red Dog. |

| Major Mining Equipment Disposal Project Posted: 13 Feb 2014 02:05 PM PST Self-propelled Dump Hopper Barge. Caterpillar Machines: D10T, D10R, 12H, 16M, 966H, 992G, 320C, 725, 773D, 775F, 785C & 793C. Atlas Copco Machines: L2C, M2C, L6C, MT2010, MT5010, MT6020. Sandvik Machines: DL430-7C, LH514, T0010, T0011, D50KS, D55KS. Reedrill SKF. O&K Terex RH200. 825 kVA Variable Hz Generators. Booster Compressors: Cubex S150, Atlas ORX10. Additional equipment can be viewed at http://www.g-es.net/MajorProject.aspx |

| Turquoise Hill shares plunge on Oyu Tolgoi update Posted: 13 Feb 2014 11:41 AM PST Shares in Turquoise Hill Resources (TSE:TRQ) dropped close to 8% on Thursday after the operator of the massive Oyu Tolgoi mine in Mongolia gave little indication of progress in its negotiations with the government of the Asian nation. By early afternoon Turquoise Hill stock was changing hands at $3.48, down 7.7% and near its lows for the day. The value of the stock has more than halved over the past year. The Vancouver-based company said talks with the Mongolian government on the expansion of the $6.6 billion mine and the reworking of the initial Oyu Tolgoi deal signed in 2009 is ongoing and that it has proposed restarting work on the underground section put on hold in July last year. The main sticking points of the negotiations which have dragged on for more than a year appear no closer to being resolved however. Turquoise Hill said "further delays may occur if outstanding shareholder issues, including project finance, are not resolved before the expiration of lender commitments on existing project finance arrangements." Turquoise Hill owns a 66% interest in Oyu Tolgoi in the Gobi Desert close to Mongolia's border with China with the government of the Asian nation holding the rest. The underground project which is estimated to cost up to $6 billion is where 80% of the value of the deposit is situated. Controlling company Rio Tinto (LON:RIO) put out stellar results on Thursday which were only marred by asset impairments totaling $3.4 billion, primarily as a result of the consolidation of Oyu Tolgoi's accounts on the Anglo-Australian giant's books. Operationally Oyu Tolgoi also hit a few roadblocks with year to date sales volumes "falling short of expectations with some sales deferred into the second and third quarters of 2014. " "Production rates have recently been impacted by various post-commissioning issues including the failure of the rake blades in the tailings thickeners. This is expected to result in the shutdown of one line for a period of six to eight weeks," the company added. For 2014, Oyu Tolgoi is targeting production of 150,000 to 175,000 tonnes of copper in concentrates and 700,000 to 750,000 ounces of gold in concentrates. Oyu Tolgoi's 2013 gross revenues were $55 million on sales of 26,400 tonnes of concentrate. |

| Gold price scales $1,300 after US data disappoints Posted: 13 Feb 2014 10:37 AM PST The gold price wracked up another session win on Thursday, after economic news from the US came in below expectations, signalling ultra-loose monetary policy could be around for longer than expected. On the Comex division of the New York Mercantile Exchange, gold futures for April delivery – the most active contract – settled at $1,300.50 an ounce, up $5.80 from yesterday's close. It was the first time the metal traded above $1,300 since early November. The price of gold is up 8.3% in 2014. However, traders point out that on a technical basis $1,304 is the key level that could trigger a series of gains. $1,304 an ounce is the 200-day moving average of the gold price and a level not breached in over a year. Gold's gains on Thursday, after advancing six sessions in a row, came after US retail sales fell 0.4% in January against an expected 0.2% increase. Consumption makes up around 70% of the US economy and any slowdown bodes ill for GDP growth in the world's largest economy. Initial claims for state unemployment benefits also clouded the outlook rising to seasonally adjusted 339,000 against expectations of decline to 330,000. The poor economic data comes on the heels of two disappointing jobs reports in December and January which have strengthened the hands of supporters of the Fed's economic stimulus program. New Fed chair Janet Yellen, in testimony to US lawmakers, told lawmmakers she expects "a great deal of continuity" in the Fed's approach to monetary policy, but left the door open to hit the breaks on tapering of $65 billion a month asset purchases under its quantitative easing program should the economic outlook deteriorate. The US central bank, together with the Bank of Japan, the European Central Bank and the Bank of England, has pumped more than $10 trillion of easy money into financial markets since the financial crisis. This unprecedented monetary expansion has been a massive boon for the gold price. Gold was trading around $830 an ounce when previous chairman Ben Bernanke announced Q1 in November 2008. Gold and the US dollar usually moves in the opposite directions and gold's status as a hedge against inflation is also burnished when central banks flood markets with money. The price of gold slid close to 28% in 2013 – the worst annual performance since 1980 – in anticipation of an early end to the ultra-loose monetary policy. Those fears may have been overblown. Other positives this year include the metal's perceived value as a safe have in times of turmoil as emerging market worries replace fears over the eurozone which occupied investors minds in 2012 and 2013. Strong physical demand from Asia has also underpinned the strength of gold this year with speculation that a purported 500 tonnes bought by the Chinese central bank will be added to this year. China consumed 1,176 tonnes of gold in 2013, 41% higher than in 2012, according to data released on Monday by the China Gold Association. Despite onerous new taxes and import restrictions Indian consumption still rose 5% to 987.2 tonnes last year. Lifting some or all of these restrictions which have been mooted by politicians ahead of general elections on the sub-continent would provide a further boost for the price. Image of gold pour at Gold Reef City in Johannesburg, South Africa by Dan Brown. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Top gold ETF holdings jump most in 16 months as rally gains momentum"