Strikers vow to fight on as platinum price goes soft |

| Strikers vow to fight on as platinum price goes soft Posted: 22 Feb 2014 02:01 PM PST A month-old strike at South Africa's PGM mines shows no signs of being resolved. More than 70,000 workers at the world's three largest platinum producers, Anglo American Platinum (LON:AAL), Imapala Platinumm (OTCMKTS:IMPUY) and Lonmin (LON:LMI), have been on strike since January. Platts News reports the militant AMCU labour union has vowed to press on with platinum strike until their demands of a doubling of base pay to $1,170 are met: "We are prepared to see it through," AMCU President Joseph Mathunjwa said. "When asked how long they were prepared to strike, Mathunjwa said: "Until we achieve a settlement.". Together the South African companies' mines produce 3.5 million ounces in 2012; almost 60% of the world's platinum. South Africa together with Russia control more than three-quarters of world supply. Estimates point to roughly 10,000 ounces of platinum and 5,000 ounces of palladium production lost each day due to the strikes. Implats says if and when the strikers do return to work it would take up to three months to restart production with around 10% of its shaft considered unsafe due to cave-ins. Last week the company, number two producer behind Angloplat, said it can supply customers to end of March, but not beyond. If strikes continue into May, the mines may need to source metal from the open market, or fail to deliver on contracts according to a research note by Standard Bank. Huge inventories built up at the largest producers and in Nymex warehouses are being blamed for the muted reaction of platinum and palladium prices to the disruption. The spot platinum price on Nymex in New York rose on Friday to trade at $1,429.60, that's down over 2% since the strike began. The price of palladium, last trading at $739.90 has lost $7 an ounce over the last month. |

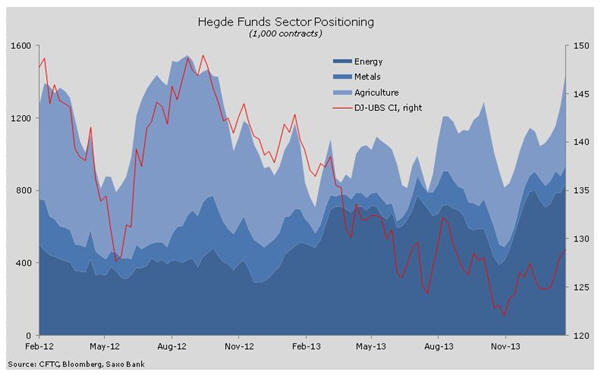

| Copper is odd one out on this hedge fund positioning chart Posted: 22 Feb 2014 11:06 AM PST Renewed interest by large investors has been a central feature of the turnaround in sentiment on the gold and silver market. After turning gold into a one-way bet lower in 2013, large investors, primarily made up by hedge funds, have recently turned more bullish as evidenced by a 17% jump in net long positions – bets that prices will go up – held by so-called "managed money". It's not just gold, up 10.3% year to date, and silver enjoying a 14.5% surge in 2014, that have attracted Wall Street speculators. Interest in commodities from hedge funds has been spiking across the board with agriculture and energy prices the main beneficiaries. Arabica coffee is up 20% in a single week, sugar has jumped 5%, natural gas gained 20% and New York harbor diesel added 4% over just five trading sessions. Saxo Bank head of commodities strategy Ole Hansen has an interesting graph showing how hedge funds are positioning themselves in the sector. This chart from the Danish bank shows among all commodities copper is the lone raw material being shunned by the smart money: "Hedge funds were behind the curve at the beginning of the year and since then, they have been an important driver of the current rally. "In just six weeks, the speculative net-long position across 24 major commodities has jumped by 28 percent. "During this time, the grain sector exposure has gone from a net-short of 11,000 contracts to a net-long of 202,000 contracts, softs from 86,000 to 113,000, and energy from 798,000 to 840,000. "The metal sector has seen a reduction from 106,000 to 98,000 contracts but this been caused by 51,400 contracts net-selling of copper while precious metals has risen strongly." Click here for more from Saxo Bank's Trading Floor and Ole Hansen. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Strikers vow to fight on as platinum price goes soft"