New online map shows deforestation as it happens |

- New online map shows deforestation as it happens

- Gold price: Hedge funds add 30% to bullish bets

- Vale opens first new Sudbury mine in more than 40 years

- India's measures to curb gold imports have worked, but what now?

- Bubba explains why US only gave Germany back 5 tonnes of gold

- Investors take chunks out of Newmont after big loss, reserves cut

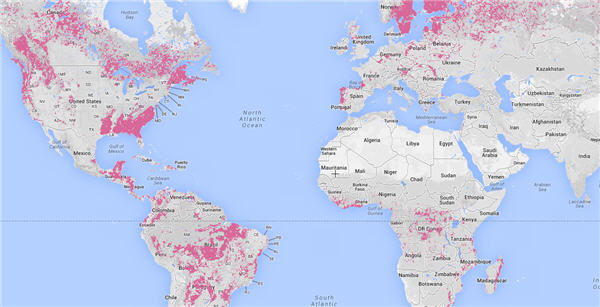

| New online map shows deforestation as it happens Posted: 21 Feb 2014 03:07 PM PST It's estimated that 50 soccer fields of forests are lost every minute, according to the World Resources Institute (WRI). But where? A new website launched this week could answer that question. A partnership between WRI and about 40 other organizations has created Global Forest Watch (GFW): A free online forest monitoring system that can detect changes in tree cover in near-real-time. Using satellites, Google Maps, Google Earth and a variety of other resources, GFW "guarantees timely and reliable information about forests for anyone with access to an internet connection," Nigel Sizer wrote in a blog post for WRI. The implications are significant. Sizer notes that we currently know "remarkably little" about deforestation levels and that this data could help companies, citizens, and governments take quick action. "[T]op government officials lack the current data necessary to make well-informed decisions about land use planning and protected areas—let alone quickly detect illegal deforestation and enforce the law," Sizer wrote. Data on deforestation could be particularly useful in places where illegal mining is rampant. The effects of illegal gold mining in Peru's Amazon rainforest have been widely documented. Journalist Guido Lombardi said the damages made it look as if someone had "put a piece of the desert in the middle of the Amazon." The GFW map also shows gains in tree cover revealing, a significant imbalance between forest losses and gains in Peru and Brazil where illegal mining is extremely prevalent. Overall, the data shows that between 2000 and 2012, the earth has lost far more trees than it has gained. |

| Gold price: Hedge funds add 30% to bullish bets Posted: 21 Feb 2014 02:35 PM PST The gold price ended Friday with a third week in a row of gains after bullish positions held by large investors soared again. By the close of regular trade on the Comex division of the New York Mercantile Exchange, gold futures for April delivery – the most active contract – hit $1,323.60 an ounce, up $6.70 from Thursday's close. There appears to be a definite shift in sentiment this year after 2013's dismal performance with the smart money only now catching up with gold's almost 10% rise this year. Long positions – bets that the price will go up – held by so-called managed money increased by 8% to 140,840 lots in the week to February 18 according to Commodity Futures Trading Commission data released after the close of business on Friday. At the same time short positions were cut by 10,603 to just under 50,000, which translates on a net basis hedge funds holding 31% more bullish positions: net longs of 90,942 lots or 9.1 million ounces. Net longs jumped 17% in the week to February 11, CFTC data showed. Net longs fell to a paltry 26,700 lots in early December when shorts held by large investors peaked at more than 80,000 lots. That was the highest number of short positions since 2007, back when gold changed hands for $700 an ounce. |

| Vale opens first new Sudbury mine in more than 40 years Posted: 21 Feb 2014 01:50 PM PST Seven years and $760 million dollars later, Vale has opened the doors to a new mine in Ontario's Sudbury Basin for the first time in more than four decades. The Totten Mine – which Vale calls 'Canada's mine of the future' – officially opened on Friday in the presence of Ontario Premier Kathleen Wynne, Minister of Northern Development & Mines Michael Gravelle, members of the Sagamok Anishnawbek First Nation and other community leaders. "The opening of Totten Mine reinforces the strong confidence we have in our world-class base metals assets to deliver sizeable value through all commodity cycles," the company wrote in a news release. "Vale is committed to its future in Canada and across base metals and we are pleased to be able to celebrate this historic milestone for our company and the Greater Sudbury community." The project provided work for 500 people during construction and will employ 200 during the production phase. "Totten Mine is so important to the prosperity of Northern Ontario," Wynne said. "It will create good jobs and help foster economic growth in the region and beyond. Full production is expected in 2016 at which point the mine should put out 2,200 tonnes per day of of copper, nickel and precious metals for 20 years. Totten's opening comes at a difficult time for Canadian mining. Just last week Labrador Iron warned that it might have to shut operations due to low grades and an unstable iron ore market. One week earlier Cliffs Natural Resources said it would slash 500 jobs in Newfoundland and Labrador. The Ontario government is fighting hard to boost its mining sector. The province recently announced that it had hired consulting firm Deloitte to help move forward the development of the mineral-rich Ring of Fire region. But Cliffs Natural Resources, a company with claims in the area, suspended its plans late last year. |

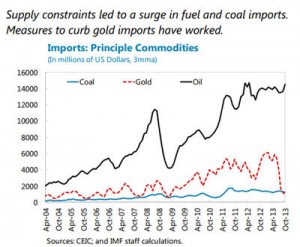

| India's measures to curb gold imports have worked, but what now? Posted: 21 Feb 2014 11:58 AM PST India has made headway in reducing its current account deficit by curbing gold imports, but is this sustainable? In 2013 India's current account deficit (CAD) reached a record 4.8% of GDP, in part due to high gold imports. The yellow metal is one of the biggest contributors to the country's trade imbalance, second only to oil. But the deficit is narrowing fast, according to a report published by the International Monetary Fund (IMF) this month. "India's external vulnerabilities have fallen significantly in recent months, helped by policy actions taken to shrink the current account and strengthen capital flows." The IMF expects India's current account deficit to fall to around 3.3% of GDP this fiscal year. The government's measures to reduce gold imports – which include import duties of 10% and the 80:20 rule – seem to have worked. Official statistics show that gold imports between July and October fell 63% compared with the year before, according to a recent report by the World Gold Council (WGC). But official imports are only half the story: The Indian gold market has a number of alternative sources for obtaining the coveted metal. Although it's impossible to calculate exactly how much gold was smuggled into the country in response to import restrictions, the Indian Finance Minister estimates that these activities may have added between one and three tonnes per month in the second half of the year. The WGC believes this could be a considerable underestimate and that smuggling could have added as much as 200 tonnes throughout the year. Regardless of how much illegal gold was actually brought into the country last year, the fact remains that Indians are hungry for gold. According to the WGC report demand hit 974.8 tonnes in 2013 – the third highest annual volume. And the government's ability to hold off imports in the long term is questionable. "The limits on gold imports should be viewed only as a stop-gap measure and have the potential to become less effective over time (including from increased smuggling)," the IMF wrote in its India report. "Durably lowering the demand for gold as a store of value will only be achieved through low inflation, raising real interest rates on deposits, and ensuring macroeconomic stability." Eroding confidence in the Indian economy, high inflation, and the rupee's weakness – highlighted by a record low in August 2013 and exacerbated by high imports – are convincing many Indians that gold may be their best bet. "High and persistent inflation is a key vulnerability that has caused household inflation expectations to continuously exceed actual inflation and become embedded in behaviors," the IMF wrote. "This, in turn, has driven a rising demand for gold and is adding to downward pressures on the rupee." Meanwhile, India's growth is expected to slow to 4.6% this year – the lowest level in a decade, according to the IMF. Authorities say they can indeed sustain low gold import levels, pointing to, among other economic policies, the introduction of inflation-indexed bonds which offer households an alternative inflation hedge to gold. But Indians have a long history with gold and the government's attempts to convince people that they don't need to rely on the precious metal in times of crisis has been a challenge, even in the best of times. |

| Bubba explains why US only gave Germany back 5 tonnes of gold Posted: 21 Feb 2014 11:45 AM PST On January 16, 2013 Germany's central bank, the Bundesbank, said it will ship back home all 374 tonnes it had stored with the Banque de France in Paris, as well as 300 tonnes held in Manhattan by the US Federal Reserve, by 2020. Fast forward a year and Bubba, as the Federal Bank of Germany is affectionately (or maybe not) known, has only managed to bring home a paltry 37 tonnes of gold. And a mere 5 tonnes of that came from the US, the rest from Paris. The US Fed holds 45% of the total 3,396 tonnes German gold. Needless to say this prompted renewed questions whether Germany's gold still exists in those Manhattan vaults or if it has been melted down, leased or even sold. At the time of the original Bundesbank announcement, there were rumours that Germany wanted their gold back because the Fed refused German officials a viewing of the bullion a couple of months earlier. In an extensive interview with German business publication Handelblatt, executive board member Carl-Ludwig Thiele, tries to lay to rest all the rumours about the program which was designed as a "trust-building" measure among the German people: There are these rumours that either the gold in New York is no longer there or you do not have unrestricted access to it. Why have you not called in auditors or other externals to oversee the transfers in response to such rumours? It astounds me that Handelsblatt pays any attention to such absurd rumours. I was in New York myself in June 2012 with the colleagues responsible for managing the gold reserves and saw for myself how our money is stored in the vault there. The Americans have never stonewalled or hindered us in any way. On the contrary, their cooperation has been most constructive in every respect. Our internal audit team was present last year during the on-site removal of gold bars and closely monitored everything. The smelting process is also being monitored by independent experts. Does this also apply to opportunities to inspect the stocks?You said a year ago that discussions on the matter with the Federal Reserve Bank of New York were making good progress. Was an external auditor present during your visit to the New York Fed gold storage facility in June 2012? No, not during my visit. However, an external auditor was present for part of the time during the internal audit team's inspection of stocks. Did the gold from New York have to be melted down immediately? [...] German gold is also held at The Bank of England which stores 13% in London, while the Bank of France in Paris has 11% in total and the remainder is held at the Bundesbank's headquarters in Frankfurt. In November 2011, Venezuela repatriated some 180 tonnes of gold held in vaults in London and elsewhere to store it with the Caracas central bank under orders from late President Hugo Chavez. Click here for the rest of the interview which includes questions on whether Germany plans to use gold as a monetary policy tool and why the US is willing to store and guard all that gold free of charge. |

| Investors take chunks out of Newmont after big loss, reserves cut Posted: 21 Feb 2014 10:02 AM PST Shares in Newmont Mining (NYSE:NEM), world number two gold producer, were hammered on Friday after the company reported fourth quarter earnings well shy of expectations. In midday trade the Denver-based miner was trading down 5.7% at $23.06 in New York, off its lows for the day. Around 12.7 million shares in the $11.5 billion company had changed hands by 12:30 pm EST on Friday already surpassing the counter's daily average. Newmont shares are flat year to date, in contrast with peers like Barrick Gold (TSE:ABX) which is up 18% in 2014, Goldcorp (NYSE:GG), up 26% and Anglogold Ashanti (NYSE:AU) which has rocketed more than 50% so far this year. Newmont said adjusted net income of $0.33 a share – versus expectations of $0.44 – was negatively impacted by impairments of stockpiles and ore on leach pads. Revenues at the company dropped 12% year on year to $2.17 billion, despite increased Q4 gold production of 1.4 million attributable ounces. Full year output jumped to 5.1 million ounces, at the high end of its 2013 guidance. Newmont, first incorporated in 1921, announced it reduced its gold reserves by 11% to 88.4 million ounces due to lower gold prices and reported a 15% drop in copper reserves. A bright spot in the results was a 14% reduction in all-in sustaining costs for gold at $1,032 an ounce. During the quarter the company with mines in seven countries and 40,000 employees, commenced commercial production at its Akyem mine in Ghana and Phoenix Copper Leach project in Nevada. Newmont expects gold output of 4.8 million to 5.2 million ounces in 2015 and 2016 while at the same time cutting all-in costs thanks to a $600 million to $700 million efficiency drive. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "New online map shows deforestation as it happens"