New Gold reports lowest costs in its history, investors not impressed |

- New Gold reports lowest costs in its history, investors not impressed

- French government backs Niger in its battle with French uranium miner

- Dispute over Australia iron ore heats up

- Q3 winning streak over: 'Considerable underperformance' among Canadian miners in Q4

- Big win for Centerra: Kyrgyzstan’s Parliament approves Kumtor joint venture

- Tragic end for Harmony’s Doornkop miners: eight found dead

| New Gold reports lowest costs in its history, investors not impressed Posted: 06 Feb 2014 03:07 PM PST Mid-tier Canadian miner New Gold (TSE:NGD) has reported its lowest total cash costs ever and a 127% increase in gold reserves on a per share basis. Investors were not impressed. The gold miner's share price dropped more than 6% to trade at $6 per share on Thursday after the company released its full-year results for 2013 and its 2014 outlook. Throughout 2013 the company achieved its lowest-ever total cash costs: $377 per ounce. However, all-in sustaining costs – which include exploration expense, head office costs, and sustaining capital - were $899 per ounce, below its initial estimate of $875. The miner is targeting additional cash cost reductions in 2014 with a goal of below $340 per ounce. The all-in sustaining costs target is between $815 and $835 per ounce. New Gold's 2013 year-end gold reserves increased by 10.7 million ounces to total 18.5 million – an increase of 127% per share when compared with the end of 2012. Silver reserves rose by 173%. Production The fourth quarter was New Gold's highest producing period in 2013 with an output of 106,520 ounces of gold and 24 million pounds of copper. Full-year and fourth-quarter production were slightly below 2012 levels though within 2013 full-year outlook . Silver production was down significantly in 2013 with total output of 1.6 million silver ounces compared with 2.2 million the year prior. Copper production jumped from 43 million pounds in 2012 to 85 million last year. New Gold expects gold production between 380,000 and 420,000 ounces in 2014 – similar to what was achieved over the past year. The company has four operating mines in Canada, the US, Mexico and Australia and three projects in exploration and development stages. |

| French government backs Niger in its battle with French uranium miner Posted: 06 Feb 2014 01:13 PM PST France's Areva isn't getting much sympathy from its home government over its troubles with the Niger government. French development minister, Pascal Canfin, has declared that the Niger government's decision to end the company's tax exemptions is "legitimate," France's Le Monde reported (in French). Over the past two years Areva and the Niger government have been negotiating uranium extraction contracts for the next 10 years. Areva's mines have been closed since mid-December and although the company says its due to routine maintenance, some see the closures as "hardball tactics" by the miner, the Guardian reported last month. Speaking before the National Assembly, Canfin said that the agreement between Areva and Niger – expected by the end of February – will allow the African nation to impose higher taxes, and that this move is considered legitimate by the French government. Areva extracts 40% of its uranium from this former colony and France is highly dependent on these resources: The country relies on nuclear energy for 75% of its electricity generation. Meanwhile, Niger is expected to become the world's second largest uranium producer within a few years. Humanitarian group Oxfram has been lobbying the French government – a majority shareholder of the nuclear company – to not put any pressure on Niger to exempt Areva from taxes. The taxes in question stem from a 2006 mining law from which Areva believes it should be exempt. According to the Guardian, the African country wants to increase the company's royalty payments from 5.5% of revenues to 12%. Areva says these royalties would render its business unprofitable. |

| Dispute over Australia iron ore heats up Posted: 06 Feb 2014 11:45 AM PST Aussie mining tycoon turned politician Clive Palmer has fuelled tensions with China after issuing fresh harsh comments against state-owned conglomerate CITIC Pacific, which began operations at its $8bn Sino Iron venture in WA late last year. Palmer, whose privately owned firm Mineralogy is in the middle of a long-running royalties dispute with CITIC, told The Australian he would not stand by and watch local interests be "raped and disrespected by foreign-owned companies," without even offering them fair compensation. His declarations come on the heels of a court win for Mineralogy, which ruled Palmer's firm was the legal operator of Cape Preston port, a key part of the Sino project, Bloomberg reports. It is still unclear the potential implications of the legal decision for the already over-budget project, which loaded its first ship last December, four years behind schedule. All CITIC Pacific President Zhang Jijing had to say about this issue was that companies should choose their counterparties "very carefully." Sino Iron aims to become the world's largest magnetite mine, turning low-grade ore in Australia's Pilbara region into 24m tonnes of concentrate annually. In addition to the mine, the project comprises a desalination plant, the concentrator and the now lost Cape Preston port. The project long-term goal is to break the dominance of the three largest iron ore miners, BHP Billiton (ASX:BHP), Rio Tinto (LON:RIO) and Vale (NYSE:VALE), from whom China imports. However, it has faced endless challenges, becoming a cautionary tale of the difficulties Chinese enterprises face as they seek to expand abroad. And the trio continues to be the main suppliers of high-quality ore to China steel industry, which imports close to 60% of its iron ore needs. Image courtesy of Big Lift Shipping |

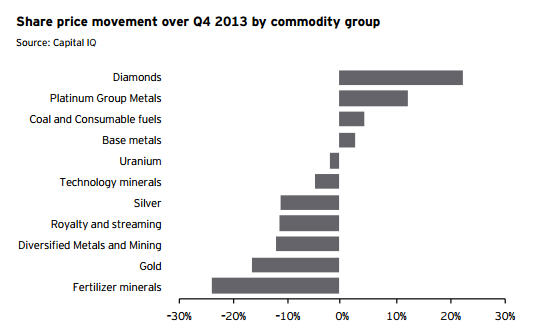

| Q3 winning streak over: 'Considerable underperformance' among Canadian miners in Q4 Posted: 06 Feb 2014 10:31 AM PST Canadian mining stocks experienced a 45% decrease in market capitalization in 2013, with the last quarter alone showing a 9% drop, according to Earnst & Young's Canadian Mining Eye Q4 2013 report. It's well known that concerns over global economic growth and uncertainty over what the US Federal Reserve would do next dragged down commodity prices, leading companies to write down assets and cut costs. But, despite some mild improvements in the third quarter, last quarter of 2013 unfolded much like the rest of the year: Poorly. The Canadian Mining Eye index – which tracks the performance of 100 TSX and TSXV mid-tier and junior companies with market capitalizations between $1.4b and $55m in Q3 – shed 9%. The preceding quarter the index rose by 5%. "This indicated a considerable underperformance relative to the S&P/TSX Composite index that gained 7% in the fourth quarter," according to the report. By commodity group, the only winners were among the diamond, platinum group metals, and coal and consumable fuels sectors. The gold and fertilizer minerals sectors were hit the hargest; gold dropped 27% over the year and the potash industry was crushed by the breakup of the Russian-Belarusian potash cartel in July. As for individual companies, Colossus Minerals is the index's biggest loser; the company experienced a net share price decline of 91% during the quarter. One-third of the comapnies tracked by the Canadian Mining Eye index realized a net gain in the fourth quarter, compared with more than half in the third quarter. Lucara diamonds came out on top, gaining 66% on its share price. Brigus gold gained 42% throughout the quarter after its flagship Black Fox mine acheieved record gold production. But miners can take solace in the fact that 2013 is over and, at least according to Earnst & Young, 2014 will provide growth opportunities for companies across the sector. "We note that a new year has brought some transactional activity for companies with good quality projects and lower valuations," researchers wrote. "Investors are likely to view the current underperformance as a buying opportunity as projects are de-risked. We expect companies to continue to adopt a disciplined approach to capital management and to seek creative financing options to withstand the downturn." |

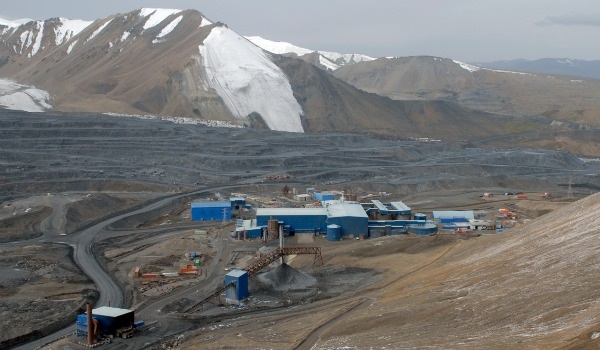

| Big win for Centerra: Kyrgyzstan’s Parliament approves Kumtor joint venture Posted: 06 Feb 2014 06:39 AM PST

With 60 votes in favour and 35 against, the deal lets Kyrgyzstan trade its current its 32.7% equity interest in Centerra for a 50% stake in a joint venture that would own and operate the mine. The agreement will also give the Asian country the right to increase its participation up to 67% after 2026, local news agency 24 reports. Later in the day Centerra said in a statement that, while the resolution seemed to support the concept of the restructuring described in last year's terms of agreement (HOA), it also contains "a number of recommendations that are materially inconsistent" with the terms of the document signed last December. Among other things, the resolution calls for further audits of the Kumtor operation and for the Government and the General Prosecutor's Office to continue pursuing claims for environmental and economic damages, which Centerra disputes. Business leaders fear the parliament's long-drawn-out dispute over rights with the Canadian firm has frightened off foreign investors. Despite the happy ending, business leaders fear the parliament's long-drawn-out dispute over rights with the Canadian firm has frightened off foreign investors. "What's happening with Kumtor signals to the world that we cannot secure property rights and have normal relations with Western countries," prominent businessman Emil Umetaliev told EurasiaNet.org in November. Kumtor employs more than 2,700 locals, many of whom are said to have lobbied before the Parliament to pass the resolution. Yesterday Centerra reported a dive in its proven and probable gold reserves, which decreased by 53,000 ounces to a total 10.2 million ounces, compared to 11.1 million ounces in 2012. The miner's measured and indicated resources at the end of 2013 were estimated to total 5.5 million gold ounces, a 378,000-ounce increase over year-end 2012. All 2013 year-end reserves were estimated using a gold price of $1,300 per ounce. |

| Tragic end for Harmony’s Doornkop miners: eight found dead Posted: 06 Feb 2014 04:43 AM PST South African rescuers have recovered eight bodies from Harmony Gold's (NYSE:HMY) Doornkop mine, near Johannesburg, who died after a fire and rock fall Wednesday. One other miner is still missing. In a statement the company regretted the fatalities and confirmed the blaze was caused by a seismic event that also triggered a subsequent fall of ground. The country's government said this accident is the most serious in South Africa's mines since nine workers died in a rock fall at a platinum mine in July 2009. "The situation is deeply regrettable," Mineral Resources Minister Susan Shabangu said in a statement. "We must ensure that we do all we can to get to the bottom of what caused this incident in order to prevent similar occurrences in future." The Doornkop mine produced 3,631kg of gold in 2013, or about 10% of Harmony's total output. Operations at the mine, which has a single shaft extending to a depth of just under 2,000 metres, have been halted. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "New Gold reports lowest costs in its history, investors not impressed"