Gold price rising? Thank the weather |

- Gold price rising? Thank the weather

- Codelco’s challenges escalate as workers reject contract offer

- Ontario hires Deloitte to push forward Ring of Fire development

- Gold price soars as ETF buyers return en masse

- Petra gets $26m for its South African 29.6-carat blue diamond

- Nautilus Minerals goes hard on PNG gov't over Solwara 1 dispute

| Gold price rising? Thank the weather Posted: 14 Feb 2014 12:11 PM PST The gold price jumped to a three-and-a-half-month high above $1,320 an ounce on Friday, capping one of its best weeks in years. Gold's rise this year – it is up 9.8% so far – has been ascribed to a number of factors. Some key technical levels have been breached, including the 200-day moving average on Friday which supposes further upward momentum. Safe haven buying on turmoil in emerging markets boosted gold in January and continued strong physical demand from Asia has also provided a solid floor to the price. But there are less obvious factors playing a role in gold's rise says independent researcher Capital Economics in a note out on Friday titled "Weather can impact commodity prices in odd ways": "Of course, the main driver has been a revival of safe-haven demand triggered by the turmoil in emerging markets. But the adverse weather is probably the biggest single factor behind the recent run of disappointingly weak US economic data, which in turn has encouraged speculation that the Fed will keep monetary policy loose for longer, driving down bond yields and weakening the dollar (all positives for gold)." Earlier this week Capital Economics reiterated its end-2014 forecast of $1,450 an ounce for gold, one of the more bullish predictions out there: "We continue to expect further gains over the course of this year, helped by continued strong demand from China and an eventual easing of the import ban in India. Gradual tightening in US monetary policy could trigger fresh falls in 2015 and beyond, although the downside should be limited by the (probably rising) floor set by mining costs and an extended period of still (relatively) loose monetary policy across the developed world." Image of Schell beer by Aaron Landry |

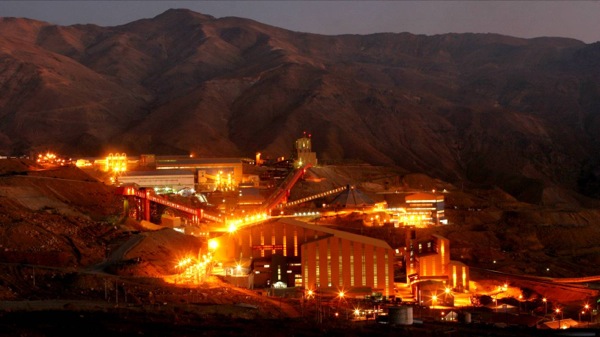

| Codelco’s challenges escalate as workers reject contract offer Posted: 14 Feb 2014 11:18 AM PST Workers at Chile's copper producer Codelco, the world's largest copper miner, have rejected the company's wage proposal presented during early collective contract negotiations, deferring union labour talks to October. About 4,300 miners (or 51.2%) of El Teniente division turned down the contract offer, which in addition to base salary, included a bonus and soft loans (those offered at very low or zero interest rates) worth around $30,700, Diario Financiero (in Spanish) reports. The union is asking for better long-term benefits and equal access for all workers to the company's benefits regardless of when they joined. Rough patch El Teniente was the company's most productive deposit between January and September last year, mining 327,000 tonnes of red metal in the period. But Codelco is currently facing tough times due to sinking copper prices, lack of cash and escalating costs. The copper giant gives all its profits to the state and had been severely disappointed by the original amount of money it was returned. As a result, the copper giant decided last year to seek outside financing to implement its $27 billion investment plan for 2012-2016, and placed a $750 million bond in August. Chile expects mining investment to reach $112 billion by 2021, figure that includes $27bn in projects planned by Codelco. By the same year, the country's total copper production is projected to reach an annual 8.1 million metric tons. As a back-up plan, the Chilean copper giant is exploring a more aggressive incursion in the silver market. Last November, CEO Thomas Keller said Codelco aims to become one of the world's ten largest producer of the precious metal as soon as its touted Ministro Hales mine begins production later this year. The nearly $3 billion copper-silver mine is expected to add 300 tons of the precious grey material to the existing silver output from the rest of Codelco's operations in the country. The firm owns about 11% of the world's copper reserves. The red metal accounts for 60% of the Chile's exports and 15% of its gross domestic product (GDP). |

| Ontario hires Deloitte to push forward Ring of Fire development Posted: 14 Feb 2014 11:08 AM PST Despite the fact that a major stakeholder has iced the project, the Ontario government is making a major push for development of the massive Ring of Fire mineral deposit. The provincial government announced on Friday that it had hired consulting firm Deloitte to help set a development corporation which would build infrastructure in the Ring of Fire region. "Deloitte LLP will act as a neutral, third-party resource for key partners, including First Nations, the provincial and federal governments and industry," the Ministry of Northern Development and Mines wrote in a news release. "Work is also underway to help partners build a common understanding of infrastructure needs in the region. A third-party research report will examine existing infrastructure proposals and establish a common technical basis to inform decisions to maximize the economic and social potential of the Ring of Fire region." Last year the Ontario government announced the creation of a development corporation for the Ring of Fire which brought together mining companies, government bodies and First Nations communities. Negotiations between these parties have stalled development for some time now: The provincial and federal governments can't agree on who should pick up the tab and they have yet to reach an agreement with the Matawa First Nations Council. "We remain committed to making a significant investment to support infrastructure needs in the region, but we need partners to come together so that decisions can be made," Michael Gravelle, minister of Northern development and mines said in a statement on Friday. A lack of infrastructure – particularly an all-weather road – has been a major sticking point. Last November Cliffs Natural Resources suspended its $3.3 billion Ring of Fire chromite mine due to an "uncertain timeline and risks associated with the development of necessary infrastructure," Cliffs Vice-President Bill Boor said at the time. Following the release of its 2014 budget, the Federal government was criticized for not including the Ring of Fire. "The Harper government was willing to invest in Alberta's oil sands and large energy projects in Newfoundland and Labrador, but won't partner with Ontario to develop the huge Ring of Fire mineral deposit or meet its infrastructure needs," Ontario Premier Kathleen Wynne said, as reported by the Canadian Press. The Ring of Fire deposit – located in northwestern Ontario – is considered so economically promising that it's been dubbed 'Ontario's oilsands.' Its worth in chromite, nickel and gold is estimated at $60 billion. Key companies with claims in the region include Cliffs, KWG Resources and Noront Resources, but there are dozens more. |

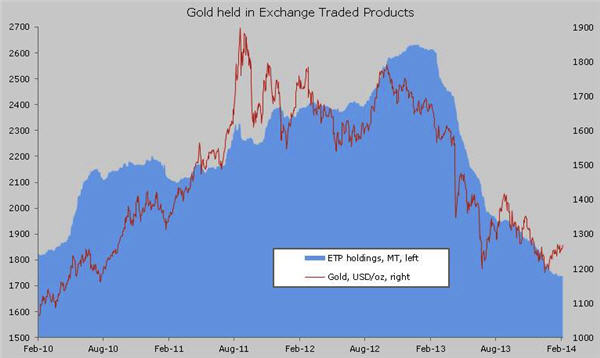

| Gold price soars as ETF buyers return en masse Posted: 14 Feb 2014 10:06 AM PST The gold price broke through key technical levels on Friday, jumping more to $20 an ounce to a three-and-a-half month high. In morning trade on the Comex division of the New York Mercantile Exchange, gold futures for April delivery – the most active contract – hit $1,321.50 an ounce, up $21.40 from yesterday's close and the highest level since end October last year. Friday's strong gains came after the metal breached $1,304 an ounce – the 200-day moving average of the gold price and a key technical indicator of positive momentum. Gold has not traded above this level in over a year. Safe haven buying on turmoil in emerging markets and economic weakness in the US, and continued strong physical demand from Asia have seen the price of gold rise 9.8% in 2014. A major negative trend in the market in 2013 – when gold retreated 28% and suffered the worst year in more than three decades – is now also showing signs of reversing. Last year the world's physical gold trusts or gold-backed ETFs experienced net redemptions of more than 800 tonnes collectively and suffered depreciation of close to $80 billion. But the gold holdings of SPDR Gold Shares (NYSEARCA: GLD) – the world's largest gold ETF by a wide margin – on Thursday shot up the most since October 2012. Investors bought a net 7.5 tonnes on Thursday bringing holdings back above 800 tonnes for the first time this year. The last time ETF investors were this bullish was on October 4, 2012 when GLD recorded 9 tonnes of inflows. At the time gold was trading just under $1,800 an ounce. The strong inflows are in stark contrast to the one-way bet gold became among ETF investors: GLD recorded only 17 days of inflows all of last year and almost 540 tonnes left the fund. If Friday's data shows more investors are buying into physical gold funds, it could provide further impetus to gold's run this year.  Source: Bloomberg | Saxo Bank |

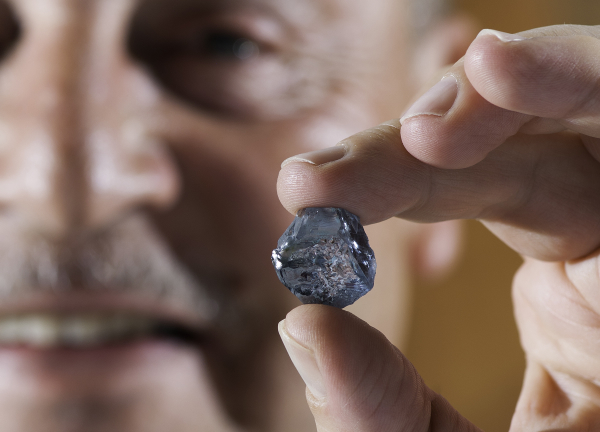

| Petra gets $26m for its South African 29.6-carat blue diamond Posted: 14 Feb 2014 07:25 AM PST Petra Diamonds (LON:PDL) has hit the jackpot twice this year, going from finding a spectacular 29.6-carat blue diamond at its Cullinan mine in South Africa last month, to selling it Friday for $26 million to US luxury jeweller Cora International NY. The precious rock, described as an "outstanding vivid blue diamond with extraordinary saturation, tone and clarity," is the biggest of its kind found at the mine, which Petra controls since 2008. "This sale result affirms this stone as one of the most important blue diamonds ever recovered," Petra Diamonds Chief Executive Johan Dippenaar said in a statement. Last year, another exceptional 25.5 carat blue diamond was found in the same mine, and sold for almost $17 million. Diamonds from both the Cullinan mine in South Africa and the Williamson facilities in Tanzania, owned by Petra, have been displayed at London's Buckingham Palace and are regarded as among the rarest and most valuable in the world. The 1905 Cullinan Diamond has been cut into two stones – the First Star of Africa and the Second Star of Africa – and form part of Britain's Crown Jewels held in the Tower of London. Image courtesy Petra Diamonds. |

| Nautilus Minerals goes hard on PNG gov't over Solwara 1 dispute Posted: 14 Feb 2014 06:18 AM PST

The company, the first yet not the only one with projects to mine the ocean floor, said in a brief statement local authorities had failed to pay their share of development costs for the mine, despite an October ruling. The Toronto-based firm also said PNG has not paid a $118 million compensation it was supposed to handle by October 23rd last year, so it will now seek undisclosed damages. Despite the hard-core decision, Nautilus said it continues to seek "an amicable resolution of the dispute" with PNG and it will hold an investor conference call and audio/webcast on Tuesday, Feb. 18 at 10.00 a.m. Eastern Standard Time. Solwara, located in the minerals-rich Manus basin, in the Bismarck Sea, was originally slated to begin production by the end of 2013. If completed, it would become the first project commercial deep-sea mining in the world. Image by Michael Bogner/Shutterstock.com |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Gold price rising? Thank the weather"