Back to miners graduating with 6-figure salaries 'in a few years' |

- Back to miners graduating with 6-figure salaries 'in a few years'

- Guinea president says Simandou rights transfer likely broke law

- Hedge fund veteran's belief in gold unshaken

- Coal port dredging, dumping threat to Great Barrier Reef

- America's biggest coal mines of 2013: They're not all in Wyoming

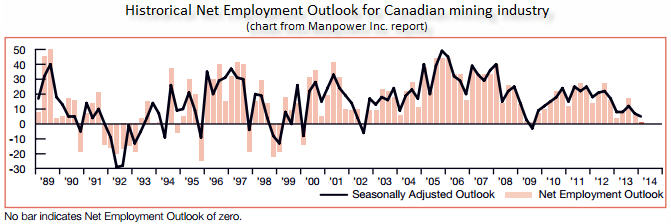

| Back to miners graduating with 6-figure salaries 'in a few years' Posted: 02 Feb 2014 03:39 PM PST The Canadian Mining Associations' latest Facts & Figures report reveals the industry employed more than 418,000 people in full-time-equivalent positions. Mining-related employment represent one in every 41 Canadian jobs and accounted for 20% of the value of the North American country's exports. In 2012 the average weekly pay for a mining worker in 2012 was $1,559 – surpassing the earnings of workers in forestry, manufacturing, finance and construction, but last year the outlook for the industry darkened considerably. Canadian mining companies are becoming increasingly unwilling to add employees to their payrolls and are reporting the weakest hiring intentions since the third quarter of 2009, according to a recent employment outlook survey by labour consultants Manpower. Of the Canadian mining companies surveyed, 14% said they plan on hiring over the first quarter of this year and 13% plan on downsizing. Adjusted for seasonal variation, this puts Canada's mining Net Employment Outlook at 5% – a 2% drop on the previous quarter, and a 3% drop on Q1 2013. Data from Statistics Canada also show jobs for miners are becoming scarcer. The government agency's latest unemployment-to-job-vacancies ratio for the mining and energy sector is 3.5, compared to a 1.1 ratio – meaning applicants were virtually assured of a position – around five years ago when the resources sector was booming. Macleans reports looking a bit further into the future the outlook for mining jobs in the country is still rosy. The magazine quotes Scott Dunbar, the interim head of the University of British Columbia's mining engineering department, as saying the soft job conditions in the sector is a short-term problem that will correct itself "in a few years, at most." A huge factor that will positively affect the market is the fact that at the moment the majority of jobs in the industry are still occupied by baby boomers, a demographic now entering retirement: "Ryan Montpellier, the executive director of the Mining Industry Human Resources Council—which foresaw the commodities slump—says the industry will still need at least 145,000 workers over the next 10 years, just to replace outgoing workers. "On top of that, roughly $140 billion worth of new projects is currently awaiting government approval, including developments in northern Ontario's Ring of Fire mineral belt. "If even a small fraction of those new mines comes on board, it will mean a significant increase in the number of people. "If you start overlaying employment growth on top of replacement, we're going to go right back to the very challenging years in 2007 and 2008, when there was a significant skill shortage and when you had mining engineers graduating with six-figure salaries." While the job climate for Canadian miners at the moment is even worse than in the US, in Australia the sector's net employment outlook stands at just 1%, even though that represents a moderate gain on the prior quarter. Homepage image of workers in control of Andina mine operations courtesy of Codelco |

| Guinea president says Simandou rights transfer likely broke law Posted: 02 Feb 2014 02:01 PM PST The Simandou mountains in Guinea holds some of the richest iron ore deposits in the world and has the potential to transform the fortunes of the impoverished West African nation. World number two miner Rio Tinto is developing the southern part of the vast mountain deposit with first production from the massive $20 billion project not expected until late 2018 at the earliest. The northern part of the Simandou concession is held by BSG Resources, a company in the stable of billionaire diamond magnate Beny Steinmetz, and Brazilian giant Vale (NYSE:VALE). All work on the section awarded to BSGR by a former Guinea dictator in 2008 and 50%-sold to Vale in 2010 has been halted as the government of Guinea under its first democratically elected president Alpha Condé revisits all mining contracts entered into under previous regimes. BSGR was awarded the rights days before the death of Guinea dictator Lansana Conté in 2008 after spending more than $160 million exploring the prospect. Conté had not long before stripped the Simandou blocks from Rio Tinto which had held the exploration rights since the late 1990, ostensibly over the Anglo-Australian company's failure to develop the deposits. The awarding of the rights are now the subject of Swiss and US anti-corruption investigations. BSGR denies the claims while Vale is not under investigation. The Wall Street Journal reports (sub) Condé said in a recent interview BSGR likely violated a clause in the country's mining code prohibiting the transfer of exploration rights with the Vale deal. Vale has not commented on the matter but a BSGR spokesperson denied any laws were broken, "because the Brazilian miner's stake wasn't in the subsidiary that holds the rights to the concession," and the transfer happened with the "full knowledge" of the government at the time, a military dictatorship. The Brazilian company acquired the interest for $2.5 billion, but stopped payments to BSGR after the first $500 million was forked over, when the probe was announced. The committee reviewing the 18 historical mining agreements held hearings in December and January and is expected to deliver a decision by the end of the month. Whatever the outcome, Vale may still be interested in developing Simandou, which has some of the highest grade ore on the planet. Last month Condé visited Brazil where he met with Vale's director of corporate affairs Rafael Benker. Condé was in the country on invitation of the Lula Institute, an NGO founded by former president Luiz Inacio Lula da Silva. Lula is said to have close ties to B&A Mineração, an infrastructure and mining investment company set up by Roger Agnelli, former boss of Vale and a large Brazilian bank. Late last year BHP Billiton (ASX, NYSE:BHP) sold its 40% stake in its massive Nimba project in the same district as Simandou to B&A. |

| Hedge fund veteran's belief in gold unshaken Posted: 02 Feb 2014 12:48 PM PST Large fund managers like Paul Johnson and Eric Sprott long on gold suffered huge losses in 2013 as the price of the metal slumped 28%. Paul Singer, boss of 37-year old investment firm Elliott Management, also took a bath on the fund's gold holdings last year, but it has not shaken legendary investors faith in the metal. USA Today report Singer in a letter to investors debunked the idea of Bitcoin as an alternative currency or storer of wealth adding that gold will be back in favour soon: "We think that gold is a unique investment asset, the only real money that has stood the test of time throughout recorded history," Singer wrote. "With its durability, finite and difficult-to-extract supply and natural allure, it is a store of value that should be particularly attractive at a time when monetary debasement is the major policy practiced by most developed countries to keep their economies afloat." "If the global economy recovers strongly without a significant uptick in inflation, then gold might continue to be a neglected asset class. But low growth and high inflation are typical hallmarks of structurally unsound economies experiencing monetary debasement, so perhaps that phase is next, or soon to appear," Singer said. "We shall see." Singer's flagship Elliott Associates fund gained 12.4% after management fees last year and boasts one of the best records in the investment industry with annualized returns of 14% since inception in 1977. |

| Coal port dredging, dumping threat to Great Barrier Reef Posted: 02 Feb 2014 12:01 PM PST Another fight over industrial and mining development in areas near Australia's Great Barrier Reef, a 345,400 square kilometer marine park along the country's eastern coast, has broken out after approvals were given that would enable the expansion of a major coal port. The Abbot Point coal port in northern Queensland will service among others the Alpha Coal project in the Galilee basin owned by Australia's riches woman Gina Rinehart and India's GVK group. On Friday, the Great Barrier Reef Marine Park Authority approved a permit for the state-owned coal terminal operator to dump as much as 3 million cubic meters of dredged sediment inside the park. The Huffington Post reports that despite strict conditions and close monitoring should reduce the impact, environment groups are not satisfied: "But outraged conservationists say the already fragile reef will be gravely threatened by the dredging, which will occur over a 184-hectare (455-acre) area. Apart from the risk that the sediment will smother coral and seagrass, the increased shipping traffic will boost the risk of accidents, such as oil spills and collisions with delicate coral beds, environment groups argue." Th Alpha coal mine, which will be built to ship 60 million tonnes of thermal coal through Abbot Point per year has also come under fire for its economics. A recent study estimated that he Alpha mine would probably need a thermal coal price of at least $90 a tonne to proceed and "possibly more than $150 to generate returns." Thermal coal used in power generation is currently trading at less than $80 a tonne as number one consumer China tries to tackle problems of pollution and change its energy mix. |

| America's biggest coal mines of 2013: They're not all in Wyoming Posted: 02 Feb 2014 07:05 AM PST Wyoming won't lose its spot as the US' coal capital any time soon: The sparsely populated state continues to host almost every major coal mine in the country, making it the largest American coal producer by far. Other states don't even come close: The biggest coal mine outside of Wyoming last year, Freedom, barely produced one-tenth of what Wyoming's biggest mine put out, and its production couldn't even top Wyoming's seventh-biggest coal mine. But unlike in 2012 when Wyoming was home to nine of the US' ten biggest coal mines, the Cowboy State had a bit more competition last year. North Dakota's Freedom mine has taken the spot of the US' tenth biggest coal producer, as Wyoming's Caballo slid off the top-ten chart. All production figures are in metric tonnes. Here are the top-ten biggest US coal mines in 2013 in terms of production. The information is based on data provided by InfoMine. The biggest mines aren't always the ones with the most workers. Here are the same mines based on staff numbers rather than production volumes. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "Back to miners graduating with 6-figure salaries 'in a few years'"