GoldMoney enters Bitcoin business |

- GoldMoney enters Bitcoin business

- US energy-related CO2 emissions increased by 2% in 2013, report shows

- Is space mining commercially viable?

- Dr Terry I. Mudder Inducted into International Mining Technology Hall of Fame

- West Virginia begins lifting water ban, lawsuits pile up

- Drummond declares force majeure in Colombia as Glencore denies it access to coal port

| GoldMoney enters Bitcoin business Posted: 13 Jan 2014 05:01 PM PST In a surprising turn of events, Bitcoin is getting support from an important member of the gold crowd. GoldMoney, one of the UK's biggest precious metals storage firms, has announced that it will introduce Bitcoin storage as part of its services. According to CoinDesk, GoldMoney has entered the Bitcoin business through its subsidiary Netagio – "a spin-off business that offers a cold storage solution for bitcions." 'Cold storage' might sound cool and confusing but it basically means the offline storage of coins, which is considered to be safer than keeping them online. The service is free. "For the safety of your Bitcoins, we can't tell you exactly where your Bitcoins are stored," Netagio explains on its website. "But what we can tell you is that all of your Bitcoins are stored in secure locations around the EU and Switzerland (together with all of our encrypted backups)." Netagio keeps a small portion of each account's coins online so that clients can trade. The company will also allow customers to buy and sell Bitcoin, along with other online currencies. "It's one of the safest ways of storing Bitcoin. We encrypt it several times before storing it on devices and store copies in several different locations in the UK," Netagio managing director Simon Hamblin told The Independent. In an interview with the Keiser Report on Monday, GoldMoney founder James Turk admitted that he was "a little bit sceptical" of the cryptocurrency in the beginning. "But I'm actually a believer in it now and I do own some bitcoin," he told Max Keiser. "It accomplishes what we tried to do to a certain extent with gold. The difference of course is that gold is something the governments want to control and regulate whereas Bitcoin is beyond government regulation." Keiser and Turk agreed that because economist Paul Krugman doesn't like Bitcoin, then it's "probably a good thing." |

| US energy-related CO2 emissions increased by 2% in 2013, report shows Posted: 13 Jan 2014 03:10 PM PST US energy-related CO2 emissions are expected to be 2% higher in 2013 than in 2012, according to a new report by the US Energy Information Administration (EIA). This is the first time since 2010 that emissions increased compared with the preceding year. The EIA contributes the rise to a small increase in coal consumption in the electric power sector. "The impact on overall emissions trends remains fairly small," the EIA wrote. Compared with 2005 levels, 2013 emissions have decreased by about 10% – "a significant contribution towards the goal of a 17% reduction in emissions from the 2005 level by 2020 that was adopted by the current Administration," the EIA writes. The Agency also shows that CO2 emissions from coal and petroleum products have been declining since 2005, while natural gas' contribution to emissions has risen by nearly 20%. Global share Energy-generation – which includes the burning of coal, natural gas and oil for electricity and heat – is the largest single source of global greenhouse gas emissions, according to the US Environmental Protection Agency (EPA). The US was responsible for about 19% of the world's CO2 emissions from fossil fuel combustion and some industrial processes in 2008, EPA data shows. China accounted for about one-quarter of this figure, while European Union countries represented 13%. |

| Is space mining commercially viable? Posted: 13 Jan 2014 01:21 PM PST There's been a lot of talk lately about space mining and the idea has earned some pretty reputable backers. NASA announced last year that it would launch sample-collecting mission in 2016. On the business side, Planetary Resources – a company backed by Google and in partnership with Virgin Galactic – is devoted solely to harvesting valuable minerals from space rocks. But one major argument against the sector is the astronomical costs associated with mining asteroids. A recent set of studies from Harvard-Smithsonian Center for Astrophysics highlights just how problematic this might be. "Ore is not simply a high concentration of some resource, but includes consideration of the cost of extraction of the resource and its price," the astrophysicist writes. "Hence we need to sieve the total asteroid population for the smaller populations that may be profitable to mine." Dr. Martin Elvis used a simple formula for assessing how many near-Earth asteroids are ore-bearing. He found that for platinum group metals, the answer is currently only 10. For water the number is much larger – about 9,000, though they're generally quite small. Elvis points out that if asteroid mining is to become a commercial reality, we need a good understanding of how many asteroids contain ore. The astrophysicist concludes that there are likely "relatively few ore-bearing NEOs" though he stresses that "this is a conservative and highly uncertain value." In fact, one of the main take-aways from Evlis' study is that a more reliable examination of ore-bearing asteroids is needed. "Significant research is needed in all areas: on meteorite composition, on telescopic discovery and characterization, and on both of these together for the small asteroids about to impact the Earth, on local assay probes, and on in-space engineering challenges, both at the ISS and with a returned small asteroid," Elvis writes. "The knowledge of which NEOs are ore-bearing could itself become commercially valuable intellectual property." In a subsequent study, Elvis examined how many assay probes would be required to find one ore-bearing asteroid. He found that if one in ten asteroids are ore-bearing, two dozen must be probed to find one at 90% confidence. The BBC, which originally reported on Elivs' study, spoke to a professor from Queen's University in Belfast who was not involved with the study. The professor claims that Elvis' calculations were "'plausible,' but that he would have placed even more emphasis on the uncertainties." "The make-up of small Near-Earth asteroids is still relatively unknown," he told BBC News. "There are large uncertainties in the total number of platinum group-rich asteroids that come near the Earth. This is because it is still difficult to unambiguously determine the mineral makeup of small asteroids." |

| Dr Terry I. Mudder Inducted into International Mining Technology Hall of Fame Posted: 13 Jan 2014 11:58 AM PST Mining disposal and cyanide expert, and EduMine author and presenter Dr Terry I. Mudder will be inducted into the Environmental Management category of the International Mining Technology Hall of Fame on February 22, 2014. Terry Mudder "has emerged as the leading environmental scientist and engineer in the mining industry internationally related to cyanide issues and has been instrumental in expanding the fundamental information and database of the environmental effects of cyanide and its many related compounds." He has more than 30 years experience in the investigation of mining and cyanide waste management and aquatic toxicity. Read more about this induction on the Hall of Fame site here, and take a look at the courses you can take from this fantastic author and presenter on EduMine. |

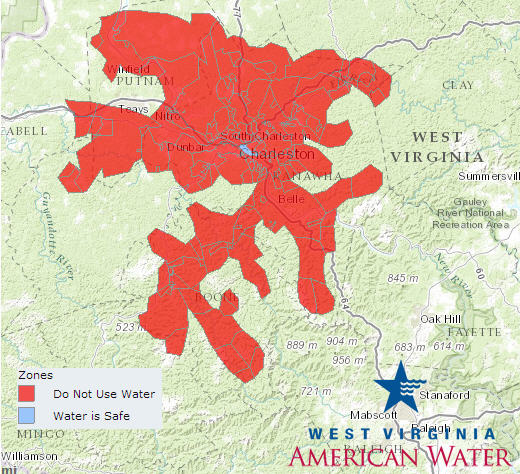

| West Virginia begins lifting water ban, lawsuits pile up Posted: 13 Jan 2014 11:48 AM PST West Virginia has begun lifting the ban on using water in certain areas of the state after a chemical spill last week contaminated the water supplies of about 300,000 people. West Virginia American Water – a subsidiary of American Water (NYSE: AWK) and the state's largest water utility - issued a statement on Monday announcing that the process of lifting the 'do not use' order on water had begun. "The ban is being lifted in a strict, methodical manner to help ensure the water system is not overwhelmed by excessive demand," the company wrote. The company published a map showing which areas were in the clear.  As of Monday afternoon only a small section is blue | Map from West Virginia American Water, click here for updated versions West Virginia governor Earl Tomblin declared a state of emergency after discovering the spill late last week. As the chemicals leaked into the Elk River, the government and water utility told those in affected areas to stop using tap water for drinking, cooking, cleaning, washing or bathing. A chemical manufacturing plant owned by Freedom Industries is responsible for the spill. The agent that caused the spill – 4-methylcyclohexanemethanol, or Crude MCHM - is used in coal processing. "Since the discovery of the leak, safety for residents in Kanawha and surrounding counties has been Freedom Industries' first priority," the company wrote in a news release on Friday. "We have been working with local and federal regulatory, safety and environmental entities, including the DEP, Coast Guard, Army Corp of Engineers and Homeland Security, and are following all necessary steps to fix the issue." According to the Wall Street Journal, the storage facility in which the chemicals were held was sitting upstream from the area's largest water-treatment palnt and "was subject to almost no state and local monitoring." The Journal also reported that "before last week's spill, a state regulator said environmental inspectors hadn't visited the site since 1991." United States Attorney Booth Goodwin has launched an investigation. In a statement published Monday, Goodwin said his office would "continue working as quickly as possible to find out exactly what happened … including the complete timeline of the release and what was done—or not done—before and after it." "If our investigation reveals that federal criminal laws were violated, we will move rapidly to hold the wrongdoers accountable … companies whose facilities could affect the public water supply should be on notice: if you break federal environmental laws, you will be prosecuted," the attorney added. "Our drinking water is not something you can take chances with, and this mess can never be allowed to happen again." But Goodwin isn't the only lawyer probing the spill. At least a dozen lawsuits have already been filed against Freedom Industries and West Virginia American Water, according to Sunday Gazette-Mail. |

| Drummond declares force majeure in Colombia as Glencore denies it access to coal port Posted: 13 Jan 2014 10:01 AM PST US-based Drummond has declared force majeure on coal shipments from Colombia after failing to finish building a $350 million direct loading facility at its Cienaga port, on the Caribbean Sea, in time to meet new environmental standards. Instead of using the old-fashioned two-step system, which implies loading barges at the docks to take them to the ships, coal miners are now expected to load their output directly. But Drummond said the two-month labour strike that affected its operations last year, also delayed construction of its new port. Colombia's second-biggest mining company now expects to have ready a conveyor system that loads ships directly by March. Last week, Colombian authorities said Drummond could, in the meantime, export some of its coal through Puerto Nuevo port, operated by Glencore Xstrata's (LON:GLEN) subsidiary Prodeco. However an industry source told Reuters that Puerto Nuevo was operating at full capacity and had no room to carry coal from its rival miner. "Whilst Drummond clearly overestimated its position as a big contributor for the Colombian arks, the decision to put a stop to the operations is an economical hara-kiri and demands a careful analysis," says OPHIR Mining, Resources & Investment in its Monday report.

Over 4,000 jobs could face temporary suspension, and the government has warned Drummond that will not allow lay-offs as the company has had seven years to complete the upgrading. Some of the world's top mining companies have operations in Colombia, including Anglo American (LON: AAL) and BHP Billiton (ASX: BHP), which jointly own Cerrejon, the country's largest coal producer. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "GoldMoney enters Bitcoin business"