Canada to liquidate first gold coins |

- Canada to liquidate first gold coins

- The gold rush is over: 2013 the worst in 32 years

- Copper ends 2013 near 4-month peak

- Dramatic video: Train with oil bursts into flames in North Dakota

- 'Midas touch' bacteria, gold roller coaster and risky countries among top stories of 2013

- Turns out the world's 'oldest diamonds' are just polishing compound

| Canada to liquidate first gold coins Posted: 31 Dec 2013 10:27 AM PST After more than 75 years of sitting in bags inside the Bank of Canada vault, the country's first gold coins went on sale this year as part of a government's scheme to save taxpayers some money and help balance the books. First announced in November 2012, the sale includes a plan to melt more than 200,000 gold produced by the Mint between 1912 to 1914, when Ottawa suspended the gold standard. The $10 coins sold for either $1,000 or $1,750 each, reports The Globe and Mail, depending on whether they were "premium" quality or not. The objective od the sale, which ended recently, was to improve the liquidity of the government's assets, provide a piece of Canadian history to coin collectors and to "extract value from coin sales for the government and taxpayers," according to last year's statement. When it opened its doors for business in January 1908 as the Canadian branch of Britain's Royal Mint, the Mint's Ottawa facility was mandated to produce Canada's circulation coinage as well as convert Canada's growing gold resources into dollar-denominated gold circulation coins. From 1912 to 1914, the Mint therefore produced $5 and $10 coins of 90% pure Canadian gold and proudly displaying national symbols. While official numbers won't be known until the spring, an insider confirmed The Globe they came very close to selling all the coins. |

| The gold rush is over: 2013 the worst in 32 years Posted: 31 Dec 2013 09:00 AM PST Gold held steady in thin year-end trade on Tuesday, inevitably heading for its first annual price decline since 2000 and the biggest in 32 years, signalling what some say is the end of the gold rush that saw the price surge six-fold and an unprecedented mining super-cycle. Bullion futures, which rebounded after reaching a six-month low today, traded 0.6% higher at $1,211.30 an ounce at 10:30 am ET on the Comex in New York, after hitting a scary $1,181.40, the lowest since June 28. Spot gold was up a mere 0.1% at $1,197.66 an ounce at 8:05 am ET.  A tough morning for gold today. Courtesy of Kitco.com The precious metal fell out of favour with institutional and retail investors since they braced for the US Federal Reserve to cut its monthly $85 billion bond-buying scheme, moving funds to equities and other riskier assets. Investors discarded as much gold from exchange-traded products in 2013 as had been purchased in the previous three years. According to data compiled by Bloomberg, they sold 789.3 metric tons since the start of January, pushing holdings to the lowest level since March 2010 and wiping $67.5 billion from the value of the funds. As a consequence of this year weak prices, analysts say gold miners will likely announce a series of fresh write-downs in 2014. |

| Copper ends 2013 near 4-month peak Posted: 31 Dec 2013 07:32 AM PST

The red metal settled at a three-month price of $7,373 a tonne by 1023 GMT, up from $7,355 per tonne as the market opened in London, closing at $7,415.50, its highest since Aug. 16. The metal is often referred to as "Dr. Copper" for its reputed ability to reflect the world's economic health due to its broad industrial uses. Prices for March delivery fell 0.1% to $3.3805 a pound on the Comex in New York, but they have added 5.5% this month, the most since September 2012. Overall this year copper slipped 7.4%, but the losses were more modest than many expected, since tons of copper concentrate are expected to flow into the market next year. According to estimates from the International Copper Study Group, mine output will increase 6.4% by year-end, which may send prices diving in 2014. The top 10 copper mine expansions – half of which are greenfield projects led by the massive new Mina Ministro Hales in Chile and Rio Tinto's Oyu Tolgoi – will alone contribute more than one million tonnes of new supply in 2014. This strong supply issue was reinforced on Monday when world's No. 1 copper producer Chile said its output increased 7.6% in November. Adding to the abundant available metal has been the relatively few supply disruptions in 2013. Total global refined production is set to increase to around 22 million in 2014 from less than 21 million tonnes this year. |

| Dramatic video: Train with oil bursts into flames in North Dakota Posted: 31 Dec 2013 05:58 AM PST A train carrying crude oil through a small town in North Dakota, US, derailed Monday night, shaking locals with a series of explosions that sent flames and black smoke skyward. Many residents were evacuated as officials warned that acrid and hazardous fumes could blow into the area. The incident, likely to prompt discussion about the safety of transporting oil by cross-country rail, comes only five months after a similar accident happened in Québec, Canada. That train was carrying crude from North Dakota's Bakken oil patch and its derailment and consequent explosion caused the death of 47 people. |

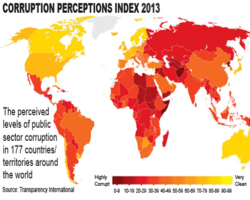

| 'Midas touch' bacteria, gold roller coaster and risky countries among top stories of 2013 Posted: 31 Dec 2013 05:24 AM PST

1.- Bacteria with superpowersCanadian scientist at McMaster University, in Ontario, identified bacteria able to turn toxic water-soluble gold into microscopic nuggets of the solid precious metal. The piece was our number one by far, with almost 36,000 visits, around 1,400 Facebook recommendations and over 50 Tweets. 2.- American CEO's "love letter" to French ministerWhile not 100% mining-related, this story attracted quite a few visitors. After all, not everyday you get to read a letter by a major tires dealer asking the French minister of industrial renewal, "how stupid" he thought American were. Too bad we never saw the reply. Over 26,000 people read this story, 300 shared it in Facebook and over a dozen in Tweeter. 3.- World's top 10 gold depositsOne of our knowledgeable contributors took the third spot with this story, pulling in close to 26,000 visits, over 110 likes in Facebook and dozens of tweets. 4.- How and why the gold crash was inevitableWith a headline like that, no wonder this concise explanation of one of this year's most followed commodities behaviour was read by more than 25,200 people.

|

| Turns out the world's 'oldest diamonds' are just polishing compound Posted: 31 Dec 2013 12:40 AM PST For years they were known as the oldest geological materials ever found: 4.3 billion-year-old diamonds. But thanks to a new study, we now know these diamonds are just polishing grit. In 2007, Nature published a report in which researchers claimed to have "unearthed diamonds more than 4 billion years old and trapped inside crystals of zircon in the Jack Hills region in Western Australia," LiveScience wrote. A team of three researchers has now discovered that the 'diamonds' are actually just a 'contamination' – "broken fragments of a diamond-polishing compound that got embedded when the zircon specimen was prepared for analysis by the authors of the Nature papers," URC Today (from the University of California, Riverside where two of the researchers are from) writes. Authors of the original study provided URC researchers with the original diamond-bearing specimens. "We confirm the presence of diamonds in their zircons but the diamonds we find are fragments of polishing compound," the study abstract reads. "There can be no doubt of the images we show," Harry Green, a UCR research geophysicist and study co-author told LiveScience. "Polishing the specimens with grinding compound that was made of diamonds was a terrible mistake." Oops! |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

1 Comment for "Canada to liquidate first gold coins"

Gold is the same with foreign exchange. Valuable and can be used to build assets in the future. This is the most active market and money circulating is over than 1 billion everyday. What a huge market, right? So, there is no reason this market will die because as long as there are buyers then also there are sellers.