China's great appetite for Port Hedland iron ore |

- China's great appetite for Port Hedland iron ore

- Bitcoin 'miner' sells $8 million in hardware in 24 hours

- China's CNOOC has big LNG plans for British Columbia

- Gold stocks take another severe beating

- Vale very much still in the running for Simandou

- China to search for rare earths in the Moon

| China's great appetite for Port Hedland iron ore Posted: 03 Dec 2013 01:08 AM PST Iron ore exports from Australia's Port Hedland to China jumped nearly 40% year over year this November, with shipments reaching 22.3 million tonnes from 16.2 million tonnes a year earlier. November 2013 iron ore shipments from Port Hedland to China were down 11.5% from October 2013. November 2013 shipments to Japan rose 38% to 2.2 million tonnes and doubled to Korea, reaching 2.9 million tonnes. Rio Tinto, whose shipments are not included in the data, is "expanding its export capacity by a third to 290 million tonnes from Indian Ocean ports south of Port Hedland on Australia's west coast," Reuters reports. |

| Bitcoin 'miner' sells $8 million in hardware in 24 hours Posted: 02 Dec 2013 05:56 PM PST A Swedish firm, KnCMiner, sold $8 million worth of their bitcoin mining hardware at $10k per unit in just one day. The hardware won't be available until Q2 next year. "KNC says it sold $1 million every hour for the first five hours the new unit, called the Neptune, went on sale," Business Insider reports. "We went right to the cutting edge, because we had to, as someone was going to, so it better be us," said KnC spokesman Alex Lawn. "A formula one race if you will. The competitors were late to the start line so they had to make wild claims, but I think they've taken it a bit too far…we may well beat Apple as they plan to use it at 'some point' next year." Bitcoin mining requires massive amounts of computing power in order to solve complex math problems. "The faster and more efficiently you can solve math problems, the more bitcoins you get." |

| China's CNOOC has big LNG plans for British Columbia Posted: 02 Dec 2013 05:05 PM PST Chinese state-run CNOOC Ltd. is making plans for a huge new LNG project at Grassy Point on British Columbia's (BC) northern coast. Nexen Inc., The Canadian subsidiary of CNOOC will apply to Canada's National Energy Board in order to export large quantities of LNG from BC to Asia Pacific: "24 million tonnes of super-cooled gas per year, or just over three billion cubic feet a day," the Vancouver Sun reports. If permission for the development is granted, exporting would start between 2021-2023. "CNOOC-owned Nexen secured exclusive rights with Japan's Inpex Corp. and JGC Corp. to examine building an export plant on the isolated peninsula after paying the B.C. government a non-refundable $12-million deposit, edging out rival bids for the Crown land." "Its export filing comes as state-owned China Petrochemical Corp., or Sinopec, eyes a possible stake in another Canadian LNG project led by U.S. oil major Chevron Corp." |

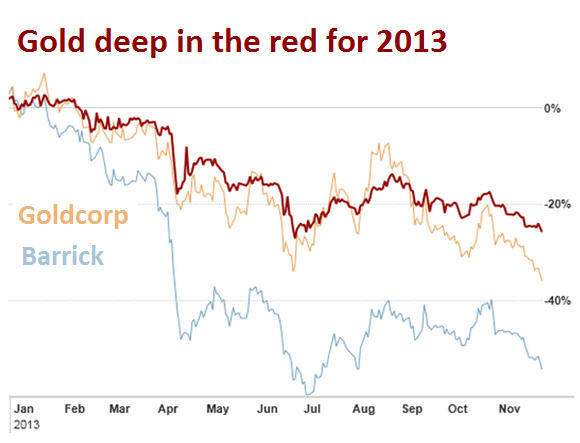

| Gold stocks take another severe beating Posted: 02 Dec 2013 03:40 PM PST The gold price slid more than $30 or 2.5% an ounce on Monday to a day low of $1,217 an ounce, levels last seen in early July. Gold's negative momentum saw gold stocks selling off heavily on the day with the Market Vectors Gold Miners ETF (NYSEARCA:GDX), holding stock in the world's top gold miners, hitting a fresh five-year low. While the yellow metal is down some 27% in value this year, the shares of major gold miners have been hammered down much more severely. By the close on Monday, Barrick Gold Corp (NYSE:ABX, TSE:ABX) had lost a shade over 6% or more than $1 billion in market value with nearly 20 million shares changing hands, making the world's number one producer of the metal one of the worst performers on the day. The Toronto-based miner is struggling with a heavy debt load and recently raised $3 billion in a stock offering that was not well received by institutions. Barrick has also suspended work at its costly Pascua Lama project on the border between Chile and Argentina to shore up its balance sheet and cut costs. Incoming chairman of Barrick John Thornton who is succeeding founder Peter Munk, 86, is widely expected to announce a shake-up at the company and a possible deal with Chinese investors following a board meeting that concludes this Wednesday. Barrick which will produce more than 7 million ounces of gold in 2013 is now worth $19.3 billion on the TSX, down 52% so far this year and nowhere near its $54 billion market value a mere two years ago. Newmont Mining Corp (NYSE:NEM) with a market value of $12 billion did not escape the carnage down 4% in regular trading. The Denver-based company will begin trading ex-dividend on Tuesday; a dividend that was cut 20% from the previous quarter at $0.02 a share. The world's third largest gold producer behind Newmont, AngloGold Ashanti (NYSE:AU) added to its nearly 60% year to date losses with the Johannesburg-based company's ADRs listed in New York sliding 6.7%. Fellow South African miner Gold Fields (NYSE:GFI) gave up a relatively modest 3.% in New York, but the world's fourth largest gold producer has had its value slashed 69% in 2013 with investors punishing it for its contrarian purchase of high-cost mines amid the slump. Goldcorp (TSX:G) declined 3.9%. The Vancouver-based company became the world's most valuable gold stock this year with a relatively small loss in market capitalization compared to its peers. But the dismal gold market has now caught up with the with Goldcorp expected to produce around 2.5 million ounces of gold this year with the miner's value on the Toronto big board slashed by nearly $8 billion since mid-August to $17.4 billion. Toronto's Kinross Gold (TSX:K) lost 3.3% on the day. Investors who bought into the company three years ago are now nursing a $15 billion loss in market cap after Kinross, like all the majors, took multi-billion charges against the value of its operations. Yamana Gold (TSX:YRI), which joined the million gold ounce club only last year, slid 4.4%. The Toronto-based company is worth $7.2 billion edging out Kinross which is set to produce some 1.3 million ounces more than Yamana this year. Canada's second tier gold miners also suffered a loss of confidence from gold investors, giving up much of the gains of recent weeks. Agnico Eagle Mines (TSX:AEM) losses were steep at 6.7% while Eldorado Gold Corp (TSX:ELD) declined 5.8% and Iamgold (TSE:IMG) dropped 6%. |

| Vale very much still in the running for Simandou Posted: 02 Dec 2013 12:50 PM PST The Simandou mountains in Guinea groan under some of the richest iron ore anywhere on the planet and winning the licence to mine the steelmaking raw material brings with it billions of dollars for decades to come. Rio Tinto is developing the southern part of the vast mountain deposit with first production from the massive $20 billion project not expected until late 2018. The northern part of the Simandou concession is held by BSG Resources, a company in the stable of billionaire diamond magnate Beny Steinmetz, and Brazilian giant Vale (NYSE:VALE). All work on the BSGR-Vale section has been halted as the government of Guinea under democratically elected president Alpha Condé revisits all mining contracts entered into under previous military regimes and dictatorships. BSGR was awarded the rights days before the death of Guinea dictator Lansana Conté in 2008 after spending more than $160 million exploring the prospect. Conté had not long before stripped the Simandou blocks from Rio Tinto which had held the exploration rights since the late 1990, ostensibly over its failure to develop the deposits. In 2010 BSGR sold a controlling half of its concession to Vale for $2.5 billion. But after forking over the first half a billion dollars the Rio de Janeiro company halted payments, following the opening of a grand jury investigation in the US into BSGR. The Guinean committee reviewing the agreements and the corruption probe into BSGR is set to hold hearings and make a decision on December 10 when it is widely thought that BSGR would be stripped of its rights. An article by Ana Mano from The Policy and Regulatory Report in Forbes on Monday argues that "while the death knell may be tolling for BSGR, Vale appears to be still in the race" to develop Simandou: One way for Vale to remain active in the project and circumvent any legal challenge by Steinmetz could be to buy out BSGR's stake in the joint venture – VBG—Vale BSGR Limited – according to a Brazil-based industry source, who added that the parties are currently "discussing price." The forthcoming decision on BSGR comes on the heels of a visit by Condé to Brazil last week. Despite having the appearance of a state visit, Condé did not officially meet Brazilian President Dilma Rousseff, according to her official presidential schedule. Yet Condé met with Vale's director of corporate affairs Rafael Benker for 30 minutes on November 18, according to the person familiar with the matter. Vale is not the only Brazilian company interested in Guinea's billions of dollars worth of iron ore and related infrastructure projects including a 750 kilometre rail line which could end up attracting more investment than the mine complex itself. According to the The Policy and Regulatory Report, Condé was invited to Brazil by the Lula Institute, an NGO founded by former president Luiz Inacio Lula da Silva "to foster cooperation with Africa and Latin America". Lula is said to have close ties to B&A Mineração, an infrastructure and mining investment company set up by Roger Agnelli, former boss of Vale and a large Brazilian bank. Late last year BHP Billiton (ASX, NYSE:BHP) sold its 40% stake in its massive Nimba project in the same district as Simandou to B&A. Image source: Roussef Flickr Stream |

| China to search for rare earths in the Moon Posted: 02 Dec 2013 12:01 PM PST  China's first lunar rover mission launches from a site in Xichang carrying a robotic rover called Jade Rabbit. (Screengrab from AlJazeera TV) China has launched its first lunar rover to explore the surface of the moon, hoping —among other objectives— to discover significant deposits of rare earth minerals said to lay under the celestial body's crust. With the "Jade Rabbit" take-off, the Asian country could become the third nation to achieve a soft landing on the moon, after the United States and Russia. The last soft landing on the moon was the unmanned Soviet Luna 24 rover, which collected soil samples in 1976. "We will strive for our space dream as part of the Chinese dream of national rejuvenation," said Zhang Zhenshong, director of the Xichang Satellite Launch Center, according to the Xinhua state news agency. The rover's name – chosen in an online poll of 3.4 million voters – comes from an ancient Chinese myth about a rabbit living on the moon as the pet of the lunar goddess Chang'e. Interviewed by BBC News Professor Ouyang, from the Chinese Academy of Sciences, said China is after the potential environment and natural resources the Moon holds, as the spacecraft is equipped with a round-penetrating radar to measure the lunar soil and crust. "The Moon is full of resources – mainly rare earth elements, titanium, and uranium, which the Earth is really short of, and these resources can be used without limitation," he was quoted as saying. If this mission is successful, China will send another mission to gather lunar samples by 2020. Image from AlJazeera TV via You Tube |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "China's great appetite for Port Hedland iron ore"