BEAR GRIP: 9 ways 2013 changed gold for good |

- BEAR GRIP: 9 ways 2013 changed gold for good

- Americans take advantage of low gold price to adorn themselves in jewellery

- The US Fed is having a very unhappy 100th birthday

- Freeport CEO cancels employment contract, gets 1 million shares

- Chile injects an extra $1bn in largest copper miner Codelco

- Troubled Baja’s mine sees another day, firm faces delisting from TSX

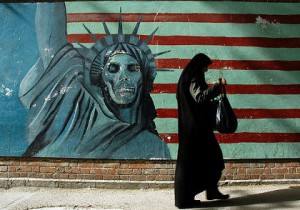

| BEAR GRIP: 9 ways 2013 changed gold for good Posted: 23 Dec 2013 05:49 PM PST The price of gold is down 28% in 2013 and is set to break the 12-year bull run that took it from around $270 an ounce at the end of 2000 to a record high above $1,900 in September 2011. Gold's $480 an ounce fall in 2013 is the worst performance since 1980, when the yellow metal hit $850 an ounce, in inflation adjusted terms still the all-time high. Here are nine ways 2013 changed the nature of the gold market and pulled it into bear territory: 1. A collective loss of confidenceGold bugs used to be able to roll with the punches and absorb price shocks. This year they had no fight left The pullback from the all-time high was as dramatic as the April shocker, but that did not stop money from continuing to pour into gold assets: gold fell almost $300 over three weeks from the $1,900+ high, but over than same period more than 20 tonnes flowed INTO granddaddy GLD alone and the buying didn't stop for another 15 months. In 2013, gold's Q2 $200 smack down over just two sessions, saw 80 tonnes flow OUT of GLD within 3 weeks and the selling hasn't stopped. 2. €urotrash talk, EM mayhem and a Cypriot riotA country named after a metal sparks a meltdown In 2013, talk of a currency war between the developed world and emerging markets briefly perked up ears, but words like Spanic and Grexit were (thankfully) banished from the lexicon completely as old Europe faded from the headlines. Except for one tiny island beloved by Russian oligarchs and other tax avoiders; its puny central bank and its miniscule gold reserves. Back in March Cyprus hinted it would sell 10.36 tonnes of gold, worth $500m at the time, to help fund its $13bn bailout. That's not enough ounces to keep the ETF trade busy for a morning, but the damage was done and the issue that paralyzed the market for decades – central bank sales – was back on the table. 3. Fed upThe days of the Fed and the gold price being joined at the hip are over By the end of that month gold was in danger of crashing through $1,600 – down almost $300 in less than a month – but once again the Fed stepped in with 'Operation Twist' lifting gold (briefly) back above $1,800 by November. Just as the Fed's easy money was losing its ability to boost anything about the US economy bar the stock market, the Feds actions and pronouncements were having less and less of an effect on gold. During the most dramatic price action in 32 years – April's $200 drop over a Friday and Monday – the Fed was nowhere in sight. And last week's surprise/no-surprise taper announcement did move the gold price, but the action was subdued, particularly considering the record number of short players present in the market. By the time the dust settled gold was back in a happy trading range. 4. Someone's using the h-word againHedging is safe, predictable and looks good on accounting paper. What's not to love? Now that the bull run is over and the windfall profits squandered on wildly overpriced takeovers and fanciful projects, suitably chastened producers are dusting off their hedge books. And are ready to spin stories about the win-win benefits of the strategy. 5. Portfolio pushers and yield chasersAfter a 12-year bull run in gold, the metal's portion of your average investment portfolio had become too outsized With confidence in the global financial system slowly returning, 2013 became the year the 'smart money' decided to turn gold into just another asset class to rotate into – but mostly out of. While this rebalancing act at times looked and felt more like a run on a bank or a currency than a careful portfolio risk-adjustment, it had to be done. That gold unlike stocks, bonds and property, offers no yield is not news to anyone and thanks to a 350% appreciation since 2000, no-one cared. But this year portfolio managers judged the opportunity cost of holding gold to be simply too high – especially considering a full percentage point in real returns on risk free investments became available as US inflation fell to 1.2% and the yield on 10-Year Treasurys approached 3%. 6. Paper beats rockIndian brides and Chinese housewives maxing out on gold don't stand a chance against New York futures and options traders Likewise China. The cultural significance of gold in China is routinely underestimated compared to their neighbours to the southwest, but on top of the social uses, the Chinese aunts and housewives (at least according to common lore) who are buying up all the tonnes the West is selling do so for very practical reasons. It's the only real investment option available to households with stack of unconvertible renminbi who shun the local stock market for obvious reasons (it's an unregulated mess), can only buy so many apartments in so many ghost towns and haven't figured out the Macau round-tripping trick yet. While premiums in Shanghai topped out at $37, even better for the demand picture is the ban on exports making Chinese the ultimate buy and hold investors. This scenario may be great for physical gold long term, but amounts to a slow day in the highly-leveraged paper trade. Two years ago already the DAILY trade in gold futures and options was worth $240 billion, more than on the S&P 500 or Dow Jones. 50 billion ounces changed ounces in 2011. This is where the pricing action is in gold. In the time US sold gold go via London to smelters in Switzerland through customs in Hong Kong to an apartment in Tianjin light years have passed in the world of high-frequency trading. 7. Not playing it safe anymoreThe contrasting reaction in the gold market to turmoil in the Middle East today and 33 years ago is striking and spells the end of gold's status as a safe haven In 2013 Syria became the crucible of the Middle-East, drawing in petrodollars and arms from all the major powers in the region and pitting Russia and China against the US. Not the threat of US military action or the continuing spillover effects could meaningfully lift the gold price – or oil for that matter – and flights to gold's safe harbour proved small-scale and short-lived. 8. Fundamentals are for foolsThe situation on the ground and underground matters little All evidence of mounting extraction costs, a dearth of new discoveries, the drying up of money to develop mines and the disappearance of skills to operate them are now being ignored when gold prices are set. 9. Doomsday postponedThey are coming for your guns and your gold, just not yet But this year the United States did not become the Weimar Republic, Japan does not resemble Zimbabwe, the UK hasn't ditched the pound for bitcoins and ECB euros still has enough value to bail out Mediterranean Europe. Despite the $9 trillion and counting monetary expansion undertaken by central banks hyperinflation is a distant prospect and CPI rates are in abeyance in most developed and emerging economies and near record lows in the US. On top of that the correlation of the gold price to the rate of paper money printing broke down early this year, long before taper became the word of the year. Image of Tehran mural by Image by -john- | Image of Limassol Carnival in Cyprus by ruzanna | Image of gold winged shoes in Hong Kong by pondspider | Image of gold street performer smoking by mattneale |

| Americans take advantage of low gold price to adorn themselves in jewellery Posted: 23 Dec 2013 03:49 PM PST As the gold price tumbles past the much-feared $1,200 mark, consumer demand for gold is soaring in the US. According to a Reuters report, the US gold jewellery industry "is on track for its highest sales for the fourth quarter since 2010 and its first annual increase in gold sales in more than a decade." Retailers have been discounting their wares as gold suppliers finish off one of their worst years in recent history; the gold price has fallen from $1,600 per ounce at the beginning of the year to as low as $1,195 today. Reuters also attributes the rise in consumer demand to the fact that the US economy is growing at its fastest pace in nearly two years, while the unemployment rate recently hit a five-year low. One jeweller told Reuters that he estimates sales at his Manhattan store will increase by as much as 20% compared to 2012. But a boost in consumer demand for gold won't provide much relief to miners. About one-third of gold demand is for investment purposes, which declined by 65% this year, according to the World Gold Council's latest quarterly report. Also, US consumer demand pales in comparison to India's and China's appetites for gold – these two make up about 60% of global consumer gold demand. |

| The US Fed is having a very unhappy 100th birthday Posted: 23 Dec 2013 02:21 PM PST December 23 marks the 100th anniversary of arguably the most powerful bank in the world: The US Federal Reserve. The Fed was created by business leaders and the government in an attempt to bring stability to the financial system. But the Central Bank didn't have many well-wishers on its big day. Public outrage over the Fed's policies has been escalating over the past few years, primarily due to the Bank's quantitative easing policy which includes buying $85 billion worth of treasury bills and bonds each month – recently lowered to $75 billion. In honour of the Fed's 100th year, the Twittersphere experienced an outburst of Fed-hating, with some calling the Fed's actions 'financial terrorism,' and others calling for the Fed to shut down forever.

|

| Freeport CEO cancels employment contract, gets 1 million shares Posted: 23 Dec 2013 12:13 PM PST Richard Adkerson, CEO of Freeport-McMoRan (NYSE:FCX), has decided to give up his salary, bonus and other perks of an employment contract in exchange for about $36 million worth of shares in the company he runs. Based on the agreement between the Board of Directors and Adkerson, the CEO will get 1 million shares of FCX – the world's largest publicly traded copper produce. Adkerson will continue in his role as President, CEO and Vice Chairman but without a salary or rights to any severance. "Our Board is pleased to have reached this agreement with Richard Adkerson," members of the Board of Directors said in a statement. "His significant contributions and proven leadership capabilities are well recognized and valued and we look forward to his continued contributions to our organization." Adkerson has held the CEO title since 2003 and the Presidency since 2008. According to Bloomberg data, the 66-year-old's total calculated compensation last year was just over $14 million. According to Forbes, the CEO's 2012 total compensation came in at $39 million, with a $10 million bonus. Adkerson ranked #18 on Forbes' 2012 list of America's highest paid CEOs. In the 'materials' category, he took the number one spot as the highest paid CEO. In July, Freeport shareholders voted against approving the compensation of executives, Bloobmerg reported. Freeport was trading at $35 per share on Monday, relatively unchanged. Shares have gained nearly 5% over the year. |

| Chile injects an extra $1bn in largest copper miner Codelco Posted: 23 Dec 2013 09:26 AM PST Chile's finance minister, Felipe Larrain, said Monday the government is handing state-owned miner Codelco an extra $1 billion in financing to help the world's No. 1 copper producer move forward with its decisive investment plans. Local newspaper La Tercera (in Spanish), reports the early Christmas gift comes on top of the $1 billion the government had said in July it would return to the mining company, which was considered insufficient by Codelco at the time. The copper giant gives all its profits to the state and had been severely disappointed by the original amount of money it was returned. As a result, the copper giant decided to seek outside financing to implement its $27 billion investment plan for 2012-2016, and placed a $750 million bond in August. Chile expects mining investment to reach $112 billion by 2021, figure that includes the $27bn planned by Codelco. By the same year, the country's total copper production is projected to reach an annual 8.1 million metric tons. The red metal accounts for 60% of Chile's exports and 15% of gross domestic product. |

| Troubled Baja’s mine sees another day, firm faces delisting from TSX Posted: 23 Dec 2013 08:21 AM PST Canada's Baja Mining (TSX:BAJ) is not giving up on its Boleo mine in Mexico, despite fresh challenges that threaten its operations, such as the Toronto Stock Exchange (TSX) recently announced review to determine whether the Vancouver-based miner meets the minimum requirements to continue on the exchange. In a project update released Monday, the company said its subsidiary Minera y Metalúrgica del Boleo is targeting mechanical completion of the copper circuit for the copper-cobalt-zinc-manganese project, located in Baja California Sur, by the end of January 2014. However, given the potential manpower shortage during the holiday season, the company warned there is potential that this completion may slip to the end of February.

Financial troubles forced Baja to lay off 40% of its staff in May 2012 and even the company's founder, John Greenslade, was forced to resign. In January this year, a consortium of South Korean lenders rescued the project, injecting an additional $30 million in April, but reducing Baja's ownership to a mere 10%. "Baja is done. It was done, in reality, in March 2009, when the market cap was in the hundreds of millions of dollars," wrote CEO.ca's analyst Chris Parry earlier this month. "It's been a wild ride, if your definition of a wild ride is a short rise and a long, agonizing, sorry slope downward," he concluded. |

| You are subscribed to email updates from MINING.com To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comment for "BEAR GRIP: 9 ways 2013 changed gold for good"